President Donald Trump couldn’t hide his frustration anymore. The stock market sell-off will wipe out his only achievement as his government is officially shut down over funding. The U.S. shutdown could stretch into January, 2019. But the president’s biggest worry is the stock market meltdown, which could spell an economy slowdown and subsequently a recession.

In fact, Trump was so angry with the stock market’s plunge that he has asked internal and external advisers about whether he can fire Federal Reserve Chairman Jerome Powell. News of Trump’s intention to sack Powell spread like wildfire and has prompted reprimands from lawmakers and shocks among economists and Wall Street executives.

But the biggest sign of panic in Washington came from none other than Treasury Secretary Steven Mnuchin. On Sunday, he called the CEOs of the six largest U.S. banks to check the liquidity of the financial institutions – to ensure sufficient money is available for lending to consumer and business markets. He also plans to convene a group of officials known as the “Plunge Protection Team.”

Mnuchin reportedly spoke with J.P. Morgan Chase CEO Jamie Dimon, Bank of America’s Brian Moynihan, Goldman Sachs’ David Solomon, Morgan Stanley’s James Gorman, Tim Sloan of Wells Fargo and Michael Corbat of Citigroup. He later issued an unusual statement declaring that the nation’s six largest banks had ample credit – on Twitter.

However, Mr Mnuchin’s action could backfire and drive even more rumours and speculations that everything isn’t as rosy as it looks. Diane Swonk, chief economist at Grant Thornton, said – “Panic feeds panic, and this looks like panic in the administration. Suggesting you might know something that no one else is worried about creates more unease.”

Two of Trump advisers, speaking on the condition of anonymity, agreed that the calls made by the U.S. Treasury Secretary would stoke unnecessary alarm – “No one thought we were at crisis level. It’s going to create more of an issue than we had already.” But at the same time, Mnuchin’s efforts to inspire confidence in the stock market have so far failed.

Adding fuel to the fire was the concern as to why the Treasury Secretary had to call the U.S. top bankers on Sunday, while he was vacationing in Mexico. Why on earth would Mnuchin call in the middle of his holidays just to do some checking, unless it was extremely urgent or life-threatening, right? Interestingly, none of the banks have verified Mnuchin’s claim that everything is functioning properly.

While it is normal for the Treasury Secretary to speak with banking executives and exchange thoughts about the economy, this is perhaps the first time the powerful man released a statement on Sunday – just 2 days before Christmas, during a government shutdown. It raises the question of whether the Treasury and Mnuchin know something the markets don’t.

The U.S. stock markets have plunged about 20% from their peak, raising concerns about whether the economy is slowing faster than widely anticipated. Trump’s anger at the stock market’s sharp drop has increasingly shifted to being directed at Mnuchin, whom the president has blamed for recommending Powell for the Fed job.

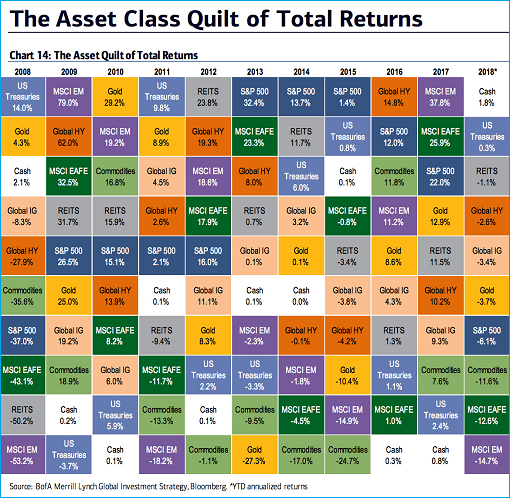

The year 2018 has been particularly bad for financial markets. Almost every single asset class one can invest in – from stocks around the globe to government debt to corporate bonds to commodities – have posted negative returns. At least during the 2008 subprime financial crisis, government bonds and gold gave some decent returns.

Why this year has been so disastrous to the financial markets? One word – low interest rate. The low rates and other easing measures fueled a boom in stocks by enabling companies to borrow and aggressively buy back their own shares, not to mention that the easy borrowing fueled their expansion. In short, easy money found its way into stocks and push it higher.

However, when the Fed accelerated the process of tightening monetary policy – hiking rates and reducing the balance sheet – the market naturally fell to new lows, as can be seen this week when the Fed raised interest rates by a quarter point on Wednesday. Madison Nestor, a senior analyst at PNC Investments, said – “We are at the end of the business cycle.”

So, will the markets reverse for the better if President Trump fires Fed Chairman Powell? After all, he has ranted publicly for weeks about the way Powell is driving the central bank. Wall Street executives have urged Trump to back off, because any move to dismiss the Fed chief would cause a massive sell-off in the markets and rattle the global financial system.

Trump has gone ballistic over Powell because he has been obsessed with the stock market’s performance, constantly asking his advisers what could turn the trend around. There are already talks that Powell could bring the president to his knees, making Donald Trump a one-term president. Hence, the Commander-in-Chief is throwing everything, including the kitchen sink at Powell.

Perhaps the White House was right to be in panic mode. Over the week, the Dow lost 1,655 points or 6.8%, its worst percentage drop since October 2008. It didn’t help that Trump’s trade adviser, Peter Navarro, told Nikkei that it would be “difficult” for the U.S. and China to arrive at a permanent economic agreement after a 90-day ceasefire in the trade tensions.

The simple question is this – if the financial system and market aren’t that serious, why was there a need to set up the “Plunge Protection Team”, the same group activated in 2009 during the later stage of the financial crisis? It will be fun to see if Trump would fire Treasury Secretary Steven Mnuchin instead, as the president has no authority to fire Fed Chairman Powell.

Other Articles That May Interest You …

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- President Trump’s Trade War Strategy Against China Isn’t Working – It Gets Worse!!

- Dow Crashes 832!! – “Geopolitical Recession” Is Here & U.S. World Order Is Ending Under Trump

- China’s Latest Strategy Against Trump’s Trade War May Be Based On Sun Tzu’s Art Of War – Stays Quiet!!

- Trump Has 2 Ways To Stop China From Becoming A Global Leader In Technology

- Get Ready For 4 Rate Hikes This Year – New Fed Boss Powell Ain’t Afraid Of Stock Crash

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

December 24th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply