Some 87% of Americans don’t consider themselves rich (or poor), despite making at least US$90,000 a year. The survey done by YouGov essentially means people would only start to consider themselves “rich” when they make at least US$90,000 (£70,560; RM375,800) annually. In general, people earning US$90,000 feel they exist in the middle zone.

However, most of them agree that being poor is when you make about US$30,000 a year. A new study from NORC at the University of Chicago published on Thursday (May 16) found that 51% of Americans could not cover necessities or basic living expenses without accessing their savings – if they missed more than one paycheck.

An additional 15% would experience financial hardship after missing two paychecks. Sadly, two-thirds of households in the U.S. actually earn less than US$30,000. And 65% of Hispanic belongs to this low-income category. Angela Fontes of NORC said – “Even short disruptions in pay can cause significant hardship, as most Americans appear to be living paycheck-to-paycheck.”

The study was conducted between January 31 and February 4, 2019 involving 1,010 interviews with American working adults. In spite of what seems like booming economy, a record number of jobs available and a bullish stock market, as President Trump likes to boast, the survey clearly provides the other flip side of the financial troubles facing half of Americans.

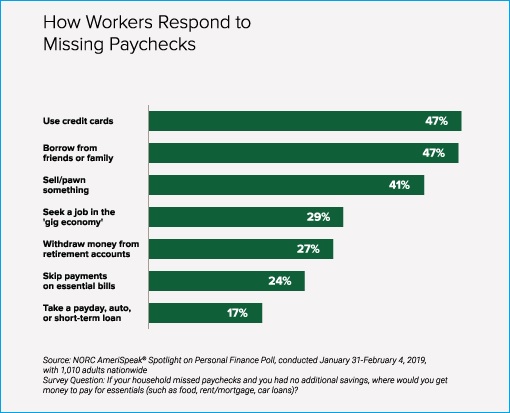

To manage sudden income disruptions, the households would terminate regular savings (43%), stop retirement contributions (28%) and cut spending on non-essential items (73%). About one-third (31%) of households said they would skip the purchase of essentials if they missed two paychecks. But the most troubling fact is how many Americans would turn to debt to make ends meet.

A staggering 47% of Americans admitted they would turn to credit cards if they did not have additional savings for essentials. More alarming is that 17% would resort to taking a paycheck, auto, or other type of short-term loan for quick money to purchase basic essentials. But with interest rates between 400% and 800%, turning to these short-term loans can easily sink borrowers into debt havoc.

Another study done by home repair service HomeServe USA found that despite years after the 2008 Great Recession officially ended, about 50% Americans either are unprepared for a financial emergency or don’t have at least US$500 set aside to cover an unexpected emergency expense. Last year, a survey carried out by the Federal Reserve found that 4 in 10 Americans could not afford US$400 emergency.

One-third of those who can’t pay all their bills say their rent, mortgage or utility bills will be left unpaid. According to the U.S. The U.S. Department of Health and Human Services, the 2019 poverty line is at US$25,750 per year for a four-person family. To combat income inequality, U.S. lawmakers are weighing whether to increase minimum hourly wages to US$15.

Perhaps it’s true that America is the world’s first poor rich country. Sure, Americans are not living on a few dollars a day like those in Somalia or Bangladesh, but considering that the average Americans can’t scrape together US$500 for emergency and a third of Americans can’t afford food, shelter and healthcare, America cannot call itself a rich nation, can they?

Other Articles That May Interest You …

- Here’s How Much Cash Billionaires Bill Gates & Warren Buffett Carry In Their Wallets

- The Rich Getting Richer – Here’s How Amazon Pays “Zero Dollar” In Taxes, Despite $11.2 Billion Profits

- “Never Underestimate Human Stupidity” – Historian Whose Books Read By Bill Gates & Barack Obama

- Record 2,208 Billionaires – So Rich They Complained About Having So Much Money

- US$1.021 Trillion – Americans’ Credit Card Debt Hits History High

- Globalism & Capitalism Not Working – 0.7% Rich Population Control US$116.6 Trillion

- U.S. Debt – How Much Does Each American Owe?

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

May 17th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply