You may not like his big mouth. You may not like his provocative tweets. You may not like his funny hairstyle. Heck, you may not even like that he has a gorgeous wife. But by now, it’s hard to deny that Donald Trump is good for business. For close to a year, the U.S. president has been subjected to daily bashing from the liberal mainstream news media.

Yet, since the 2008 U.S. Subprime Financial Crisis, 2017 was the year markets finally saw the financial crisis come to an end. There’s a reason why Dow Jones stubbornly climbs to its historical high. At 24,746 points today, that’s close to 5,000 points increase when the Dow was below 20,000 at 19,732 before Trump’s inauguration as the 45th President of the U.S.

When Barack Obama took office on Jan. 20, 2009, the same DJIA (Dow Jones Industrial Average) plunged to 7,949.09, the lowest inaugural performance for the Dow since its creation. As of the end of Obama’s term on January 20, 2017, the Dow Jones had more than doubled to 19,732.40. Still, that’s only 12,000 points over 8 years, as compares to Trump’s 5,000 points over 1 year.

In fact, Wall Street has been on an upswing ever since Trump’s historic upset of Hillary Clinton. The stock market welcomed Trump with a bang as the Dow soared 257 points the day after the election. Eventually, the Dow would surge more than 1,400 points between the election and the end of 2016 – adding US$1.4 trillion in value. And following the swearing in of Donald Trump, the Dow added 95 points.

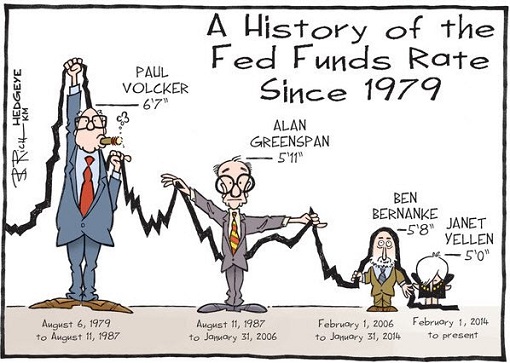

But the bullish stock market isn’t the only proof that Trump knows the financial market more than his predecessor. Obama had shamelessly hidden behind low interest rates to maintain the growth of U.S. economy. Trump, who had mocked and criticised the Federal Reserve Chairwoman Janet Yellen for keeping the rate low to help Obama, forced her to reversed the policy.

Not only has Federal Reserve raised interest rates 3 times this year alone, something which Obama and Yellen were too chicken to do, it also has begun winding down its 2008 financial crisis’ program of asset purchases. But that’s not the end of Trump’s MAGA. The unemployment rate is now sitting at a 17-year low of 4.1%, while consumer and business confidence are at cycle highs.

Heck, even the bitcoin or crypto-currencies are riding high on the back of Trump’s bold economic policies. As the year ends, Wall Street actually expects that 2018 will look a lot like 2017, despite the expectation that the Federal Reserve will raise interest rates another 3 times in 2018. It’s all because of Trump’s fault (*grin*) – his US$1.5 trillion tax cut.

After Trump signed into law the slashing of corporate tax rate to 21% from 35%, AT&T immediately said it would give a special US$1,000 bonus to 200,000 U.S. workers to celebrate the tax cut. Boeing Co., on the other hand, pledged US$300 million for employee training, improved workplace infrastructure and corporate giving.

Although it’s too early to tell if companies will bring at least US$4 trillion in cash into the U.S. from overseas as a result of the law (corporate tax rate reduction), as bragged by President Trump, the American consumers have shown why Trump is good for business. MasterCard Inc. said shoppers spent over US$800 billion during the season – the highest in the U.S. history.

Sarah Quinlan, head of market insights for MasterCard Advisors, said the historical high in sales were boosted by growing consumer confidence, rising employment and early discounts. The report also said holiday sales in stores and online between Nov 1 and Dec 24 rose 4.9% – the fastest year-on-year pace of increase since 2011.

After the revelation, shares of U.S. department stores jumped on Tuesday, including J.C. Penney Co Inc (up 7.6%). Kohl’s Corp. (up 5.8%), Macy’s Inc. (up 5.1%) and Nordstrom Inc (up 2.8%). MasterCard is one of the best measurements of consumer confidence because it tracks spending by combining sales activity in its payments network.

Trump haters, however, may argue that the U.S. president should not take the credit because he inherits the good economy from Barack Hussein Obama. That would be a valid argument if Mr. Trump hadn’t practically reversed everything Mr. Obama had done. Obama’s favourite but toothless Federal Reserve boss Janet Yellen will be jobless on Feb 2018.

Interest rates have been hiked 3 times this year, with another 3 more hikes in 2018. Obama wouldn’t dare to do that. Obama would have fell off his chair laughing at the idea of cutting corporate tax rate to 21% from 35%. Unemployment rate is now even lower than during Obama’s 8 years in Oval Office, despite more than half of Americans voted for liberal Hillary Clinton.

The U.S. president must have done something right. There’s little doubt that Donald Trump is the best Santa Claus the U.S. has ever had. Otherwise, Americans would have had tightened their belt instead of splashing US$800 billion shopping during the season. And that’s a trophy that not even Barack Obama could get despite a higher popular rating than Donald Trump.

Other Articles That May Interest You …

- Here’s What Trump’s Successful Tax Reform Means To You And Stock Market

- U.S. Household Debt Hits Record $12.84 Trillion – China Top Owner Of I.O.U. Papers

- US$1.021 Trillion – Americans’ Credit Card Debt Hits History High

- Outgoing President Obama’s Greatest Legacy – Added $8 Trillion To National Debt

- Here’s Why “President Trump” Wants To “Fire” Janet Yellen In 2018

- Great Minds Think Alike – Both Obama & Najib Are Great Debt Accumulators

- U.S. Debt – How Much Does Each American Owe?

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

December 27th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply