Throughout the first 10 months of fiscal 2017 (Oct 2016 to July 2017), the U.S. federal government collected record amounts of taxes – both individual income taxes and payroll taxes – to the tune of US$2.288 trillion. They collected US$1,312,691,000,000 in individual income taxes and US$976,278,000,000 in Social Security and other payroll taxes.

However, the Treasury still ran a deficit of US$566,022,000,000 (that’s US$566 billion, in case you couldn’t figure it out). Still, all the numbers seem insignificant when you put the Americans’ latest household debt on the table. As the nation’s credit card debt hits history high of US$1.021 trillion, so does the bigger picture – the household debt.

The latest quarterly Federal Reserve Bank of New York’s report on household debt and credit is out, and the picture isn’t pretty. Americans have successfully recorded 12th consecutive quarterly increase in household debt – a new record of US$12.84 trillion – thanks to rising mortgage debt, auto loan and of course, historical high of credit card debt.

United States’ household debt is now up US$552 billion from a year ago, and US$1.7 trillion higher than it was in 2013. Effectively, the total debt was 67% of the nominal GDP (gross domestic product) in the second quarter. It’s still lower than during the 2008-09 subprime mortgage crises, which recorded 87%. This is good news, right? Well, it depends on whom you speak to.

One side says this reflects renewed confidence in the economy, as Americans are more willing to purchase homes and borrow to fuel consumer spending. The other side says this reflects problem and new bubble in the economy, as total credit-card debt alone climbed by US$20 billion in the second quarter – reaching US$784 billion – the highest level since the fourth quarter of 2009.

More importantly, there’s a disturbing number revealed in the quarter. Auto loans saw a new US$148 billion in borrowings, including US$51 billion of loans given out to people with credit scores under 660, which are considered subprime. Those figures are near the highest levels since the 2008-09 crisis. Guess what, Americans now owe a record high US$1.19 trillion in auto loans.

The biggest category of household borrowing is for mortgages, registering US$8.69 trillion in the second quarter – up US$329 billion from last year. It also shows that total mortgage balances increased by US$64 billion in the quarter. Another type of debt – student loan – was US$1.34 trillion, up US$85 billion. As the U.S.’ debt skyrockets, another country is picking the tab.

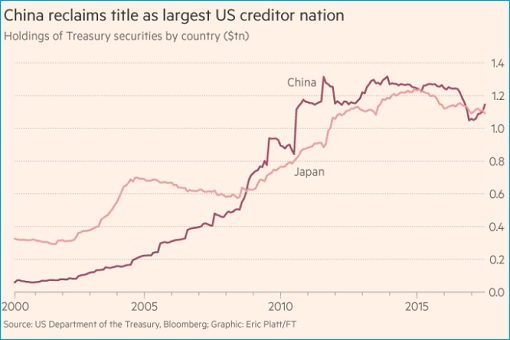

After 8 months fighting cash outflows, China has again reclaimed its top position as the world’s top owner of U.S. Treasuries – essentially I.O.U. debt paper. Japan had held the top spot since October 2016. China’s foreign-exchange reserves rose for sixth straight month to US$3.08 trillion in July, after it breached below the US$3 trillion momentarily.

As of June, the Chinese’s holdings of U.S. bonds, notes and bills rose to US$1.147 trillion, up US$44.3 billion from the previous month. It was China’s biggest purchase of Treasuries since June 2011. Japan was bumped to second place, owning US$1.09 trillion of Treasuries. Both China and Japan now own more than a third of all foreign ownership of Treasuries.

Beijing’s stricter capital controls have successfully strengthened the Chinese currency and economic growth remained strong. The Yuan / Renminbi has climbed nearly 4% against the U.S. dollar this year, after declining about 7% in 2016, largely due to policies that encourage foreign investors to channel more money into the country.

But the Chinese’s demand for U.S. sovereign debt could only happen if trade flows between the U.S. and China continue to be strong. This also means Trump administration might think twice about starting a meaningful trade war with China. Clearly, with strengthening Yuan, the China isn’t done buying the U.S. debt paper, something which Trump needs badly to feed Americans’ escalating debt.

Other Articles That May Interest You …

- US$1.021 Trillion – Americans’ Credit Card Debt Hits History High

- Here’s Why You Should Get Out Of Stock Market Now – Before The Volcano Erupts!

- Finance Minister Najib Drove Reserve To Its Lowest In Asia, Unable To Pay $600 Million Debt

- Australian Property Bubble – Get Out Now – Before It Burst

- China Invasion – Top 10 American Iconic Brands Now Owned By Chinese

- Outgoing President Obama’s Greatest Legacy – Added $8 Trillion To National Debt

- U.S. Debt – How Much Does Each American Owe?

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

August 16th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply