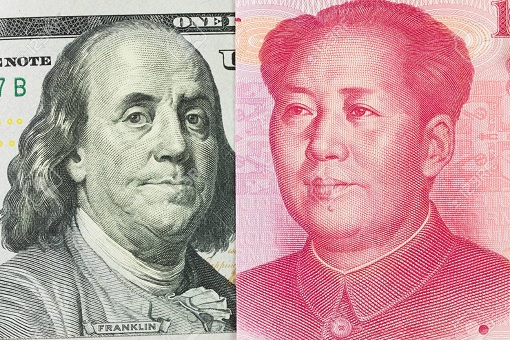

In retaliation for Donald Trump’s announcement last week of new 10% tariff against an additional US$300 billion of Chinese goods, effective September 1, Beijing has finally fired its biggest shot since the trade war started in March 2018. It devalues its currency Yuan (Renminbi) and officially suspends purchases of American agricultural products.

As a result, the DJIA (Dow Jones Industrial Average) plunged 767 points, falling below 26,000 points for the first time since June. Effectively, it has fallen 5 sessions in a row, marking the worst losing streak since March. The bloodbath was so bad that Apple, Microsoft, Amazon, Alphabet and Facebook – the 5 most valuable U.S. companies – lost a total US$162 billion on Monday.

China deliberately picked Trump’s two sore spots – dollar and farmers. The U.S. president has been protesting about the strong dollar and complained how other countries weaken their own currencies for trade advantage. He has also repeatedly asked China to purchase agricultural products from the U.S. to limit the impact of trade war on American farmers.

By weaponise it’s currency President Xi Jinping has essentially called his counterpart, President Donald Trump to do his best to escalate the US-China trade war further. In an immediate response, the U.S. Treasury Department has designated China as currency manipulator – the first the White House has done so since President Bill Clinton administration in 1994.

The People’s Bank of China sets the Yuan fixing at 6.9683 to a US dollar on Tuesday morning, slightly weaker than 6.9225 levels from Monday morning – it’s the weakest since May 20, 2008. In Monday’s Asian afternoon trading hours, the onshore currency traded at 7.0304 against the dollar, while the offshore Yuan changed hands at 7.0807 against the greenback.

On a daily basis, the Chinese central bank sets a rate for the Yuan, allowing this rate to trade in a band against the dollar that is 2% on either side of its midpoint value. That is known as the onshore currency, or CNY. The offshore currency CNH is used by foreign investors and banks to trade the Yuan and dollar currencies and it fell to a record 7.09 per dollar.

The global financial markets have been watching to see if Trump administration would slap the Chinese with “currency manipulator” label. However, the title currency manipulator is mostly symbolic and rhetoric and will not lead to any penalties even if the U.S. complains to the IMF. The fact that China decided to play the currency game shows that they have given up that a trade deal with Trump can be reached.

Stephen Roach, a senior fellow at Yale University, said the U.S. labelling China a currency manipulator is nothing but an “empty threat”. After China allowed its currency to breach a psychologically important level, the Chinese will most likely remain quiet and observe what the U.S. will do next. Beijing is not expected to engage in war of words with Trump, like what he did with North Korean Kim Jong-Un.

Of course, the United States can always retaliate against China’s currency devaluation by trying to sanction the entire Middle Kingdom. But that would definitely put not only the U.S. stock markets in meltdown, but also triggers panic around the globe, as can be seen on Wall Street. Obviously, the Chinese have made careful calculations and in depth considerations before its latest retaliations.

Alternatively, Trump can copy what Xi is doing – intervenes in the currency market to bring down the U.S. dollar. But it would be a never-ending game as China can continue its devaluation as well. It would probably work if other countries agree to gang up with America against the Chinese. However, there is no reason for other countries to get involved as the war is between the U.S. and China.

Interestingly, while the U.S. has the advantage of trade deficit of US$419.2 billion with China as a tool to raise tariffs to punish the Chinese, the reverse is true about engaging a currency war. With only US$36 billion of cash and cash equivalents, the U.S. Treasury does not have enough fire power to intervene and weaken the dollar. China has US$3.12 trillion in foreign reserves as of June.

Of course, officially, the China’s central bank will never admit to devaluing its currency in response to Trump’s latest tariffs. But every analyst will tell you that the weakening of Yuan currency was the easiest way to help offset the revenue impact of tariffs imposed by Washington. Like 2015, however, the strategy carries the risk of capital flight if the currency gets too cheap.

Besides dollar and farmers, it’s also an open secret that the stock markets’ performance is the “Achilles Heel” of Donald Trump. China is sending a message that they no longer are interested in Trump’s boring game and invites the president to play the currency war, if he dares and has the funds to play the new game. Any further retaliation from Trump could raise the risk of recession.

Trump apparently has only one supporter amongst his trade team, namely Peter Navarro. Everybody told the president not to increase the tariffs on the remaining US$300 billion of Chinese goods. The narcissist Donald Trump, could not afford to lose face, ignored all his advisers and went ahead with his combative option with China, forcing the Chinese to weaponise its Yuan.

His band of advisers were deeply concerned that the latest round of U.S. tariffs would hit on goods that are more directly consumer products, and could impact companies, retailers and consumers just as holiday shopping gets underway. China calls Trump’s tariffs a declaration of war on “Christmas”, clearly referring to American consumers in the coming holiday season.

At the same time, China also suspended its purchases of U.S. agricultural products, dealing a blow to Trump’s support base that sent him to the White House in 2016. To add salt into injury, the Chinese Commerce Ministry said it will not rule out taxing imports tariffs on American farm imports purchased after August 3.

Agricultural exports have been a major red button for the U.S. president, whose re-election chances could be affected by his trade wars. The Trump administration has already rolled out a massive US$28 billion bailout program for farmers, a major constituency for Trump that has largely lost access to the Chinese market in the wake of tariffs.

Goldman Sachs now said that it’s impossible for the world’s two largest economies to reach an agreement over trade before the 2020 election. Former Treasury Secretary Larry Summers, meanwhile, warned that the ongoing trade war between the U.S. and China is potentially creating “the most dangerous financial moment” since the global crash in 2008.

Peter Boockvar, chief investment strategist at Bleakley Global Advisors, said – “Trump lives by the market dies by the market and lives by the tariffs and dies by the tariffs.” But the U.S. should not be too surprised with China’s retaliations. You can only push someone for so long before they start pushing back. Nevertheless, analysts say the speed at which it moved to let the currency fall was a surprise.

Other Articles That May Interest You …

- Trade War Is Tough To Win – How A Desperate Trump Vetoed Advisers’ Objections Of New Tariffs On China

- How Wall Street Lost 590 Points After Trump Slapped China With 10% Tariff On $300 Billion Goods

- The Trump Effect! – Home Sales Plunge 36% As Chinese Buyers Flee, Continue Dumping US Treasury

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Trump Is Bluffing – He Will Not Let The Stock Market Collapse, And He Lied About Forcing China To Pay $100 Billion

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

August 6th, 2019 by financetwitter

|

|

|

|

|

|

|

Currency manipulation started when USA went off the gold standard.