Donald Trump still talks as if his latest tariff hike – from 10% to 25% on US$200 billion worth of Chinese goods – is like money dropping from the sky. The U.S. president continues hoodwinking his supporters that the Americans are winning because as a result of the trade tariffs, China pays US$100 billion to the U.S. Treasury. Well, if that’s true, he should forget about talks and escalates the trade war further.

Tariffs are used to restrict or limit imports by increasing the price of goods and services purchased from another country (in this case China), making them less attractive to domestic consumers (in this case Americans). Such tool is typically used by a government to raise revenue, protect domestic industries, or exert political leverage over another country.

The goal is to make foreign-produced goods more expensive. In the same breath, it will make domestically produced goods seem cheaper and more attractive. However, in this case, American companies, in order to be more competitive and profitable, have already outsourced jobs and goods to foreign workers in foreign countries like China, eliminating jobs for Americans.

So, when higher tariffs are imposed, the burden of the tariffs will fall on buyers of Chinese-made products – essentially the American consumers. Trump fails, or deliberately refuses to tell his supporters that the higher tariffs are being paid by Americans (importers), not the Chinese (exporters). The only thing that concerns China is the decrease in its exports to the U.S. because of pricier products.

According to estimates from Oxford Economics recently, the U.S. economy would be about US$100 billion smaller by 2020 if Trump administration imposes a 25% tariff on all imports from China. Essentially, that could end up costing every American household about US$800. Hence, it is the American consumers – not Chinese – who pays the US$100 billion to the U.S. Treasury.

But American consumers have been lied to by Trump administration not only about the real suckers who actually pay to the U.S. Treasury, but also other damaging counter measures adopted by the Chinese. Trump might have underestimated the creativity of China in its retaliation against the U.S. in the trade dispute. Sure, Trump’s threat of tariffs cannot be matched by Beijing due to US$375 billion deficit.

However, China can hit U.S. exporters twice. First, the Chinese retaliated by slapping the same tariffs on American goods. Then, the Chinese deliberately “lowered” tariffs on goods from countries that compete with America. So, while everyone else enjoys a sudden improved access to China’s 1.4-billion consumers, Americans were left wondering why their goods could not sell.

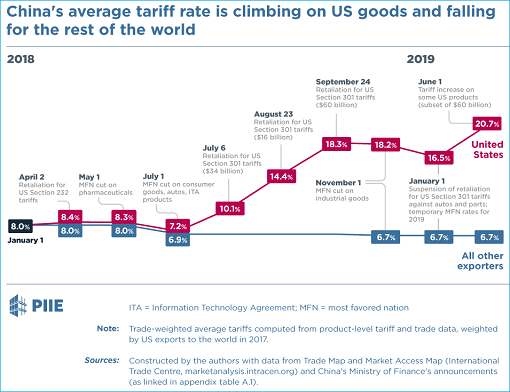

According to Peterson Institute for International Economics, China has over the past year lowered tariffs on goods from everyone except the Americans. The research data showed that while China’s average tariff rate on U.S. goods jumped from 8% at the start of 2018 to 20.7% this month, the average tariff rate on its imports from all other countries fell from 8% at the start of 2018 to 6.7% last November.

To put this into perspective, the U.S. and other countries competed in China with each other on a level playing field – average tariff of 8% – in the early 2018. Now, American goods are 12.7% more expensive, while goods from the rest of the world are 1.3% cheaper. That’s a whopping 14% of price differences between American and other countries’ goods.

Interestingly, China’s tactical move to lower tariffs on countries other than the U.S. has received very little public attention, with Western media coverage focusing on war of words between Beijing and Washington. While Trump has been threatening China, Mexico, Europe, India and the world with new tariffs, China has been offering carrots to other countries.

Apparently, China’s strategy has put the U.S. companies at a “considerable” disadvantage – American companies and workers are at a considerable cost disadvantage relative to both Chinese firms and firms in third countries. The report also said that another important implication of China’s action is that “Americans are likely suffering more than President Trump thinks”.

Such strategy of lowering tariffs on products from other countries also allows China to limit or minimize the harm to its economy. It allows the Middle Kingdom to import vital goods at better prices from other parts of the world. This is basic tariff 101 where the higher the rate of tariffs is, the more expensive the goods will be to consumers, and vice-versa.

For example, the American lobster industry saw its exports fall by 70% after China imposed its retaliatory tariff of 25 percent on July 6, 2018. On the other hand, Canada’s lobster exports to China nearly doubled as it benefited from a 3 percentage point tariff cut in 2018. To add salt into injury, the U.S. lobster industry was not eligible for subsidy programs introduced by Trump.

In the same breath, American exporters of Pacific salmon suffered horrible business when their sales in China decline after the retaliatory tariff, only to be replaced by Chinese imports from Japan. Scottish salmon exports from the U.K. to China have jumped more than 40% at the beginning of the year. But the Chinese need not necessary to give the “lower tariff” carrot to other countries to punish the U.S.

China has successfully shifted much of its imports of U.S. soybeans in 2018 to imports from Brazil and Argentina – even without giving the incentive of reducing its existing 3% tariff on soybean imports from those countries. Thanks to Trump, China found out that on average, it is now 14% cheaper to buy something from Canada, Japan, Brazil or Europe than it is to buy from the U.S.

Tariffs are costly to the country imposing them, and China is no exception. The Chinese, realising the impact of imposing higher tariff rate, which in essence is taxes, have instead lowered tariffs when imports from other countries – the opposite of what the U.S. is doing. President Donald Trump and his advisers have fiercely defended their tariff strategy in the trade war with China.

Commerce Secretary Wilbur Ross has been telling all and sundry that Trump is “perfectly happy” to impose tariffs on the remaining US$300 billion of Chinese imports if the two countries fail to strike a deal. If it’s true that Americans are the sure winners, why even bother to threaten the Chinese, and not just go ahead and slap whatever tariffs Trump likes?

U.S. companies, of course, have painted a different picture. More than 600 American companies, including Walmart and Target, wrote a letter last week urging the Trump administration to resolve the dispute – warning the tariffs could cost the average American family US$2,000 each year and destroy 2 million U.S. jobs.

China’s calculated move is definitely not good news for U.S. exporters. More importantly, it was seen as a clever strategy to shift U.S. allies into depending on the country. If countries like Japan, Germany, Canada, and other countries start to rely on China, and view China as a good trading partner, they’re going to have less incentive to work with the U.S.

Other Articles That May Interest You …

- China’s Trade Surplus For May Hit $41.65 Billion – Trump Threatens Xi To Meet Him At G20 Summit … Or Else

- “Best Friend” Russia To Fill China’s Food Gap As Trade War Forces The Boycott Of U.S. Meat & Soybeans

- As Trump Uses Tariffs To Fight Immigration War With Mexico, China Raises Doubts About U.S.’ Trustworthiness

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

- Watch Out Trump!! – China May Weaponize “Rare Earth” To Retaliate Against U.S.’ Ban On Huawei

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Trump Is Bluffing – He Will Not Let The Stock Market Collapse, And He Lied About Forcing China To Pay $100 Billion

- Huawei Sues The U.S. – A Law That Bans Procurement Of Huawei Products Violates American Constitution

- China Furious!! – CFO & Daughter Of Huawei Founder Arrested In Canada On Behalf Of The U.S.

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

June 21st, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply