Warren Buffett has just published his latest annual letter to shareholders. Why should you care, you may ask yourself. After all, you didn’t own and perhaps will never own Berkshire Hathaway stock. At roughly US$200,000 (£144,434; RM842,568) a share, perhaps it’s impossible for you to afford even “one share” of the company.

Still, you can benefit from Buffett’s take on stocks he loves – energy, metals, mergers, and the list goes on. Every year, thousands of investors, analysts, economists and even speculators wait for this moment to read the Oracle of Omaha’s insights. Here’re 7 important things to note from Warren’s latest letter.

{ 1 } Presidential Candidates Are Wrong About U.S. Economy

Berkshire’s letter didn’t mention anything about China, oil, currency or monetary policy. And there’s a reason why Warren didn’t give them any attention. He wrote – “The babies being born in America today are the luckiest crop in history. For 240 years it’s been a terrible mistake to bet against America, and now is no time to start.”

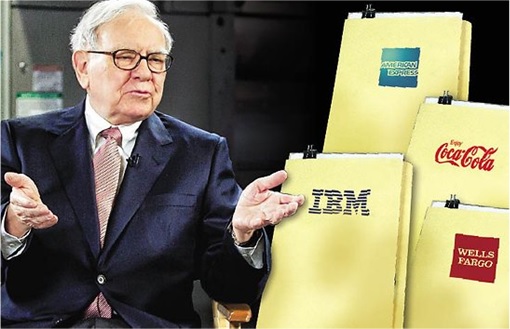

{ 2 } Confidence On “Big Four” Remains

Berkshire’s commitment to four major stocks remains as strong as ever – American Express, IBM, Coca-Cola and Wells Fargo. Warren Buffett doesn’t have any wish to sell any of them. In fact, his Berkshire had puchased more – IBM ownership up to 8.4% from 7.8%; Wells Fargo up from 9.4% to 9.8%; Coca-Cola grew from 9.2% to 9.3% and AMEX from 14.8% to 15.6%.

{ 3 } Powerhouse Six

In 2015, all of Berkshire’s other businesses – including a railroad, utilities and energy, financial products, manufacturing and retail – were more profitable than the previous year. Together with BNSF railroad, the “Powerhouse Five” earned US$13.1 billion in 2015. After the purchase of aerospace industry supplier Precision Castparts last month, Buffett will be discussing about “Powerhouse Six” next year.

{ 4 } Berkshire’s Real “Threat”

While the Oracle of Omaha isn’t afraid of any recession or depression due to economy factor, together with Charlie, they are powerless against cyber, biological, nuclear or chemical attack on the United States. That’s the only risk Berkshire would like to share with all of American business.

{ 5 } Productivity Needs Safety Nets

Buffett recognised productivity have delivered awesome benefits to the society. But productivity gains have largely benefitted the wealthy and suffered terrible price due to innovation. The solution – provide a variety of safety nets aimed at providing a decent life for those who are willing to work but find their specific talents judged of small value because of market forces.

{ 6 } Warren & Charlie To Enter 21st Century

For the first time, stone-aged Warren Buffett and Charlie Munger agreed to step their foot into the 21st Century – Berkshire’s annual meeting this year will be webcast worldwide in its entirety. To view the meeting, simply go to http://finance.yahoo.com/brklivestream at 9 a.m. Central Daylight Time on Saturday, April 30th.

{ 7 } Berkshire Gained US$15.4 Billion in 2015

Berkshire’s gain in net worth during 2015 was US$15.4 billion, which increased the per-sharebook value of both our Class A and Class B stock by 6.4%. Over the last 51 years, per-share book value of the stock has grown from US$19 to US$155,501, a rate of 19.2% compounded annually.

The billionaire admitted that his parents, when young, could not envision a television set; the same way he thought he didn’t need a personal computer in his 50s. Today, Warren Buffett whose net worth of US$62.1 billion makes him the second richest man in the U.S. has a different view on technology. He now spend 10 hours a week playing bridge online and couldn’t live without “search” engine.

Other Articles That May Interest You …

- Move Over U.S. & New York, Now China & Beijing Have More Billionaires

- Worst Is Over On Oil? Not So Fast – Here’s Why

- Soros – We’re About To See Something That Hasn’t Happened in “80 Years”

- Greatest Daddy – US$77 Million Blue & Pink Diamonds For 7-Year-Old Josephine

- 20 Crazy Facts About Lord Pablo Escobar You May Not Know

- Berkshire’s 50th Annual Letter Shows Why Warren Buffett Is Worth US$72 Billion

- Revealed!! – Billionaire Warren Buffett’s Youthful Secret

- Meet Billionaire Stephen Hung, Who Just Ordered 30 Rolls-Royces For Louis VIII

- Alibaba’s Jack Ma Is China’s Richest Man. Here’s Top-5 Richest People In China

- Warren Buffett’s 2013 Top-10 Stocks

|

|

February 29th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply