Oracle of Omaha – Warren Buffett – has just released his 2017 annual letter to shareholders. As usual, his flagship Berkshire Hathaway’s stock portfolio was the hot commodity that everyone has been waiting for. According to the letter, the company had stock holdings totalling a staggering US$170.5 billion in market value as of end of 2017.

Warren Buffett’s newsletter is closely watched – by both technical and fundamental investors – because apart from details about Berkshire’s operations and investments, there are many useful investing mantras and wisdom that can be drawn from the document which comes directly from the legendary investor whose net worth is US$86.9 billion today.

Over the last 53 years, Berkshire’s per share book value has grown from merely US$19 to US$211,750 – an impressive return of 19.1% compounded annually. In other words, from 1964 to 2017, the per share book value of Buffett’s flagship gained a mind-boggling 1,088,029% while it’s per share market value made 2,404,748%.

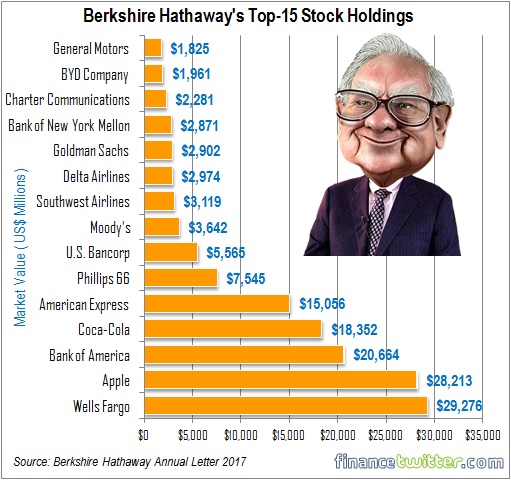

Berkshire’s largest positions included Wells Fargo, Apple and Bank of America. In his letter to shareholders, the billionaire said while the company continues searching for new stand-alone business, they can’t find good deals despite having tons of cash. As a result, the company’s cash pile had ballooned to US$116 billion in cash and short-term Treasury bills.

Still, for the year 2017 alone, Berkshire Hathaway had gained US$65 billion in its net worth – US$36 billion derived from the company’s operations while US$29 billion was delivered in December when Congress rewrote the U.S. Tax Code. The 87-year-old billionaire assured shareholders that he will still handle the big acquisition decisions for the company, along with 94-year-old Charlie Munger.

However, Buffett also reveals that some of the stocks are the responsibility of either Todd Combs or Ted Weschler, with each manages more than US$12 billion for Berkshire. The newsletter offered some tips – that stocks will be riskier, even far riskier than the short-term U.S. bonds. In the meantime, Buffett and Munger will stick to a simple guideline.

That guideline is the following – “The less the prudence with which others conduct their affairs, the greater the prudence with which we must conduct our own.” Berkshire’s goal is to substantially increase the earnings of its non-insurance group. Buffett also said admits that Berkshire Hathaway is a big beneficiary of corporate tax reform where corporate tax is lowered to 21% from 35%.

As the U.S. “Super Bull Run” continued – until the recent steep correction – many potential investors were attracted to the idea of borrowing money to play the stock markets. Billionaire Buffett has an advice for these people – DON’T borrow money to buy shares. The reason is simple – even Berkshire Hathaway shares have suffered 4 major plunges, ranging from 37% to 59% over the last 50 years.

From 1973 to 1975, Berkshire shares tumbled 59% follows by 37% plunged in 1987. The company subsequently saw its shares shed 49% between 1998 and 2000. And during the subprime crisis between 2008 and 2009, Buffett’s flagship lost 51%. Therefore, Buffett predicted the company’s stock will fall again by similar large declines in the next 53 years.

Warren Buffett wrote – “There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

More importantly, he wrote – “No one can tell you when these will happen. The light can at any time go from green to red without pausing at yellow. When major declines occur, however, they offer extraordinary opportunities to those who are not handicapped by debt.” This is perhaps the single most vital reason why you should not borrow money to buy stocks.

Although he acknowledges that stocks will be riskier than short-term bonds, Buffett still recommended investors to stay in equities due to negative impact from inflation on the purchasing power of fixed income holdings. The trick is to have a diversified portfolio of U.S. stocks to reduce the overall risks when compared to bonds.

The investor also offered this wisdom – treat stocks like business, not tickers. He wrote – “I view the stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their ‘chart’ patterns, the ‘target’ prices of analysts or the opinions of media pundits. Overall – and over time – we should get decent results.”

For those how think professional fund managers have been overcharging, they’re not alone. He wrote – “American investors pay staggering sums annually to advisors, often incurring several layers of consequential costs. In the aggregate, do these investors get their money’s worth?” The tycoon said he easily makes annual gains of 8.5% by betting on the S&P 500 stock index in Dec 2007.

Other Articles That May Interest You …

- Bloodbath Continues – Stocks Plunge 1,032 Points – Here’s The Biggest Culprits!!

- Get Ready For A Currency War – Trump Wants To Make American Dollar Weak Again

- U.S. Household Debt Hits Record $12.84 Trillion – China Top Owner Of I.O.U. Papers

- Here’s Why You Should Get Out Of Stock Market Now – Before The Volcano Erupts!

- 10 Business Philosophy Billionaire Trump Disagreed With Billionaire Buffett

- Berkshire Annual Letter – Billionaire Buffett Reveals 7 Important Messages

- Berkshire’s 50th Annual Letter Shows Why Warren Buffett Is Worth US$72 Billion

- Revealed!! – Billionaire Warren Buffett’s Youthful Secret

|

|

February 26th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply