Are you in the oil and gas (O&G) industry? If you’re, then you should know that your job is on the line. Once a prestigious job where the pay, bonus and perks were the envy of your schoolmates, jobs with giant O&G company aren’t that secure anymore. British BP announced plans on Tuesday to slash 5% of its global workforce.

British Petroleum (BP) aims to reduce its global oil production (or upstream) headcount by 4,000 to 20,000 as it undergoes a US$3.5 billion (£2.42 billion; RM15.4 billion) restructuring programme. As of end of 2015, BP’s headcount totalled about 80,000. Last month, Royal Dutch Shell promised to cut 2,800 jobs while Chevron slashed 1,200.

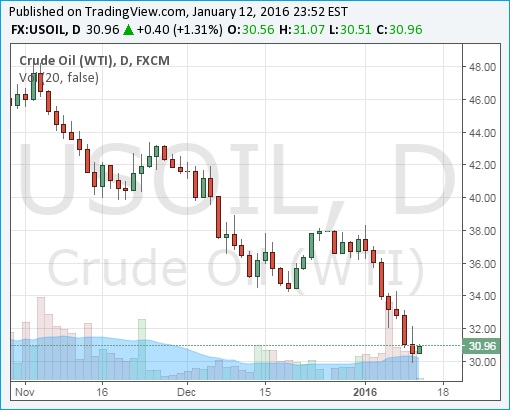

The US$30 a barrel is an extremely critical support level. U.S. crude WTI (West Texas Intermediate) fell as low as US$29.93, the weakest since December 2003, before recovered sightly to above US$30 level. We believe should the US$30 level breached and becomes a new resistance level; OPEC would call for an emergency meeting.

Still, besides whining, crying and bitching, we don’t think Saudi Arabia would take the “face-losing” step of cutting production. And there’s nothing other OPEC members could do except to exit as a member of the cartel, which is unlikely, or to secretly sell more in the black market to compensate for the losses due to low prices.

Trading data showed that “short positions” in WTI crude contracts, which would profit from a further fall in prices, are at a record high, suggesting that many traders and speculators expect further falls. A source said that Iraq, the second-biggest producer within OPEC, plans to export a record of around 3.63 million barrels per day starting next month (February).

Although the U.S. Energy Information Administration (EIA) announced on Tuesday that it expects U.S. production to fall more quickly in 2016 than previously thought, it may not be enough to push crude oil prices higher because China economy is slowing down at a much faster rate.

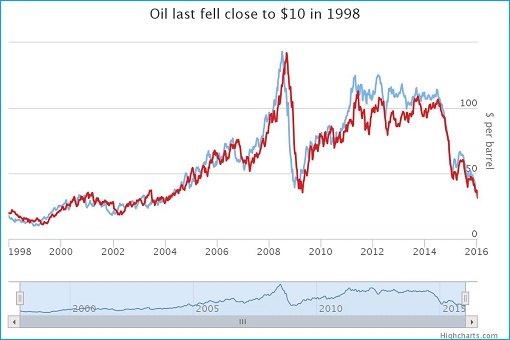

After Goldman Sachs, RBS and Morgan Stanley announced the bearish moment for the O&G industry, a British bank – Standard Chartered – became the latest major bank to add salt to injury. Standard Chartered now thinks the global crude oil could reach as low as US$10 a barrel so you should expect another 66% depreciation from the present US$30 / barrel.

At US$10 a barrel, that’s roughly ten bucks for 158 litre of oil or US$0.06 (£0.04; RM0.27) for a litre of black gold. Essentially, oil would be cheaper than water, if it’s not already is. For a global major bank such as Standard Chartered to make such insane prediction speaks volumes about the type of trouble O&G industry is drilling into.

The last time oil last slumped to US$10 / barrel was during the height of the Asian financial crisis in 1998. The biggest problem is China’s economy. It’s a real issue because the problem cannot be solved by crunching some numbers. The problem ranges from stock market, property or real estate, banking, domestic debt, jobs – all intertwined together.

It doesn’t help that China is now the world’s largest oil importer. Nobody dares to poke at one of those bubbles. Forget about growing its economy. Inexperienced Beijing is trying to keep its economy afloat, using trial-and-error method. And they could be fighting a losing battle because there’s only so much foreign reserve they can burn.

While the China factor is beyond control, OPEC can easily influence the oil price by lowering its 30 million-barrel-day production quota. But they wouldn’t because the cartel kingpin Saudi Arabia is fighting with everyone. Saudi is fighting with the United States’ shale oil producers. They’re also fighting with Iran over the originality of Islam – who’s more genuine, Sunni or Shiite.

Even if Saudi didn’t quarrel with Iran, King Salman won’t cut production unless non-OPEC countries, especially Russia, also agreed in black-and-white to reduce their output. With every country – OPEC and non-OPEC – pumping at record level, do you need a rocket scientist to predict how low oil price will be?

Other Articles That May Interest You …

- Forget About Gas At $2 – It’s Going Toward $1 / Gallon

- China (Secretly) “Devalues” Yuan – Global Recession Is Calling

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Are You Ready For Crazy Oil Prices At US$30 A Barrel?

|

|

January 13th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply