This country is so screwed up that it couldn’t even pay US$600 million of debt to IPIC (International Petroleum Investment Company), Abu Dhabi’s US$80 billion sovereign-wealth fund. After the deadline on Tuesday, IPIC has given 1MDB (1Malaysia Development Berhad), a fund set up by Prime Minister Najib Razak himself in 2009, five more days to make the payment.

Najib Razak, who is also Malaysia’s finance minister, has rubbished that his administration was unable to pay but rather – it was a technical matter. He didn’t explain what the technical matter was but his pet project, which has been classified as a “Ponzi Scheme” by the Swiss Attorney General, said in a statement it was committed to meeting its obligations to IPIC.

1MDB said in a statement that it would pay in August 2017. But it did not specify a date in August. Obviously, 1MDB has trouble paying and is dragging its feet. But Mubadala, which now owns IPIC, wasn’t amused and said in a separate statement on Tuesday that 1MDB and the Malaysian Ministry of Finance (MoF) have just five days to resolve the non-payment.

But if Mr. Najib couldn’t even pay the first installment of US$600 million, chances are he would similarly default on the second installment of the same amount, which is due end of this year. That was part of the agreement between 1MDB and IPIC, which Najib has now defaulted. And there’re additional two bonds worth US$3.5 billion in total that 1MDB has to pay.

Flashback – the agreement was reached after the Malaysian fund (1MDB) defaulted on its bonds in 2016, sparking a dispute with IPIC, which asked a London court to arbitrate a claim totaling some US$6.5 billion. 1MDB claimed initially that it was “confident in its legal position” and had even submitted a “robust” response through legal counsel. Of course, 1MDB failed to prove its innocence.

The long and short of the infamous 1MDB scandal is this. The 1MDB was part of a Ponzi scheme, which is the subject of money-laundering investigations in at least six countries, including the United States, Switzerland and Singapore. When the scheme was discovered and exposed, the bubble burst. It had accumulated debt of more than US$50 billion as of 2016.

Abu Dhabi was approached to bailout 1MDB. In return for unspecified amount of assets from 1MDB, IPIC agreed to lend US$1 billion to 1MDB and assume payments on US$3.5 billion of the Malaysian fund’s debt. It is believed that one of the assets sought by Abu Dhabi in the debt-for-asset-swap exercise was Bandar Malaysia. But that didn’t materialise.

Turned out, Mr. Najib “secretly sold off Bandar Malaysia” to somebody else – China. Bandar Malaysia became “Bandar China” via a sale of 16-plots of extremely valuable Sg. Besi land to China Railway Engineering Corporation (CREC), whom together with Iskandar Waterfront Holdings (IWH) forms a consortium (40:60 basis) and paid RM7.41 billion for a 60% stake in Bandar Malaysia.

Abu Dhabi was furious and demanded its money back. 1MDB agreed to pay back after it lost its case in the London’s court. But the greedy but foolish Najib wanted more from China as he thought he was short-changed. So he unethically terminated the Bandar Malaysia sealed agreement, accusing the Chinese investors of “failing to meet the payment obligations” instead.

Now that the RM7.41 billion Bandar Malaysia property deal has collapsed, Najib has trouble searching for money to pay IPIC as per agreed. The finance minister had tried courting U.S. Fortune 500 to bid higher price for the toxic Bandar Malaysia. However, it has only attracted bidders from seven firms in China and two from Japan.

Perhaps this was what Najib meant when he said there was technical matter in the debt payment to IPIC. His administration hasn’t decided on the winning bidders yet, hence no money could be collected from them to pay Abu Dhabi. Still, the burning question remains as to why a rich and prosperous country like Malaysia is unable to pay IPIC in advance, instead of defaulted its debt.

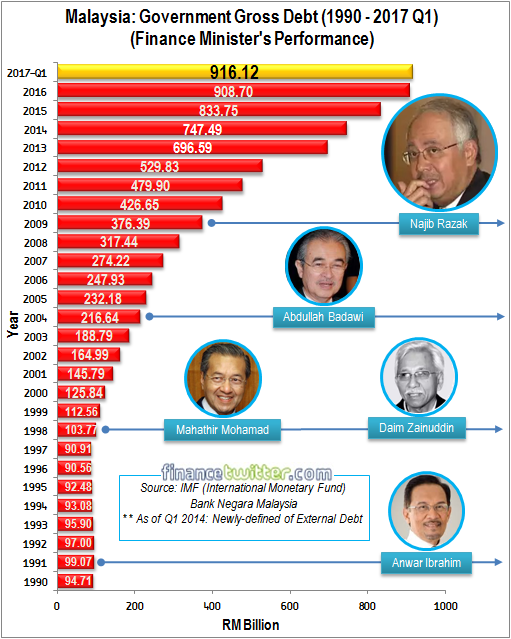

After all, 1MDB’s advisory board was dissolved last year and its assets were shifted to the Ministry of Finance. It would look extremely bad that the country is unable to pay the small amount of US$600 million, would it not? Again, it has everything to do with Najib administration. According to Bloomberg, as expected, Najib has been driving the national coffers to the ground.

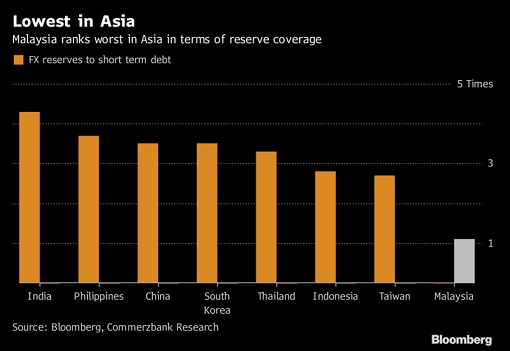

For four consecutive years – from 2013 to 2016 – Malaysia’s reserve, under finance minister Najib’s leadership, declined from as high as US$141.4 billion in May 2013 to as low as US$93.3 billion in September 2015, before rebounding slightly. Effectively, Malaysia’s reserve is today the lowest in Asia, partly thanks to Najib’s lavish spending and heavy borrowing.

According to data compiled by Commerzbank AG, Malaysia’s reserves are only sufficient to finance 6.5 months of imports. That compares with 9.9 months for Indonesia, 10.8 for Thailand, 11.2 months for the Philippines, and 21.6 for China. However, Bank Negara Governor Muhammad Ibrahim disagreed and said his calculations show the country’s reserves are sufficient to finance 7.9 months of import.

Regardless, the Malaysian Central Bank governor cannot dispute the fact that the country’s reserve has hit rock bottom in Asia. At the same time, analysts cheer that global funds are returning in a big wave, pointing to RM15 billion of hot money flowing in during April and May. But they conveniently ignored that a whopping RM59 billion flowed out in the 5 months though March.

Make no mistake about it. The strengthening of local currency Ringgit recently has very little to do with the bullish local economy, but rather due to weakening of US dollar across the board because of the White House’s crisis. And despite RM54.8 billion collection of GST for the first 9 months of 2016, the country is crawling to survive. That speaks volumes about bad paymaster Najib Razak’s performance.

Other Articles That May Interest You …

- A Greedy Najib – From China To U.S. Fortune 500, Bailing Toxic Bandar Malaysia

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- No Deal For Bad Deal – Here’s Why China Pulls Plug On Bandar Malaysia

- Here’s Why Najib Should Be Encouraged To Sell More Assets To China

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

- WikiLeaks: Soros Slammed Obama Of Trading TPP For A Racist, Extreme & Corrupt Najib

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

|

|

August 2nd, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply