As feared, tech giant Apple plunged and brought along with it the rest of the stock markets not only in the U.S., but also the world. The earning warning from the iPhone maker was sufficient to erase 660 points off the Dow Jones Industrial Average (DJIA). S&P 500 lost 62 points and NASDAQ tumbled 202 points. All the three major indexes have lost over 2 percentage points.

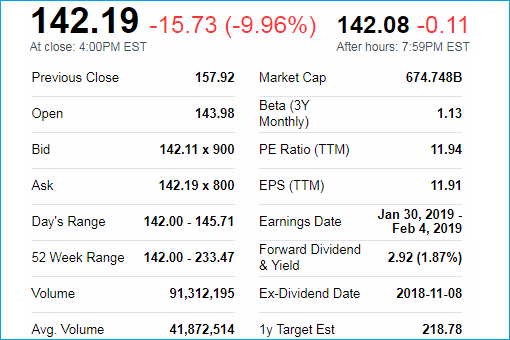

Apple stock itself lost close to 10% after the closing bell. For every share of Apple, a shareholder is 15 bucks poorer as the stock sank to 142 a share. In essence, Apple has lost US$452 billion in market capitalization within the last 3 months. Yes, since Oct 3, 2018, the tech giant’s shares have fallen by 39%, when it hit a 52-week high of US$233.47 a share.

It was as if yesterday that Apple became America’s first trillion-dollar company. However, the milestone, first hit on Aug 2, 2018, didn’t last long. Today, its market value has been reduced to just US$674.75 billion, hitting the 52-week low instead. But just how much is US$452 billion of market value that the company has lost?

At the moment, there are only four S&P500 companies – Amazon, Alphabet, Berkshire Hathaway and Microsoft – that have market capitalization larger than Apple. That speaks volumes the gigantic size of Apple Inc. This means its losses – US$452 billion – are larger than individual value of 496 members of the S&P 500.

This also means the US$452 billion that Apple has lost since Oct 3, 2018 can buy the entire Facebook, whose market capitalization is just about US$378 billion. Even JP Morgan Chase’s market value of US$322 billion is a distance away from Apple’s loss. The US$452 billion can actually buy 2.5 times of Boeing (US$176 billion) or close to 6 times of Starbucks (US$76 billion).

Apple’s market losses are also more than 3 times the size of McDonald’s and more than 10 times of Raytheon, a major U.S. defense contractor that manufacture the infamous Tomahawk cruise missiles. The money lost could also buy 2 times Wells Fargo – Warren Buffett’s bank. Heck, the US$452 billion can even buy Alibaba Group (US$338 billion) with some loose change.

And the cash lost can certainly buy the entire Exxon Mobil, Walmart, Visa, Chevron, Pfizer, AT&T and whatnot. No wonder President Donald Trump was so lost for words that he could only say it was just a “glitch” that the stock markets have experienced such a meltdown. But Apple’s Tim Cook has pledged not to sit around waiting for Trump to do the right thing.

After warning investors to expect lower revenue for Apple’s fiscal first-quarter earnings, CEO Tim Cook said he plans to focus on the factors he can control. He said fewer people than expected upgraded their iPhones due to the lack of carrier subsidies, cheaper battery replacements and price increases thanks to the strength of the U.S. dollar.

Moving forward, iPhone fans can expect greater trade-in rebates as Apple plans to boost the program to encourage customers to upgrade their Apple products more often. Tim Cook believed the trade-in program can help offset the sting of a new iPhone as carrier subsidies have diminished. And it appears Apple has already started the program aggressively.

When you go to Apple website now, the first thing you see isn’t the sexy pictures of the iPhone. Instead, you will see the iPhone XR advertised as the gadget available from as little as US$499 while the iPhone XS from US$699 – depending on the type of your existing iPhone to trade-in. An iPhone 5 is worth up to US$25, while iPhone 7 Plus’ trade-in value is US$300.

Although buying an iPhone on instalments already exist, Apple says it is working to help customers own a new iPhone using instalment programs. How the company could further enhance or expand the existing monthly instalments remain to be seen. Perhaps Tim Cook should consider lowering the prices of its overpriced iPhone instead.

Other Articles That May Interest You …

- Mutual Assured Destruction – Tim Cook’s Latest Sales Warning Shows More Havoc Is Coming

- Why You Should Afraid Of “Black Christmas” – Dow Drops 653, S&P 500 Enters Bear Market, Oil Nears $40

- Panic In Washington – Treasury Secretary Calls Top Bankers To Check Liquidity, While On Vacation

- Get Ready For $40 Oil – Crude Drops Like A Rock, Here’s Why America Holds The Key To Oil Prices

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- President Trump’s Trade War Strategy Against China Isn’t Working – It Gets Worse!!

- China’s Latest Strategy Against Trump’s Trade War May Be Based On Sun Tzu’s Art Of War – Stays Quiet!!

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

January 4th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply