Malaysia is largely self-sufficient in poultry meat production. Eggs and chicken are among the cheapest and mostly consumed protein staples in the country. Almost 90% of production occurs in Peninsular Malaysia, with the remaining in East Malaysia. Peninsular Malaysia has about 3,200 broiler farms, which includes contract and independent farmers, as well as large vertically integrated farms.

In terms of bird numbers, commercially bred broilers comprise 67%, while layers make up around 25% and breeders make up 8% of the total. Egg production increased from an estimated 659,664 tons in 2013 to 679,803 tons in 2014, with an average growth rate of 3%. Malaysians like chicken a lot (*grin*) and they eat as if there’s no tomorrow.

At 1.44 million tons in 2014, it means Malaysians consume over 40 kilograms per year and such per capita consumption is among the highest in the world. That’s because chicken is much cheaper than beef and pork, not to mention is the dominant meat offered in all fast-food service outlets.

Average cost of production has increased from US$1.45 per kg (2012) to US$1.60 per kg (2013), to about US$1.68 in 2014. The poultry sector uses roughly 4 million tons of compound feed annually. And feed makes up roughly 75% of poultry farmers’ costs, with two major import feed – soybean and corn – account for 80% of production cost.

Three major factors have contributed to the higher production costs since 2013: reduction and subsequently abolishment of fuel subsidy, implementation of minimum wages and of course, the depreciation of local currency Ringgit. So, how come the prices of chicken and eggs are relatively stable even with the currency going fast into the toilet bowl?

Fortunately, the U.S. farmers have been enjoying bumper harvests so much so that they do not know where their yields should be sent to. Months of timely rains and mild weather created ideal growing conditions. With inventories left from the 2013 harvest and extraordinary yields in 2014, America corn growers could see a bumper crop this year again, if El Nino develops during the November-December timeframe.

As for soybean, Jerry Gulke, president of the Gulke Group in Chicago, thinks its prices are in dangerous territory right now. Soybeans price closed last week at the lowest level since they’ve been since 2009. Prices for November soybean futures closed at US$8.854 last Friday, so it remains to be seen if it could slide below US$8.00.

Some analysts also blame a lower soybean commodity price due to the weakening China economy hence a lower import from the Chinese. But that’s merely perception because regardless of economy, people still need to buy food. And there’s a tipping point where the commodity price goes below production cost before farmers call it a day.

Prices of feed supplements such as vitamins, enzymes, minerals have already gone up by as much as 30%. Although they constitute less than 3% of the feed mix to grow the chicken faster, they easily make up to 10% of total feed costs. Malaysia’s weather is not suitable for corn and soybean plantation hence they’re imported, primarily from Argentina.

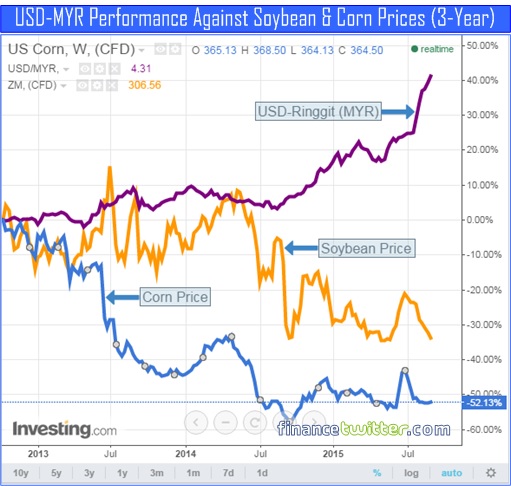

Over the last 12-months, the bumper season has offset the 30% decline in the ringgit. And if you look at the 3-year chart above, the prices for corn and soybean seems to have developed a resistance level, starting middle of 2014. So, there’s so much the commodities’ price can go down before it rebound. The ringgit has lost over 40% in value over the same period.

This week, the ringgit has weakened to as low as RM4.3690 to a US dollar. No rocket science here. If the local currency continues to drop like a rock, there’s very little Najib administration can do to keep eggs and poultry prices in check. Let’s hope the prime minister doesn’t go bonkers by asking you to grow soybean and corn.

It’s estimated that Malaysia have only two months worth of corn and soybean meal at any given time. Hence the situation is quite critical with high possibility that poultry farmers would pass the cost to consumers. It’s worth to note that traders who previously sold corn and soybean to farmers in ringgit, are now demanding contract terms in US dollar, or cash on delivery, for obvious reason.

So, to those shallow-thinking geniuses who think Malaysians are not affected by weakening ringgit as long as they don’t go study or holiday in the U.S., don’t shop online from U.S. websites, don’t buy food or goods from the U.S., don’t use US dollar in daily life; think again. You’re not affected in meaningful way because you’re “lucky” commodities price were tumbling.

But the good time could be over so you better pray really hard the U.S. Federal Reserve doesn’t raise interest rate next week to compound the problem. So no, you don’t have to be currency expert to understand why toilet paper ringgit is bad for you. Otherwise why should Bank Negara Malaysia (Central Bank) fight so hard trying to prop up the ringgit? And stop hunting for a RM1 chicken (the bird, not an egg). You’re not Najib Razak.

Other Articles That May Interest You …

- Do You Understand Nurul Hidayah Ahmad Zahid’s Real Message?

- Here’re Why Ringgit Can Go Further – RM4.50 To US$1 – And Beyond

- These 8 Charts Show How China’s Economy Meltdown Spreads To The World

- Flashback Of 1997 & Today’s Financial Crisis – Here’s Why You Should Be Scared

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

|

|

September 9th, 2015 by financetwitter

|

|

|

|

|

|

|

RM 1.00 per chicken (day old chick) 🙂