Bandar Malaysia, supposedly the country’s biggest real estate project, has collapsed. TRX City Sdn. Bhd., an indirect wholly-owned subsidiary of the Ministry of Finance, said the sale of its 60% interest in Bandar Malaysia Sdn. Bhd. has lapsed. TRX blames failure to meet payment obligations as the reason why the deal was called off.

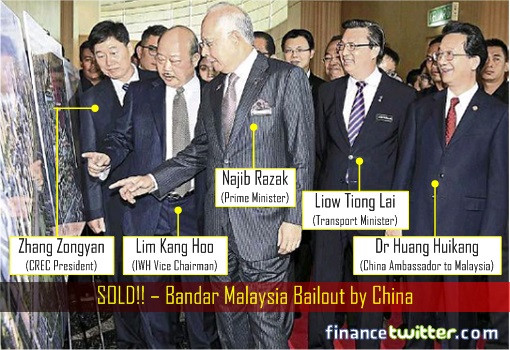

In Dec 2015, Malaysia’s Iskandar Waterfront Holdings (IWH) and China Railway Engineering Corp (CREC) jointly secured rights as the master developer with a RM7.41 billion winning bid to buy a 60% stake in the project. The Malaysian government, through a unit of state fund 1Malaysia Development Berhad (1MDB), was to hold the remaining 40% stake.

The consortium of IWH-CREC was supposed to bailout 1MDB – Prime Minister Najib Razak’s pet project. 1MDB’s debts began at RM5 billion in 2009 before jumping to RM42 billion at end-2014 and by January 2016, its debts ballooned to RM50 billion. It was so massive that 1MDB was spending RM3.3 billion just to repay interest on its debts between April 1, 2014 and March 31, 2015 alone.

In exchange for money to cover up Mr. Najib’s scandal, IWH-CREC would develop a precious 196.7-hectare site of the former RMAF base in Sungai Besi for a mixed development comprising a shopping mall, canals inspired by the likes of the Marina Bay Sands, indoor theme parks, cultural villages, indoor gardens, a financial centre etc.

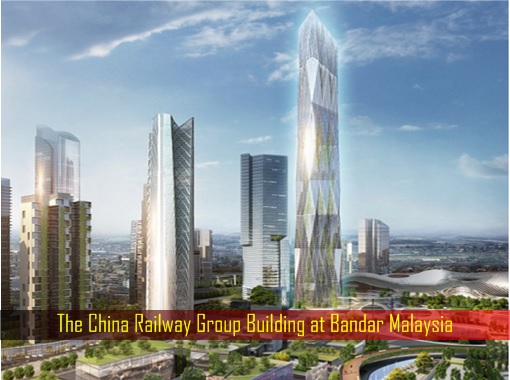

More importantly, there would be a US$2 billion regional headquarters of the China Railway Group. Bandar Malaysia was supposed to be China’s “primary base”, and would be connected to Bangkok through a high speed rail. The track would later connect to Laos, then to Kunming in China, as well as westward to Yangon and eastward to the capitals of Vietnam and Cambodia.

So, the burning question is: why would IWH-CREC break its promise of payments despite 12 extensions being granted, as claimed by TRX? Its size of 196.7-hectare is nearly five times the area of the iconic Kuala Lumpur City Centre (KLCC) project that includes its large park. Bandar Malaysia was indeed a strategic investment to meet China’s agenda in the region.

CREC is a state-owned holding company of China with almost unlimited cash to purchase foreign strategic assets such as Bandar Malaysia. Therefore, there’s no question of money shortage on the part of CREC. After all, China has “colonized” Malaysia through purchases of Forest City, Malacca and Kuantan Ports and East Coast Railway Line (ECRL) project.

TRX City said with the lapse of the agreement, it will be immediately inviting expressions of interest for the role of master developer of Bandar Malaysia. However, IWH-CREC was offended that TRX City blames the consortium, saying “the factual matrix does not fully and accurately reflect the circumstances and conduct of the parties in the matter”.

The consortium of IWH-CREC is currently reviewing the content of the termination notice and press release with its advisors and legal counsel, suggesting that TRX, and Najib administration for that matter, could be in trouble for telling lies to all and sundry that the consortium has financial problems hence the breach of agreement.

If indeed TRX City has screwed up, Prime Minister Najib, who happens to be also the finance minister, could be sued for improper termination of share sale agreement entered on 31 December 2015. Of course, Najib regime, which is presently short of cash due to mismanagement, would need to raise RM741 million to refund the deposits paid by IWH-CREC consortium.

According to Wall Street Journal, the deal was called off after the Chinese government refused to authorize the investment. But why would cash-rich Beijing refused to pump some loose change into a great project such as Bandar Malaysia? Unless, of course, the problem isn’t about IWH-CREC’s inability to pay according to the payment schedule at all.

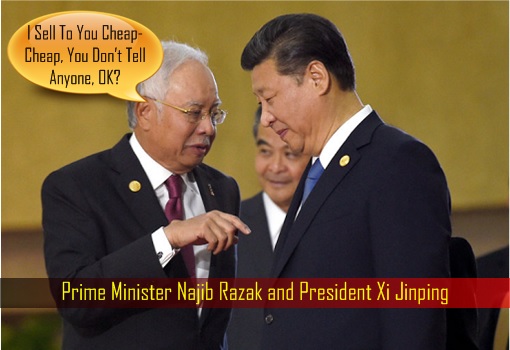

With 14th general election around the corner, Najib’s machinery needs money – lots of money to not only buys votes but also to buy over oppositions in case the present Barisan Nasional government tumbles. Najib’s boys, thinking China was easy-meat, could have approached IWH-CREC for “donations”, as they normally would against local corporations for election campaigns.

The Chinese Communist Party, of course, was greatly upset. China might be corrupt but CREC is a state-owned company. You don’t steal money from your own piggie bank, not to mention President Xi Jinping’s high profile anti-corruption campaign. It would be a different story if CREC was purely a contractor paid to build Bandar Malaysia. CREC would happily mark up profits to pay kickbacks.

However, CREC was more than a contractor in this case. They are the majority shareholder owning Bandar Malaysia. Beijing expects Kuala Lumpur to be grateful that when Najib Razak was in deep shit, it was China who stepped forward to bailout 1MDB. They agreed to pay top dollars when no country in the world dared to touch Malaysia with a ten-foot pole.

But paying kickbacks under the pretext of “donations” wasn’t the biggest problem that had frustrated Beijing. Last week, 1MDB and a former business partner in Abu Dhabi – IPIC – struck a deal to avoid arbitration over part of the missing money. 1MDB claimed it had transferred US$3.5 billion to IPIC between 2012 and 2014, but IPIC said it never received the money.

Strangely, despite claiming it was the victim of probably a scam job, Malaysia’s finance ministry (of which the minister is PM Najib Razak) had agreed to assume US$3.5 billion of 1MDB bond liabilities which were previously borne by the International Petroleum Investment Corporation (IPIC) of Abu Dhabi, suggesting that Mr. Najib wasn’t that innocent after all.

According to 1MDB, it will meet these obligations primarily via monetisation of 1MDB-owned investment fund units. But if 1MDB’s so-called “fund units” worth a dime, they wouldn’t have had begged China to buy Bandar Malaysia in the first place, would they? So, where could 1MDB get the money to pay IPIC, of which the Abu Dhabi fund is seeking US$6.5 billion?

Well, the nearest ATM machine is none other than China. Najib might have “demanded” the Chinese to take over all the US$3.5 billion of 1MDB bond liabilities, without which Beijing might not get the high-speed rail (HSR) link between Kuala Lumpur and Singapore project. Najib knew Bandar Malaysia would be meaningless to China without the HSR.

Last December, Financial Times revealed how Najib son of Razak approached China to help settle the US$6.5 billion dispute over an alleged breach of contract between two Muslim nations – Malaysia and U.A.E. Therefore, it makes perfect sense that when the Chinese refused to continue bailing out Najib’s 1MDB scandal, things started to get sour.

Najib’s grand plan is to squeeze more money from Bandar Malaysia by terminating the deal so that Abu Dhabi and Beijing could be put to a bidding war for the land – driving up the price even higher. And China wasn’t impressed that the son of Razak has chosen to play the friend who bails him out – by threatening to give HSR project to someone else.

Beijing was also deeply concerned that 1MDB, despite repeatedly claiming it had settled all its debts, hasn’t actually published financial statements for 2015 and 2016. There was also the issue of minority shareholder 1MDB trying to dictate what majority shareholder IWH-CREC should do. To teach Najib Razak a lesson, Beijing has decided to pull the plug.

Other Articles That May Interest You …

- Saving Pirate Najib – China To Solve Stolen Money Dispute Between 2 Muslim Nations

- Here’s Why Najib Should Be Encouraged To Sell More Assets To China

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

- WikiLeaks: Soros Slammed Obama Of Trading TPP For A Racist, Extreme & Corrupt Najib

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- Singapore-KL High-Speed Rail – Here’re 10 Things We Know (And Don’t Know) So Far

- China Wins Indonesia High-Speed Train Contract, And Japan Isn’t Happy

- An Ambassador A Day Keeps The Gangster UMNO Away

|

|

May 4th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply