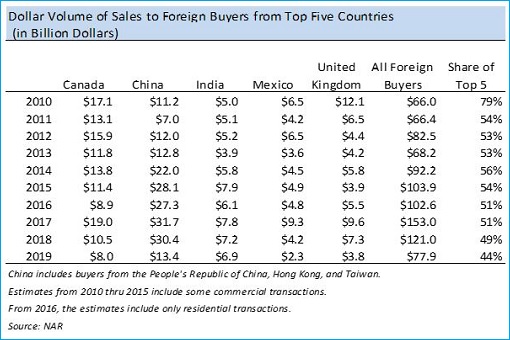

For the 12-month period from April 2018 to March 2019, U.S. home purchases by foreign buyers dropped 36%. According to the National Association of Realtors (NAR), foreigners bought only 183,100 properties worth about US$77.9 billion, down from 266,800 valued at US$121 billion in the previous period. That’s a loss of US$43 billion worth of home sales in the U.S.

Lawrence Yun, NAR’s chief economist, said – “A confluence of many factors – slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale – contributed to the pullback of foreign buyers. However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.”

Although Chinese continues to be the leading buyers of American homes for the seventh consecutive year since 2011, purchasing an estimated US$13.4 billion worth of residential property, it was a drop of 56% from the previous 12 months which saw booming market when the Chinese bought a staggering US$30.4 billion worth of houses.

The housing purchases declined for all top five foreign buyers, but the steepest drop came from Chinese buyers – Canadians (US$ 8 billion), Asian Indians (US$6.9 billion), U.K. buyers (US$3.8 billion), and Mexican buyers (US$2.3 billion). Florida remained the major destination, accounting for 20% of foreign buyers, followed by California (12%), Texas (10%), Arizona (5%), and New Jersey (4%).

Southern California, the popular place amongst Chinese parents hoping to send their children to American colleges, saw a major pullback in purchases. Carrie Law, CEO and director of Juwai.com, a Chinese real estate site, said – “We call it the Trump effect. It’s a combination of anti-Chinese political rhetoric, a clampdown on visa processing, and of course tariffs.”

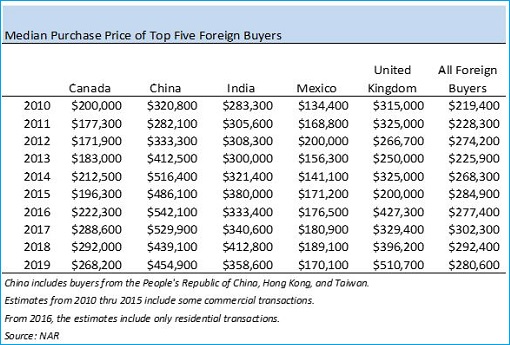

The Chinese buyers purchased approximately the same number of homes as Canadians, but the Chinese bought pricier homes, hence, they beat the Canadians in terms of dollar volume. The median purchase price was highest among Briton (US$510,700), followed by Chinese (US$454,900), Asian Indian (US$358,600), Canadian (US$268,200) and Mexican (US$170,100).

While a third (33%) of Chinese buyers purchased property in California, 42% of Canadian buyers preferred Florida due to its lenient tax laws. Indian and Mexican buyers, on the other hand, like Texas. But the US’ loss means that foreign investment, especially from mainland Chinese, can instead go to major cities in Australia, United Kingdom and even Japan.

But the drop in housing purchases by foreigners isn’t the only impact hitting the Trump administration as a result of his trade war with China. On Tuesday (July 16), the U.S. Department of the Treasury released Treasury International Capital (TIC) data for May 2019, which showed that China continued to sell US Treasurys for the third straight month.

China now holds only US$1.11 trillion of US Treasuries – the lowest since May 2017 – amid an escalation of the trade war between the world’s two largest economies. Still, China remained the US’ biggest foreign creditor, but not for long. Japan, the second biggest US Treasuries holder, has US$1.1 trillion, up by US$37 billion from a month earlier – its largest monthly purchase since August 2013.

Just shy of US$9.2 billion, the Japanese could become United States’ biggest debt collector if the Chinese continue to sell. Whether China is deliberately dumping the U.S. Treasuries is a tricky question. Even if it was done on purpose in retaliation to trade war with Washington, Beijing will never admit it as a panic in the bond market will damage China as well.

The selling could be profit-taking, or diversifying away from the dollar and stockpiling gold, or genuine dumping done in a slow manner. They just need to consistently sell the U.S. Treasury debt paper in small amount to create confusion sufficient to impact on the Treasury yields and together with cheap yuan’s value, it could blow back onto American soil and of course, the Trump administration.

Even if China does not sell, but merely stop buying Treasuries, it would be seen as a threat that will shake the bond market. UBS estimates that if the reduction is gradual, it likely would result in a rise in the benchmark 10-year Treasury yield of at most 0.4 percentage point. Any aggressive actions to cut holdings are considered a nuclear option.

Other Articles That May Interest You …

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- The U.S. Is Already In Recession – And There’s Something Wrong With The Stock Market Rally

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

- Watch Out Trump!! – China May Weaponize “Rare Earth” To Retaliate Against U.S.’ Ban On Huawei

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Trump Is Bluffing – He Will Not Let The Stock Market Collapse, And He Lied About Forcing China To Pay $100 Billion

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

July 18th, 2019 by financetwitter

|

|

|

|

|

|

|

Congratulations for the post and for your work. Great Job!