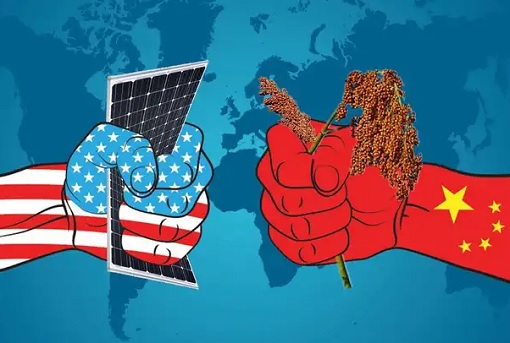

Dell CEO Michael Dell warned in July last year that the U.S. and China face a “mutual assured destruction” if trade relations collapse, adding that “no one will win” a trade war. But judging by Donald Trump and Xi Jinping’s latest antics, losing face is not an option. In denial, the U.S. president even said in his latest defence that the stock market only experienced a “glitch” in December.

The first trading day of the New Year started with a crash – a plunge of 400 points – before stunningly recovered 18.78 points higher. But can it do the same on the second day of 2019? The Dow and S&P500 futures have dropped again before the Thursday’s opening bell, largely thanks to Apple, which could drag the entire technology stocks lower.

The Dow future index has tumbled more than 300 points after Apple slashes its revenue going forward as the giant struggles in China. In his letter to investors, Apple CEO Tim Cook said the trade war between the United States and China is finally impacting the company’s revenue. After trading hours, Apple stock lost 7.5% or close to US$12 a share.

Mr. Cook says – “It’s clear that the economy began to slow there in the second half and I believe the trade tensions between the United States and China put additional pressure on their economy.” Apple cuts its first-quarter revenue to US$84 billion, against analysts’ expectation of US$91.3 billion. Actually, investors have already started dumping tech stocks before last Christmas.

Apple’s admission of a slowing economy and the effect of US-China trade war only confirms that the recent massive sell-off means the 2019 recession could have already started. Apple stock alone dropped 30% in the final three months of 2018. Tim Cook’s latest warning, however, would be affecting any American company that does big business in China.

It’s worth to note that the Chinese manufacturing for the month of December was worse than expected, contracted for the first time in 19 months amid a trade dispute with the U.S. The Caixin/Markit Manufacturing Purchasing Managers’ index (PMI) fell to 49.7 in December from 50.2 in November. A reading above 50 indicates expansion, while a reading below that level signals contraction.

It was this disappointing economic data which had contributed to Wednesday’s U.S. stock index futures plunge. This shows the U.S. does not necessarily win when China suffers. Instead, the mutually assured destruction would kick in. Worse still, Apple wasn’t alone in the destruction process as industrial giant Caterpillar’s stock suffered a 3% fall after Tim Cook’s warning letter.

Prior to Cook’s latest letter to investors, Apple had sent a letter to U.S. Trade Representative Robert Lighthizer warning President Donald Trump’s proposed tariffs on China would affect a number of its products, increasing costs for consumers. However, Lighthizer appeared adamant to continue the trade war, telling friends he would stop Trump from accepting “empty promises” from China.

Apple’s letter in September said – “It is difficult to see how tariffs that hurt U.S. companies and U.S. consumers will advance the Government’s objectives with respect to China’s technology policies. We hope, instead, that you will reconsider these measures and work to find other, more effective solutions that leave the U.S. economy and U.S. consumer stronger and healthier than ever before.”

FedEx CEO Frederick Smith said “most of the issues that we’re dealing with today are induced by bad political choices”, as did General Motors’ warning of uncertainty around China in the bleak picture of the global economy. Cook’s letter also paints how important the Chinese market is for Apple, and to other American companies for that matter, one way or another.

Tim Cook wrote – “While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China. In fact, most of our revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad.”

The Apple CEO, who has spoken out against trade tensions for months, has good news though – that he isn’t worried about travelling to China in the wake of the Huawei CFO’s recent arrest on U.S. warrants. Cook says – “I was just there in October. I’m going back later this quarter. What I can tell you is I feel welcomed when I go there.”

Other Articles That May Interest You …

- Why You Should Afraid Of “Black Christmas” – Dow Drops 653, S&P 500 Enters Bear Market, Oil Nears $40

- Panic In Washington – Treasury Secretary Calls Top Bankers To Check Liquidity, While On Vacation

- Get Ready For $40 Oil – Crude Drops Like A Rock, Here’s Why America Holds The Key To Oil Prices

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- President Trump’s Trade War Strategy Against China Isn’t Working – It Gets Worse!!

- BOOM!! U.S. Now World’s Largest Oil Producer – Oil Lost 20% In A Month, Could Drop To $40 In Bear Market

- China’s Latest Strategy Against Trump’s Trade War May Be Based On Sun Tzu’s Art Of War – Stays Quiet!!

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

January 3rd, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply