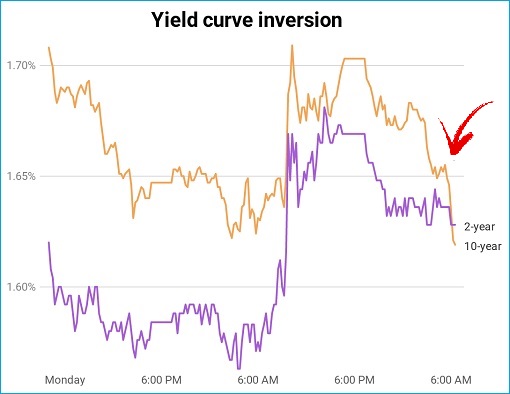

Stocks dropped like a rock on Wednesday (August 14) when the DJIA (Dow Jones Industrial Average) plunged 800.49 points – worst percentage drop of the year. What happened? Apparently the bond market flashed warning of recession. The yield of 10-year Treasury note broke below the 2-year rate – a rare but reliable indicator of economic recession.

It’s called “Yield Curve Inversion”. To get an idea how rare such inversion happens, consider that since 1978 there have been only 5 inversions of the 2-year and 10-year yields. The last time this happened was in December 2005, about 2 years before the Great Recession hit the world. On average, a recession occurred 22 months after the inversion. That’s the good news.

However, you don’t wait until the last minute to prepare for the recession. Historically, it could strike as early as 6 months after an inversion. That explains why all hell breaks loose after the signal flashes. President Donald Trump also joined the panic bandwagon, instantly fired his tweets – blaming “clueless” Jerome Powell and calling the inverted yield curve “crazy”.

To add salt to the injury, official data released on the same day showed growth of China’s industrial output slowed to 4.8% in July from a year earlier – the weakest growth in 17 years. On the same day also, Europe’s largest economy – Germany – registered “negative GDP” growth. It got so bad that US$63 billion was wiped off from the Australian stock market on Wednesday.

But the party has just begun. China said it will have to take the necessary counter-measures to Trump’s latest tariff threat, accusing the U.S. president of “seriously violated” a consensus reached by leaders of two countries at the G-20 summit. Amusingly, Trump had accused the Chinese of not keeping its promise to buy U.S. agricultural products, a promise made at the same summit.

However, Beijing appears to have softened its stance on Thursday (August 15) and hopes to “meet the U.S. halfway” on trade issues. If a Bloomberg report is any indicator, the recession signal on Wednesday has awakened Trump to the reality that the U.S. wants a trade deal with China after all. Praising President Xi Jinping a “great leader” and a “good man”, Trump offers a “personal meeting”.

Despite using Hong Kong protests to mask his desperate desire for a personal meeting, there’s no guarantee that President Xi will meet his counterpart, now that it’s obvious President Trump is desperate for a trade deal right now. In fact, Beijing might just proceed with its threat to take the necessary counter-measures to bring Trump to his knees.

Already, the devaluation of the Yuan and the boycott of American agricultural products have caused chaos in the financial markets. To stop now and give Trump the necessary oxygen to recover so that he can fight back later is quite an idiotic strategy. So, how else could Xi retaliates to teach Trump a lesson he won’t forget even after he leaves the White House?

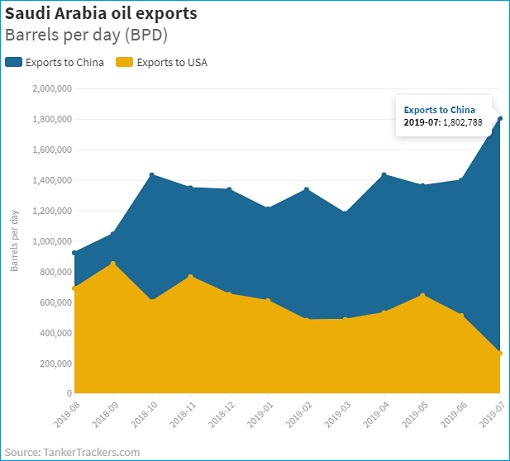

Perhaps the answer can be found in Saudi Arabia. In recent months, China has been buying oil from the OPEC leader like crazy. The Kingdom of Saudi’s crude shipments to the Middle Kingdom has doubled in the span of a year. Coincidentally, during the same period, Saudi’s exports to the U.S. have dropped substantially by nearly two-thirds.

According to data from TankerTrackers.com, Saudi Arabia exported a whopping 1,802,788 barrels per day (bpd) to China in July, compared to 921,811 bpd in August of 2018, about a year ago. This could be due to the fact that the U.S. has become the world’s largest oil producer by the end of last year, hence the self-reliant country did not need to buy so much oil from Saudi.

However, it could also mean that China might be getting ready to target the U.S. oil industry as trade war enters a new chapter, thanks to Trump’s 10% tariff on US$300 billion of Chinese goods. Using the same strategy where the Chinese switch from the U.S. to Brazil for soybean supply, it’s not hard to see how China can easily switch from the U.S. to Saudi Arabia for the supply of crude oil.

TankerTrackers.com co-founder Samir Madani has described China as a “black hole” for the world’s oil exports – its ability to “easily absorb” oil barrels from the market, especially when prices drop like presently. China’s two newly launched refineries can grow its refining capacity by 800,000 barrels per day. So, the Chinese could either buy oil from Saudi for storage or weaponise it against the U.S.

China is the world’s largest importer and the second-largest consumer of oil after the U.S. As its economy slows, so too does its oil demand. But based on the sudden huge purchases from Saudi, it didn’t seem that China is slowing down. Actually, Chinese refiners and traders have been staying away from US-origin crude cargoes for months, despite the fact that China doesn’t have tariffs imposed on U.S. oil.

Although American crude oil is currently not an essential trade item between both nations, China is expected to dramatically reduce its intake of U.S. crude imports further to depress the crude oil prices. When the oil price crashes, American shale producers could be out of business while the Chinese could buy more cheap oil from the market.

Sure, OPEC has agreed to extend oil output cuts until March 2020 to prop up prices. However, its efforts clearly have been outweighed by worries about the global economy due to the US-China trade dispute and uncertainty over Brexit, as well as rising U.S. stockpiles of crude and higher output of U.S. shale oil. If China officially stops buying U.S. oil, it could create more problems for Trump.

Other Articles That May Interest You …

- Trump Blinked Again – Postponed Tariffs On $300 Billion Chinese Goods Under The Pretext Of Saving Christmas

- China Strikes Back!! – Trade War Becomes Currency War After Suspends U.S. Agricultural Goods & Devalues Currency

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- Oil Prices In Free Fall Despite OPEC Supply Cuts – Here’s Why It Could Get Worse

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Forget OPEC – These 3 Powerful Men Will Determine & Control The World Oil Prices

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

August 16th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply