Warren Buffett’s 50th letter to Berkshire Hathaway shareholders has just been released. Despite being a non-dividend stock, thousands of Berkshire shareholders look forward to the company’s annual letter, as if it’s the last love letter before a worldwide apocalypse. Buffett is a non-believer in paying dividend to shareholders, argues that reinvestment is a better use of profits than payouts to shareholders.

Amazingly, shareholders agreed to it. Last year, when a shareholder – tax accountant David Witt – asked Berkshire’s board to consider paying dividend, it was put to vote. Owners of “A shares” voted against the resolution (to pay dividend) by a mind-boggling margin 89 to 1. Shareholders of “B shares” (such as David Witt) voted against it by 47 to 1. It was a nice try though, but not good enough.

To people who want to make money on Berkshire stock, this is what Buffett has to offer – sell your shares. But extremely few would do so. And it’s not hard to understand why. The annual letters to shareholders would be followed by a festive-like shareholders meeting in May. This year, an early-morning parade of Texas Longhorns down 10th Street in Omaha would be particularly meaningful – a half-century celebration.

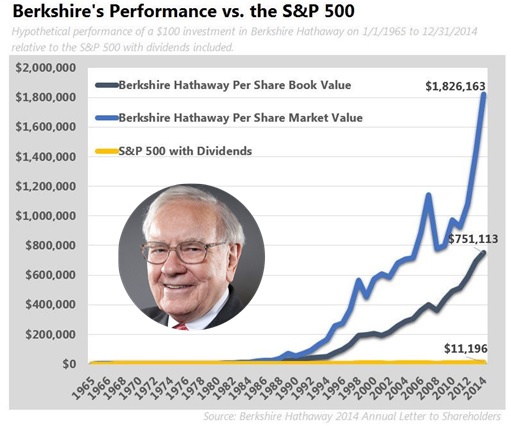

With Buffett’s successor issue solved – either Reinsurance head Ajit Jain or Energy CEO Greg Able to take over – Warren had included, for the very first time, Berkshire’s historical price in this year’s annual letter. Berkshire’s return over the last 50 years? A mouth-watering 1,826,163%. What this means is if you’ve invested one share of Berkshire Hathaway in 1965, your investment compounded gain would have ballooned to 1,826,163%.

Buffett loves comparing his investment brilliance to S&P 500. Hence, in the same letter, S&P was shown to have gained, with dividend, at merely 11,196% from 1964-2014. Berkshire’s gain in net worth during 2014 alone was a staggering US$18.3 billion. Over the last 50 years, Berkshire Hathaway book value per “Class A” share has grown from US$19 to US$146,186, a rate of 19.4% compounded annually.

The “Powerhouse Five” – a collection of Berkshire’s largest non-insurance businesses – had a record US$12.4 billion of pre-tax earnings in 2014, up US$1.6 billion from 2013. The companies in this fantastic group are Berkshire Hathaway Energy (formerly MidAmerican Energy), BNSF, IMC, Lubrizol and Marmon. Of the five, only Berkshire Hathaway Energy, was owned a decade ago. The rest were purchased thereafter – all on cash-basis.

Berkshire Hathaway also has the “Big Four” investments – American Express, Coca-Cola, IBM, and Wells Fargo. Buffett proudly wrote investments in all these four companies have been increased. American Express and Coca-Cola ownerships were raised from 14.2% to 14.8% and 9.1% to 9.2% respectively. Meanwhile, IBM stake was increased from 6.3% to 7.8%, while Wells Fargo’s ownership jumps to 9.4% from 9.2%.

Yawn – isn’t that a pathetic increase in ownerships not worth mentioning? Well, if you think tenths of a percentage point aren’t important, ponder this math: For the four companies in aggregate, each increase of one-tenth of a percent in ownership actually raises Berkshire’s portion of their annual earnings by US$50 million (*tongue-in-cheek*). That’s a crazy lots of money, which many of you don’t have (*grin*).

As usual, Buffett re-emphasizes that Berkshire prefers owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business. Perhaps this is the main recipe why Warren Buffett is worth US$72 billion while you’re not. And we’re talking about the fourth-most valuable firm in the United States, behind Apple, Google and Exxon.

Berkshire’s employees – including those at Heinz – totalled a record 340,499, up 9,754 from last year. That’s a staggering huge number of staffs, roughly the size of Honolulu and slightly smaller than Brunei’s population of 420,000. But that is not the reason why Berkshire Hathaway is so damn successful. The secret is this – the headquarters have a workforce of only 25 people, including Warren Buffett and vice chairman Charlie Munger.

This is perhaps the best case-study of how decentralization works wonderfully, 25 people in Omaha overseeing vast empire with more than 340,000 employees. Buffett believes all meaningful operational responsibility remains with executives who run all those portfolio companies. The advantage? Berkshire decides how to allocate capital with neither the self-interested decision-making of many operating executives.

Besides, Berkshire business model attracts many owners or family looking to cash out of a business but want to leave the company intact and keep long-time employees in place to run it. For example, the aging Teh Hong Piow of Public Bank (Malaysia) may want to cash out from his highly successful bank because non of his son nor daughters is interested to continue the family legacy. If Mr Teh wants to preserve it, he can sell it to Warren Buffett.

Other Articles That May Interest You …

- Revealed!! – Billionaire Warren Buffett’s Youthful Secret

- Here’re Top-48 Science Discoveries In 2014 That You May Have Missed

- Reason Why People Get Cancer Found – It’s Purely Bad Luck

- Mystery Solved!! – Why Certain People Say & Do The Stupidest Things

- Another Reason To Eat More Chocolate – It Can Reverse Memory Loss

- Meet Coca-Cola Life, The New Coke From South America

- Warren Buffett’s 2013 Top-10 Stocks

- Soros, Buffett and Trichet said It Ain’t Over Yet

|

|

March 4th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply