President Trump may have scaled back tariffs on Chinese goods this week to spare holiday shoppers, but consumers are still likely to feel a pinch. He announced a new round of 10% tariff on US$300 billion worth of Chinese imports, the remaining goods yet to be taxed, and even promised to raise the tax from 10% to 25% – only to make a stunning U-turn and postpone it.

An array of apparel, electronics, watches and sporting goods from China will be hit with levies of 10% starting Sept. 1. The value of these and other products subject to the new tariffs totaled US$111 billion last year, according to a Wall Street Journal analysis. While economists say the impact won’t derail the U.S. economy, it could slow fourth-quarter growth.

“It is not entirely accurate to label this a de-escalation,” said Chris Krueger, managing director of the Cowen Washington Research Group. He likened the policy to telling someone – “I was going to break both of your arms on Sept. 1 – now I am only going to break your elbow.”

As reported by the Wall Street Journal, Beijing wasn’t impressed by the ratcheting back of tariffs, either. On Thursday, an official with the State Council’s Customs Tariff Commission denounced the rise in tariffs and said “China would have no choice but to take necessary countermeasures.”

Mr. Trump did sideline tariffs on smartphones, laptops, toys and other Chinese imports valued last year at US$156 billion, saying that he wanted to soften the impact on consumers for the holiday season. What the president didn’t tell the American consumers is that they have been saddled with US$69 billion in added costs because of the tariffs the U.S. imposed last year.

But those tariffs are set to kick in December 15, and meanwhile the United states under Trump administration will in 2 weeks be collecting tariffs on about US$361 billion in Chinese imports – the levies on the US$111 billion worth of annual imports that starts September 1, plus previous tariffs on US$250 billion in Chinese goods.

Previous rounds of tariffs have largely spared consumers, with the administration targeting items such as telecommunications equipment, metal alloys and mechanical devices that tend to be purchased by businesses. So, American consumers in general did not feel the impact, hence they probably believed Trump’s rhetoric that they were winning the war.

That changes next month. And there’s a reason why Donald Trump deliberately puts his latest tariff on hold, at least until after the Christmas. About US$33 billion in apparel, shoes and hats are among the items subject to a 10% tariff on Chinese imports beginning September 1, according to a Journal analysis of data from the U.S. Trade Representative’s office and the Census Bureau.

The Sept. 1 list also includes about US$27 billion in electronics. That includes a bevy of routine items ranging from wireless surveillance cameras to solid-state drives and some televisions, the Journal’s analysis found. All told, 69% of consumer goods from China will be subject to tariffs starting Sept. 1 – up from 29% currently, according to Chad Bown, a senior fellow at the Peterson Institute for International Economics.

Mr. Trump held off on imposing all the threatened tariffs following warnings from retailers who said the levies could dim prospects for the holiday shopping season, the Journal has reported. The retreat also came as financial markets shuddered over fears that the U.S.-China trade war could put the global economy in a funk (Germany and China have reported weak economic data).

In determining which tariffs to postpone, one factor appears to have been the availability of alternatives to Chinese imports, according to the Wall Street Journal analysis. A review of the tariff list indicates that tariffs were generally postponed for import categories, such as video game consoles, where China accounted for about 75% or more of imports in 2018.

By December 15, however, just about everything coming from China will be subject to tariffs. What is left is only US$19.8 billion of Chinese goods aren’t covered, including pharmaceuticals, some medical equipment and organic chemicals, and items under special import provisions. In essence American consumers will bear all those extra costs.

The office of the U.S. Trade Representative has said there will be a process for companies to seek exclusions from tariffs, however, if their business would be unduly damaged by the new duties. Theoretically, the direct effect of new 10% tariff on US$111 billion of goods is too little to derail the US$21 trillion U.S. economy, say economists.

But that is not the same as saying the effects will be unnoticeable to the U.S. economy. The direct effects of the newest tariffs would slow growth in the fourth quarter by about 0.1 percentage point, according to Gregory Daco, chief U.S. economist for Oxford Economics, a forecasting and economic analysis firm. He expects the economy to grow about 2% in the fourth quarter.

That damage is likely to persist into 2020 and could be amplified by growing awareness of the tariffs, and growing uncertainty from businesses and financial markets about what to expect from the future trade policy. Mr. Daco said – “The uncertainty that pertains to these tariffs is going to have an effect beyond the tariffs. It’s not just about goods costing more, it’s about the cost and time it takes for businesses to plan around these tariffs and trade tensions.”

Overall inflation has been modest in the past year, with the Labor Department’s consumer-price index up about 1.8% in the 12 months through July. But many items in the consumer-price index, from rent to health care to higher education costs, don’t have prices that are significantly influenced by tariffs.

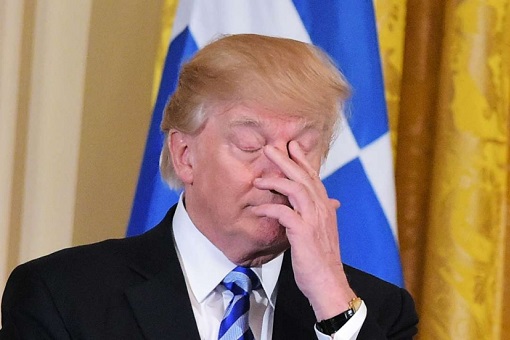

The Trump administration focused its early tariffs on intermediate or capital goods, such as machinery purchased by businesses. Price increases on those items, though a hit to the U.S. importers paying the tariffs, aren’t obvious at the consumer level. Trump, in his haste to punish the Chinese, did not think it over and had to make an embarrassing U-turn.

But when tariffs have hit consumer goods, the price increases for retail customers have been more apparent. According to a Goldman Sachs analysis of Labor Department data earlier this month, prices have risen by 3% among the categories of items that have faced tariffs, such as laundry equipment and furniture. Prices have declined by about 1% for core goods that haven’t faced any new tariffs.

That backs up the findings of most research examining the tariffs, such as two high-profile studies earlier this year – one from a quartet of economists, including the chief economist of the World Bank, working on a National Science Foundation grant, and another from the Centre for Economic Policy Research written by economists from the Federal Reserve Bank of New York, Princeton and Columbia universities.

Both concluded that although tariffs are formally assessed on U.S. importers when they bring in goods from foreign countries, the costs are passed on almost entirely to consumers. Of course, not all consumers will blame Trump even if they notice watches, smartphones, video games, laptops, apparel or toys have become pricier. But for those who do, Trump will lose their votes.

Other Articles That May Interest You …

- It’s Not Over Yet – Promised To Take The Necessary Countermeasure, China Could Target The U.S. Oil

- Trump Blinked Again – Postponed Tariffs On $300 Billion Chinese Goods Under The Pretext Of Saving Christmas

- China Strikes Back!! – Trade War Becomes Currency War After Suspends U.S. Agricultural Goods & Devalues Currency

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- Oil Prices In Free Fall Despite OPEC Supply Cuts – Here’s Why It Could Get Worse

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Forget OPEC – These 3 Powerful Men Will Determine & Control The World Oil Prices

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

August 18th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply