Not long ago, a gold credit card was the most prestigious. Since then you had platinum taking over gold’s place. Now, the top-10 most exclusive credit cards are all mostly “black” or even “diamond”. The most prestigious credit card today is the same card which was launched in 1999 – the American Express Centurion Card. Before you can even be considered into their club, you must have charged at least US$250,000 on the American Express Platinum card within a year.

And if you’re lucky enough, they’ll invite you where you need to pay US$5,000 initial fee. And if you don’t mind paying US$2,500 annual fee thereafter, then you’re part of the exclusive club. Still, if you do not really fancy the ugly American Express Centurion Card, you can consider the second most prestigious credit card – JP Morgan Clase Palladium. Made of laser-etched palladium and gold, this card is reserved for those who have a business relationship with JP Morgan. The annual fee is only US$595.

We bet you can never guess the third most exclusive credit card. It’s the Dubai First Royal Master Card. As the cardholder you are free to spend as much as you like. Basically there’s no credit limit and zero restrictions. So much so that if you ask for the moon, they will try to get it for you. The card itself is already valuable because the left and top sides of the credit card are trimmed with gold, not to mention a 0.235-carat diamond in the center of the credit card.

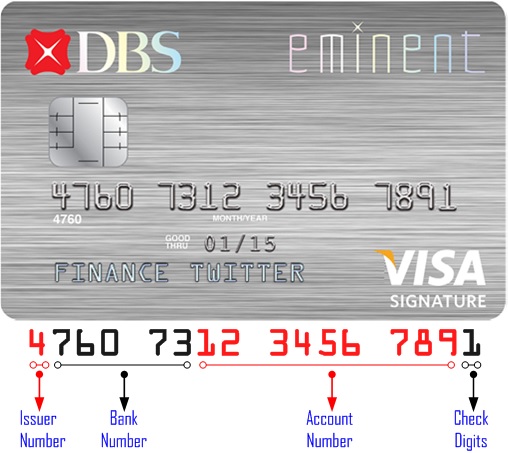

But do you know the real meaning of the numbers embossed on your credit cards – Master, Visa or American Express? Contrary to what you may think, they aren’t random. Those 16 digits are there for a reason and, knowing a few simple rules, you could actually learn a lot about a credit card just from its number, just in case your kids start asking you about it since you’re an engineer or a pilot (*grin*).

Security begins with the first number:

- 1 and 2 – for Airlines

- 3 – for travel and entertainment such as American Express and Diners Club

- 4 – for Visa card

- 5 – for Master card

- 6 – for Discover card

- 7 – for Petroleum

- 8 – for Healthcare and Telecommunication

- 9 – for National Assignment

American Express

American Express card is rather special because it contains only 15 digits instead of the normal 16 digits you see on Master or Visa credit cards. The first 2 digits always starts with 34 or 37. The 3rd and 4th digits indicate the card type (business or personal) and the currency. The 5th till 11th digits are the account number, the 12th-14th digits are the card number associated with the account. And the 15th digit is the check digit.

Master Card

There’re 16 digits for MasterCards – the first digit is always a 5 and the second digit is always between 1-5, so it’s from 51xxxx to 55xxxx. The 2nd-3rd, 2nd-4th, 2nd-5th, or 2nd-6th digits correspond to the bank number (depending on whether digit two is a 1, 2, 3 or other), and the remaining digits up through the 15th are the account number. As usual, the 16th digit is the check digit.

Visa Card

Similar to MasterCard, Visa cards have 16 digits although initially it used to have only 13 digits. The first digit is always 4 as in 4xxxxx – with the 2nd to 6th digits being the bank number while the 7th-15th numbers are your account number. Needless to say, the final digit is the check digit.

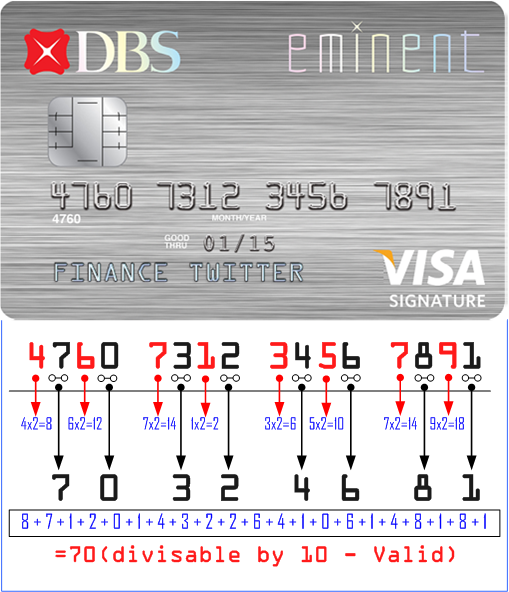

The most important digit is the last digit – the check digit. Invented by IBM engineer in 1954, Hans Peter Luhn, the patented mathematic formula is now in the public domain and a Worldwide standard ISO/IEC 7812-1. Although not all errors can be detected, the algorithm is smart enough to detect any single error and almost all pair-wise switching of two adjacent numbers.

To check if your card is fake, every number in the even position is multiplied by two. If this multiplication creates a two-digit number, such as multiplying 6 by 2 resulting in 12, then the two digits are added together to make a single digit number (1+2). Add all the results of the multiplication together. Then add every number in the odd-digit position to this sum. Now, if the final sum is divisible by 10, then the credit card number is valid otherwise it’s a “fake”.

Try it out on your credit card and see if it works. Of course there’re other cards such as Diners Club cards which always start with either “36” or “38”, although in Canada and United States they start with “54” or “55” since an alliance between MasterCard and Diners Club in 2004. Effective October 2009, Discover Card start processing Diners Club cards starting with “30”, “36”, “38” or “39”.

Other Articles That May Interest You …

- 15 Successful, Rich and Famous People – Their Humble First Jobs

- Top 15 Creative, Stunning, Cool & Useful Business Cards

- 30 Investing Tips & Tricks You Won’t Learn At School

- 15 Tax Deductions You Should Know – e-Filing Guidance

- How To Save Money This Year – 15 Exciting Tips

- Credit Card Safety Tips That You May Have Missed

- Warren Buffett’s 2013 Top-10 Stocks

|

|

August 4th, 2014 by financetwitter

|

|

|

|

|

|

|

heres my number crack it : 4539292378855535