We wish to say “I told you so” again. But to hear it from the horse mouth – Mahathir – is equally satisfying. Yes, Malaysia has already breached the RM1 trillion marks, for the wrong reason. Speaking for the first time to staff of the prime minister’s office, Mahathir revealed the troubling debts accumulated, thanks to 9 years of corrupt Najib administration.

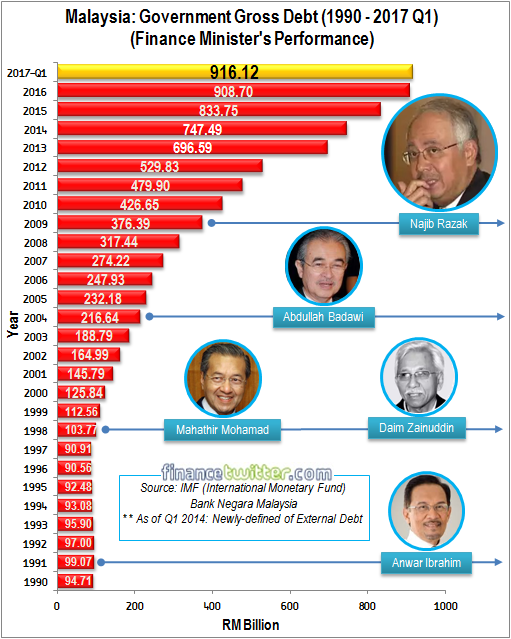

When Mahathir resigned in 2003 after ruling for 22 years (1981 to 2003), the debt was only about RM190 billion. After he passed the baton to Abdullah Badawi, the sleeping head doubled the nation’s debt to about RM380 billion. But after Najib Razak took over the country, he tripled it to RM1 trillion in debts. In short, Najib doubled the debt in 4 years what Badawi would have done in 8 years.

During the 14th election campaign, Najib Razak conveniently used the national debt as a weapon to attack his opposition. He warned the people that a victory for the opponent coalition Pakatan Harapan’s would cause debt to skyrocket. He claimed that the opposition’s promise to abolish GST (goods and services tax) and road toll collection would increase national debt to RM1.1 trillion.

Najib, of course, didn’t want the people to know that his regime had already clocked the RM1 trillion figures. By first quarter of 2017, the country was already burdened with RM916.12 billion. Since Najib came to office in 2009, Malaysia’s debt has grown at an average of 10% a year. Hence, if you look at the government gross debt chart, the first number of debt figure will jump – every year (get the picture?).

The worst part is this – despite abolishing subsidies for petrol, diesel, sugar, cooking oil, electricity tariffs, water and whatnot, Najib regime somehow still couldn’t find the money to run the government efficiently. The son of Razak was practically stealing rice from a beggar’s bowl when he introduced 6% GST (goods and services tax) on 1 April 2015.

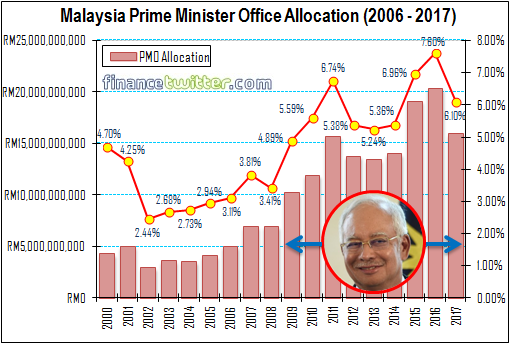

Do you need more proof that the despicable and corrupt Najib had been stealing from the people to live lavishly? The clearest proof of excessive spending, and even corruption for that matter, can be found in this chart – the yearly allocation for the Prime Minister Office (PMO). In his first year as prime minister, the budget for the PMO breached RM10 billion for the first time in the history.

The yearly budget for the PMO continued to climb and reached the climax when it hit the RM20 billion in 2016. Now we know why a small nation with 32-million populations need to pay RM20 billion for the operation of Najib’s office. After the stunning defeat of Barisan Nasional coalition government, it is discovered that a whopping 17,000 “political appointees” were hired by the previous government.

Prime Minister Mahathir Mohamad, shocked, said the contracts for the highly paid 17,000 “political appointees” will be axed. This will reduce the expenditure. Assuming each of them was paid a conservative RM5,000 every month, the annual expenses would hit RM1 billion already. When Mahathir resigned in 2003, the PMO was allocated merely RM3.5 billion.

However, paying top dollar for 17,000 “political appointees” to boost Najib’s image wasn’t the only wastage policy adopted by the former prime minister. His wife, Rosmah Mansor, was the biggest beneficiary from the massive yearly budget to the PMO. Auntie Rosie’s pet project – Permata Programme – was allocated RM100 million and RM111 million in 2010 and 2011 Budget respectively.

When Najib presented the 2013 Budget, the so-called pre-school education programme was allocated a whopping RM1.2 billion. The amazing part about the “Permata” programme is that nobody knows how the money was being used. In fact, the programme has been such a cash-cow to Rosmah that even after his husband has lost, she insisted the new government to retain the project.

Najib’s previous government operated without transparency. As the finance minister himself, he spent excessively and lavishly without thinking about the source of income. His answer to lack of funding was to borrow money. One of Najib’s tricks in hiding the RM1 trillion debts accumulated over the years – exclude the government-guaranteed debt.

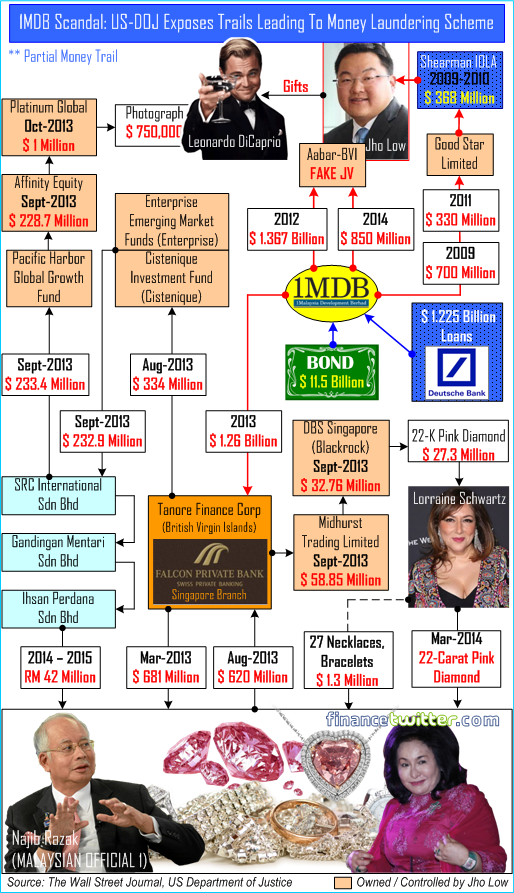

Based on statistic from Bank Negara Malaysia (Central Bank), the debt guaranteed by the Federal Government is at eye-popping RM238 billion. And thanks to the declassification of 1MDB audit report after Najib was defeated in the 14th general election, it has been revealed that the state investment fund was drowning in debt. Now, where is that Arul “Anaconda” Kanda guy when you need him the most?

According to the audit report – assuming there are no new loans after October 2015 – it was estimated that RM42.26 billion was needed to pay the principal and interest that will be due between November 2015 and May 2039. 1MDB also needs a minimum of RM1.52 billion every year for 10 years from November 2015 to May 2024 just to pay back its loans.

In short, the declassified report said the scandal-tainted firm had debt commitments totalling RM74.6 billion, inclusive of interest and borrowing costs, from November 2015 to 2039. That’s about RM3 billion of debt commitment every year – for the next 25 years. This is what going to make the country in serious trouble, if billions of dollars plundered by Najib is not recovered.

Now, do you understand why newly sworn-in finance minister Lim Guan Eng is roped in to clean the shit left by the former Thief-in-Chief Najib Razak? Based on his track record in managing Penang finances, only Mr. Lim has the ability to fix the problem. Crooked Najib was essentially driving the country to the brink of bankruptcy, had he not stopped in time.

Other Articles That May Interest You …

- Like Hillary Clinton, Najib Razak Is Blaming Everyone & Everthing – Except Himself & Witch Wife

- Oh My Hermes Birkin Handbags!! – Najib & Rosmah’s 284 Boxes Of Handbags, 72 Bags Of Cash & Jewellery Seized

- First Prime Minister To Be Imprisoned – Najib Razak To Be Arrested & Charged, As Soon As This Week

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- Najib Runs Out Of Panic Buttons – 92-Year-Old Mahathir Could Return As PM Again

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

- Great Minds Think Alike – Both Obama & Najib Are Great Debt Accumulators

- Budget 2013 – What the Govt Doesn’t Want You to Know

|

|

May 22nd, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply