Admiral Michael Mullen, former chairman of the Joint Chiefs of Staff, once said – “The most significant threat to our national security is our debt. He commented that back in 2010, when the federal debt totalled US$13 trillion. Nine years later today, Donald Trump has taken over from Barack Obama. But the debt continues its rampage. Not even Trump could stop it.

According to data released by the U.S. Treasury Department on Friday, the federal government’s outstanding public debt has surpassed US$23 trillion (£17.8 trillion; RM95.5 trillion) for the first time in history. The debt has grown about 16% since Donald Trump’s inauguration, when it stood at US$19.9 trillion.

The highest growth in national debt happened under former President Barack Obama, who brought the federal debt above the US$20 trillion mark. President Donald Trump may have slammed Obama about the national debt, but he has followed the same pattern of increasing the debt. He is the third consecutive president to run an annual budget deficit of more than US$1 trillion.

Yes, both President Obama and President Trump had accumulated on average US$1 trillion of debt every year. “Reaching $23 trillion in debt on Halloween is a scary milestone for our economy and the next generation, but Washington shows no fear,” – said Michael A. Peterson, CEO of the fiscally conservative Peter G. Peterson Foundation.

As an illustration of how massive the US$23 trillion debt is, it’s more than 7 times of China’s foreign reserve. China, the country with the biggest foreign reserves in the world, has US$3.092 trillion in September 2019. Even the top-10 countries with the highest foreign reserves – totalling US$9.3 trillion – would not be enough to clear half of America’s debt.

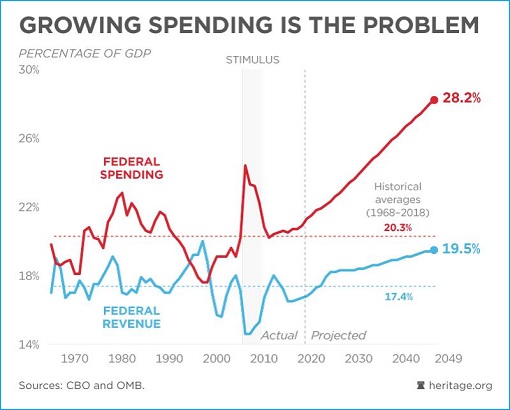

The best part is the nonpartisan Congressional Budget Office expects annual deficits of $1 trillion will continue for at least the next 30 years. While the military and economic superpower will not collapse overnight, the piling on debt and the deteriorating fiscal position could threaten and ruin the nation in the long run.

First, as the national debt grows, so too will interest payments on the debt. In the 2019 fiscal year, the U.S. government had to pay US$376 billion just on the interest alone – nearly half the defence budget. The interest payment was as huge as the annual GDP (2018, World Bank) of Israel (US$369 billion), Hong Kong (US$362 billion), Malaysia (US$354 billion) or Denmark (352 billion).

Second, the growing national debt will put pressure on funding for national defence. As interest payments and non-defense programs further dominate federal spending, the U.S. government has no choice but to slash the military budget. The interest payments were more than the amount spent on the combined costs of education, agriculture, transportation and housing.

The largest factor contributing to the ballooning debt is entitlement programs such as Social Security, Medicare, and Medicaid. It’s the biggest problem because the majority of Americans receive more in benefits from such programs than the taxes they paid in their entire life. Without reforms, higher taxes would need to be slapped on younger workers.

But imposing a higher tax regime without a good justification would be a suicidal mission for politicians. Therefore, to avoid making difficult choices on taxes and spending, most politicians prefer the easier option of letting the debt pile up. Until they face political consequences for doing so, they will keep passing the bill to the next presidency and the future generations.

Since mid-September, the Federal Reserve has been injecting capital into the financial system to calm money markets. On Oct 15, the Federal Reserve has begun buying US$60 billion worth of Treasury bills per month just to keep its key interest rate within an intended range. On Friday (Nov 1), the Federal Reserve Bank of New York added US$104.583 billion in temporary liquidity to financial markets.

While government spending continues to raise red flags, consumer spending also displays concerning trends. Serious debts and late payments on credit card and auto loans are increasing. If current spending levels continue, some analysts predict that the U.S. debt will equal more than 100% of gross domestic product by 2034. That’s debt-to-GDP ratio last seen at the end of the Second World War.

Still, some economists have expressed little or no concern about the U.S. deficit as well as its ever growing national debt. They completely dismiss the risk of the superpower defaulting on debt, arguing that large economies, such as the U.S., could survive simply by printing more money. Debts, they argued, are good and essential in spinning American economic wheel.

Other Articles That May Interest You …

- U.S. The Poor Rich Country – Half Of Americans Will Plunge Into Financial Crisis If Missed More Than 1 Paycheck

- Trump Is Selling Huge Debt Papers To Fund Tax Cuts – But China & Japan Are Dumping Treasuries Instead

- Record 2,208 Billionaires – So Rich They Complained About Having So Much Money

- Trump Brings Best Christmas In U.S. History – $800 Billion Sales By MasterCard

- U.S. Household Debt Hits Record $12.84 Trillion – China Top Owner Of I.O.U. Papers

- US$1.021 Trillion – Americans’ Credit Card Debt Hits History High

- Outgoing President Obama’s Greatest Legacy – Added $8 Trillion To National Debt

- Globalism & Capitalism Not Working – 0.7% Rich Population Control US$116.6 Trillion

- Cracking 16 Digits Credit Card Numbers – What Do They Mean?

|

|

November 2nd, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply