When a crook like Najib Razak proposes something, just do the opposite and it should be the best solution. The former premier’s insistence, or rather blackmails without which he threatened to withdraw his support for the fragile backdoor Muhyiddin government, that EPF members must be allowed to withdraw up to RM10,000 as part of Covid-19 measures is a wrong and dangerous proposal.

It’s already bad that a jaw-dropping 71% of EPF contributors have less than RM50,000 in savings. To make matters worse, over 30% of EPF members have less than RM5,000 in their accounts. It was shocking when some EPF members, when allowed to withdraw from their own savings to make ends meet, had already exhausted their Account 2 after just two months (only RM1,000).

Introduced in 1951, the EPF (Employees Provident Fund) compulsory retirement savings scheme was supposed to ensure contributors have minimum savings to retire in the next 20 years upon retirement at the age of 55. Even then, the recommended RM240,000 minimum savings would allow the retirees to survive on only RM1,000 per month. And only 18% of EPF contributors belong to this category.

After allowing the contributors to withdraw from their Account 2, now the government allows them to drain more of their savings from Account 1 – the account specifically for retirement (effective Jan 2007, EPF accounts are separated into two accounts – “Account 1” which stores 70% of members’ monthly contribution, while the “Account 2” comprises the remaining 30%).

During the tabling of the budget on Nov 6, Finance Minister Zafrul had announced only those who have lost their jobs due to the pandemic were allowed to withdraw from their Account 1. The amount allowed was RM500 a month, with a total of up to RM6,000 in a year. EPF subsequently announced on Nov 16 that those with an account balance below RM90,000 could withdraw up to RM9,000.

After pressure from Naijb, Muhyiddin government obediently agreed to increase the withdrawal limit to RM10,000 if their savings in Account 1 are less than RM90,000. Those having more than RM90,000 (in Account 1) can withdraw up to RM60,000. The numbers of EPF members who are qualified to withdraw have also been increased from 2 million to 8 million.

By opening the floodgate of Account 1, the government estimated that a whopping RM70 billion would be withdrawn, something that had never happened due to extremely strict withdrawal conditions in the past. Even during the 2008 Great Recession, during which Najb was the prime minister, EPF members were not allowed such liberty to drain their saving funds.

That could only mean one thing – the country is in deep financial trouble. It also means the previously chest-thumping RM295 billion worth of “economic stimulus packages” – Prihatin stimulus package (RM250 billion), Prihatin Supplementary package (RM10 billion) and the National Economic Recovery Plan (Penjana) worth RM35 billion – to reduce the impact of Covid-19 had failed!

In essence, either the real economy on the ground is so bad or the government is so incompetent that the only thing the Perikatan Nasional government could think of is to use RM70 billion of retirement savings belonging to 8 million EPF members to excite the sagging economy. Obviously, using contributors’ hard-earned money but calls it as a government’s effort to help people is shameful.

Exactly why can’t the corrupt government borrow money during such crisis to help the people? It could be in the form of partly free cash and partly soft loan with zero interest rate to help people weather the hardship in the current financial storm. Mr Najib, however, argued that the government cannot borrow to help people because the debt ratio to GDP could balloon to 65%.

Disagreeing with opposition Subang MP Wong Chen, the former PM said that while the government has a responsibility to help the people, borrowing money to help them would do more harm than good. Therefore, the so-called “caring government” has decided to allow (or rather force) the people to use their EPF money, which are their own money in the first place, to save themselves.

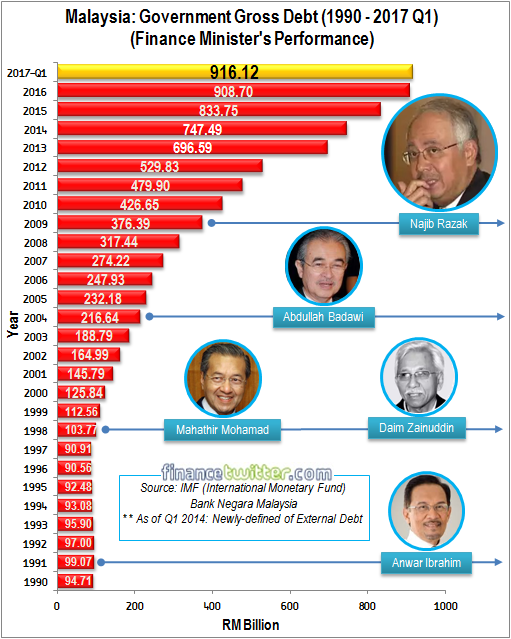

Was Najib not the same prime minister who had borrowed like crazy during his tenure from 2009 to 2018, where the government’s gross debt skyrocketed from RM376 billion to RM1 trillion? Yes, the crook had accumulated an extra RM624 billion in debts. Yet, he has the cheek to say borrowing money to help the people would damage the country’s debt ratio to GDP (gross domestic product).

Why is Najib so concerned about the debt ratio now when he didn’t care about the national debts from 2009 to 2018? The outstanding debt of his 1MDB scandal alone is RM44.54 billion, as admitted by his own government days ago. In fact, the amount of 1MDB debt that has to be paid in 2021 is RM1.705 billion – involving interest payments for three bonds and one “sukuk”.

Since the Muhyiddin regime snatched power in March via a political coup, the people can see how a bloated 72 ministers and deputy ministers are being rewarded with top salaries and perks. State governments under Perikatan Nasional have been buying new cars to reward their politicians, ranging from Toyota Hilux for low ranking officials to Honda Accord, Lexus and Mercedes Benz for top guns.

This month, even Kelantan, supposedly one of the poorest states with no access to clean water had unilaterally approved its own proposal for all state executive councillors (Exco) and assemblymen to get a pay raise. It’s absolutely astonishing that while people were struggling with unemployment or underemployment, each state lawmaker received a RM5,000 increments.

Of all the Coronavirus vaccines, the government chose Pfizer-BioNTech, despite its extra cost to handle distribution and logistic nightmare. The vaccine requires specialised freezers as it must be stored at about -70º Celsius (-94º Fahrenheit). If the vaccine is not kept in the super-cold freezers, which cost around US$10,000 a pop, the mRNA can break down, making the vaccine unusable.

Of course, we know why a corrupt government loves the most expensive solution, even in the middle of economic downturn due to Covid-19. Politicians, ministers and cronies would be getting truckloads of contracts to supply not only the vaccines, but also lucrative projects of importing, selling and maintaining super-cold freezers to store Pfizer vaccine – especially in rural areas.

And if you think the Perikatan Nasional government will not re-introduce GST (goods and services tax) if it wins big in the next 15th General Election, you must be hallucinating. With the pirate ship now filled to the brim with corrupt UMNO-Bersatu-PAS politicians, only a new tax regime like GST can refill the empty coffers, as repeatedly promoted by Najib and Muhyiddin government.

Make no mistake. In spite of 1MDB scandal and unpopular GST, former PM Najib still managed to win 4-million Malay votes in the 2018 General Election. That means at least 4-million UMNO-Malay supporters did not mind GST at all. Now that the Malay-Muslim Perikatan Nasional government is more popular than before, it would be dumb for it not to re-impose GST again.

Heck, the gullible UMNO-Malay zombies were not even offended, let alone suspicious, despite Najib regime’s admission in 2015 that EPF (KWSP, Kumpulan Wang Simpanan Pekerja) had pumped in RM1.52 billion to “invest” in 1MDB, which turned out to be nothing but a bailout of the sovereign fund after billions were plundered and stolen by Najib and partner-in-crime Jho Low.

Even if borrowing money to help people during financial difficulties due to Coronavirus is not feasible, the government should sell assets to raise money. Some may think it is a crazy idea to sell national or strategic assets to help people. Such argument may be valid before the collapse of the legitimately and democratically elected Pakatan Harapan government.

But with traitors Muhyiddin Yassin and Azmin Ali working hand-in-glove with the same band of crooks they had initially pledged to exterminate, it’s only a matter of time before many new versions of 1MDB scandal will emerge. In fact, 3 days ago, Najib has questioned why his own government continued to sell assets of TH Plantations Bhd, which is owned by Tabung Haji (Hajj Pilgrims Fund).

Yes, Muhyiddin regime is quietly selling Malay-Muslim-owned assets even after the multiracial Pakatan Harapan government – which Najib falsely accused as anti-Malay, anti-Muslim, anti-Islam and whatnot – had collapsed. Hilariously, it was Najib, who told all and sundry in Oct 2019 that strategic assets would never be sold if his own Barisan Nasional coalition was still in power.

Of course, Najib should be the last person qualified to grill Muhyiddin. Mr Najib himself had sold off more national assets than any Malaysian leaders – including power plants, Bandar Malaysia and RM60 billion worth of ECRL (East Coast Rail Link) to China. Regardless whether the premier is Najib, Muhyiddin or Azmin, all of them were cut from the same cloth.

Based on past by-election results, a huge majority of ignorant Malays, at least 4-million UMNO-Malays and 2-million PAS-Malays, will vote for the present government. In the same breath, selling assets or borrowing money to feed the increasing appetite for corruption will continue. Like it or not, GST will come back as this is the only method to repeatedly tax everyone’s pocket – rich or poor.

So the burning question is, why should EPF contributors naively celebrate the news that they are allowed to dig into their own retirement savings to fix their financial issues, which partly was caused by the power-hungry Muhyiddin and his minions? Why not ask the government for free cash or zero-interest loans instead, and keep your EPF money intact?

Get real, the corrupt politicians will continue to borrow money, sell assets and re-introduce GST anyway. It’s wiser to ask for free cash now because if you don’t, the corrupt government will be more than happy to steal all of them. Why should you suffer when the corrupt leaders enjoy lobsters? This country is extremely screwed and it has yet to see the worst, even when Najib was defeated in 2018.

Other Articles That May Interest You …

- Printing Money – The Stupid Backdoor Deputy Minister Who Thought Malaysia Ringgit Is As Powerful As US Dollar

- A Grand Coalition For Corruption – Fake Research Report Of Racist UMNO Having More Chinese Support Than DAP

- Moderna Reveals Covid Vaccine – Here’s How This 94.5% Effective Vaccine Differs From Pfizer’s Vaccine

- Budget 2021 – Here’s What The Backdoor Government Does Not Want You To Know

- Told You So!! – Power-Crazy Dictator Muhyiddin Tries To Gain Absolute Power Thru “Emergency Rule”

- Get Ready For Bad Time Ahead! – As Malaysia’s Economy & Corporate Debt Get Worse, Retrenchment Has Just Begun

- Reopen For Business – Backdoor PM Muhyiddin Would Be Overthrown If Gravy Trains Do Not Restart

- From Doraemon To Finding Coronavirus In Sewage – The Government’s Top-6 Screw Ups Within 14-Day Of Lockdown

- How Najib Almost Got Away With RM21.5 Billion, Until Mahathir Govt Negotiated A New Brilliant ECRL Deal With China

- Congrats UMNO & PAS – How Najib Regime Transformed Tabung Haji Into A Ponzi “Get-Rich-Quick” Scheme

- This Chart Shows How Najib Drove The Country To RM1 Trillion In Debt

- Bandar Malaysia Has Become “Bandar China” – The U.S.& Malays Conned By Najib

|

|

November 30th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply