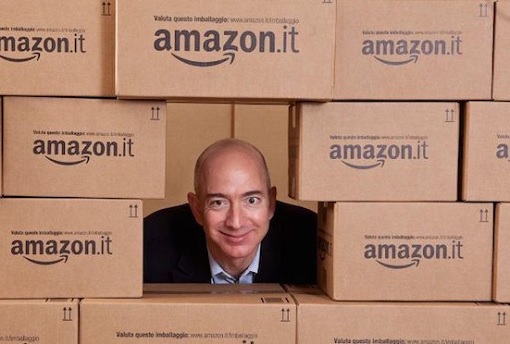

Amazon.com is worth a staggering US$800 billion. It became the second company to reach a stock market value of US$1 trillion just weeks after Apple hit the same milestone. Its stock price is above US$1,600 a share. The company’s CEO and founder – Jeff Bezos – is not only the world’s richest man with a net worth of US$134 billion (Forbes), he is also the first person with a net worth surpassing US$150 billion.

In comparison, Bill Gates, the co-founder of Microsoft and the world’s second richest man, is only worth US$96.6 billion (Forbes). Yet, Amazon will pay US$0 (yes, that’s a big fat ZERO US dollar) in federal taxes, despite almost doubled its U.S. profits from US$5.6 billion in 2017 to US$11.2 billion in 2018. Adding insult to the U.S. Treasury, this is not the first time the company is paying zero taxes.

Yes, according to a report published by the Institute on Taxation and Economic (ITEP) Policy, the online retail giant won’t have to pay a cent in federal taxes for the second year in a row. But that was not the end of the story. The company will actually receive a US$129 million federal income tax rebate, effectively making their tax rate -1% (minus 1 percent).

Amazon’s low (or rather non-existent) tax rate has invited criticism from politicians, ranging from Senator Bernie Sanders to President Donald Trump. Sanders, in his tweet, unleashed his frustration – “Amazon made $US16.8 billion in profits over the past two years but have paid ZERO in federal income taxes. In fact, it got a $US269 million tax refund.”

Trump, a well known critic of Bezos, tweeted last year that the United States Postal Service’s business deals with Amazon has made the company richer, but at the same time made “the Post Office dumber and poorer,” and suggested that the Bezos’ company should be charged more.

However, Donald Trump is partly to be blamed for Amazon’s non-existent federal tax payment. Thanks to the U.S. president’s corporation-friendly tax cuts, the company benefits tremendously from the “2017 Tax Cuts and Jobs Act”, which not only decreased corporate tax rates from 35% to 21%, but also didn’t close some tax loopholes.

Prior to President Trump’s business-friendly tax plan, Amazon paid 11.4% federal income tax rate between 2011 and 2016. Being based in the state of Washington, Amazon also does not pay any state income tax. ITEP said the company has built its business model on tax avoidance, and its latest financial filing makes it clear that Amazon continues to be insulated from the nation’s tax system.

Indeed, Amazon is a specialist in exploiting state sales tax loopholes. It avoids paying federal taxes using a variety of tax credits and tax exemptions that are legal and built into the U.S. federal tax code. For example, research and development tax credit allows them to deduct some of the costs of new investments. Amazon spent US$22.6 billion on R&D in 2017, more than any other company.

Amazon also receives a lot of tax credit for state and local taxes. For example, the company reportedly received a staggering US$40 million in tax incentives from Kentucky for building a US$1.49 billion air cargo hub attached to the Cincinnati / Northern Kentucky International Airport, with a promise that it will create 600 new jobs.

It can also deduct stock-based compensation for executives or employees. This incentive encourages businesses or corporations to share their stock with employees, who ought to benefit from a company’s success. This profit-sharing result is what everyone hoped would happen with the reduction in the new corporate tax rates.

A ruling from a Supreme Court case in 1992 that prevented states from collecting sales tax from e-commerce companies have also helped Amazon saved truckloads of money. It allowed Amazon to sell tons of stuff effectively tax-free. However, by 2017, the company started charging sales tax in all the states. Along with the disappearance of this tax advantage, Amazon’s sales fell by 10%.

But that didn’t stop the creative Amazon from finding new ways to avoid or reduce taxes. As billionaire Jeff Bezos wanted to add more warehouses in more states to support its growing Prime two-day delivery program, the company often negotiated to get the taxes delayed, deferred, or reduced as a condition of collecting them.

Amazon is notorious for using its massive size to pit states against each other in order to get the best tax incentive package available. For example, when the company was scouting for a second headquarters, the company solicited bids from cities and regions interested in hosting its second headquarters, promising US$5 billion in investment and 50,000 new jobs over the next decade.

Other Articles That May Interest You …

- Here’s Top-10 Most “In-Demand” Skills That You Should Have In 2019

- Ouch!! Apple Has Lost $452 Billion – That’s 3 Times Size Of McDonald’s Or The Entire Facebook

- Don’t Get Scammed Or Cheated – One Every Three (33%) Reviews At TripAdvisor Are “Fake”

- Here’s How Amazon Uses “Fake Packages” To Trap Dishonest Drivers Who Steal

- Record 2,208 Billionaires – So Rich They Complained About Having So Much Money

- Something Is Very Wrong!! – World’s Richest 1% Grab 82% Of Global’s Wealth

- Globalism & Capitalism Not Working – 0.7% Rich Population Control US$116.6 Trillion

|

|

February 15th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply