For the first time in 13 years and after 51 consecutive quarters of uninterrupted sales growth since 2003, Apple sales finally collapse. The tech giant reported revenue of US$50.6 billion and earnings of US$1.90 per share. Analysts were looking for US$52 billion and US$1.99, respectively. Last year the same quarter, they did US$58 billion and earned US$2.33 per share.

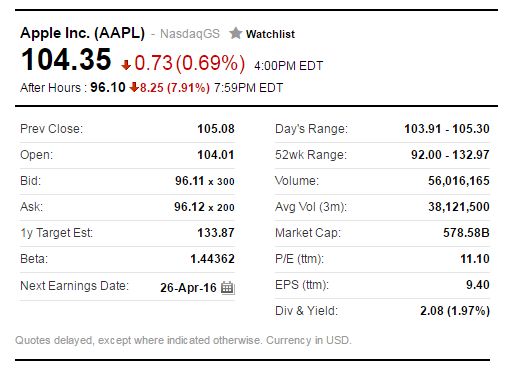

With the latest earning report released by Apple on Tuesday after closing bell, essentially investors were disappointed with the 13% decline in revenue in the comparable year-ago period. Almost immediately Apple stock was hammered down more than 8%. And it’s not hard to understand why considering investors saw the company’s annual revenue jumped by US$227 billion in the 13-year-period.

So, what had gone wrong with Apple sales? The key product – iPhone – had seen its sales tumbled 16% year-over-year to 51.19 million units. Naturally, iPhone revenue dropped 18% to US$32 billion. If that wasn’t bad enough, iPad sales fell 19% to 10.25 million units while Mac sales tumbled 12% to 4 million units.

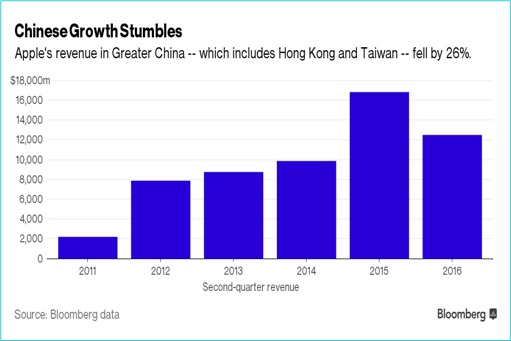

Apple’s largest market sales – America – fell 10% to US$19 billion. Didn’t somebody say when China sneezes, the U.S. catches a cold? Sales in China mainland, Taiwan and Hong Kong fell 26% in the period to US$12.5 billion. Apple blames it to lower sales in Hong Kong, where the local currency peg with the U.S. dollar made products more expensive to consumers.

But the straw that broke the camel’s back was the lower guidance provided by Apple’s management. Apparently, Apple is projecting Q3 revenue in the range of $41 billion and $43 billion, lower than analysts’ expectation of US$47.3 billion. CEO Tim Cook admitted that a saturated smartphone market would be a huge challenge to Apple sales going forward.

Still, Tim is banking on the iPhone SE rolled out last month to bolster sales. However, the cheaper new iPhone, selling at US$399 a pop, could cannibalize its other more profitable flagship smartphone iPhone 6 or the soon-to-be-released iPhone 7. There’s another thing that Tim Cook plans to do to cure Apple’s growth problem.

Mr Cook may go shopping. He said Apple had so far acquired 15 companies in the past 4-quarter. But it won’t be easy to find another company with a great story and product to complement Apple’s line of products. Clearly, there’s little innovation coming from Tim Cook after the death of Steve Jobs. Tim Cook has been relying on iPhone story for too long.

There’s one simple way to boost Apple iPhone sales – by making the flagship more affordable, so cheap that consumers would not think twice about Android smartphone produced by Samsung, Lenovo, Huawei, LG, HTC or Xiaomi. With a life span of only 4 years, Apple iPhone is still terribly expensive in other countries.

Other Articles That May Interest You …

- FBI Finally Cracked iPhone, But Did Apple Help Them – “Secretly”?

- Apple iOS-Liked Technology Coming To Your Car’s Windshield?

- Forget About US$10,000 Apple Watch. Here’s China Version For Just US$40

- Admission!! – Apple CEO Tim Cook Is Proud To Be iGay

- One More (Secret) Thing … Apple iOS 8 Allows Wireless Charging Using MicroWave

- Apple Pay, iPhone 6 & Watch – Welcome To The Party, But You’re Late

- Here’s Proof That Apple Deliberately Slow Down Its Old Models, Before A New Release

- Apple Has More Cash Than Malaysia, France & Dozens Other Countries

- Here’s How To Tell If You’re A Samsung or Apple Fan

|

|

April 27th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply