Earlier this month, when President Donald Trump announced a new round of 10% tariffs on US$300 billion worth of Chinese imports, the remaining goods yet to be taxed, Beijing was not convinced that the U.S. would escape from the escalated trade war unscathed. Trump also overplayed his hand in the poker game when he threatened to raise the tariff from 10% to 25%.

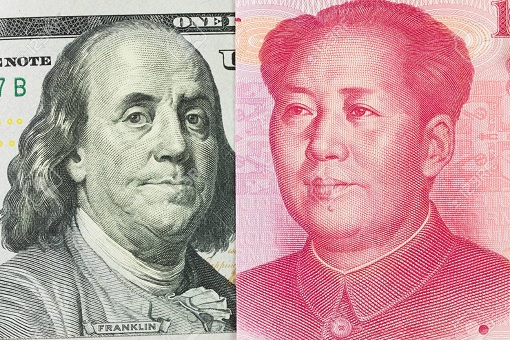

China calls Trump’s bluff, and fired two shots – aiming at US dollar and American farmers. The Chinese central bank devalued its currency – Yuan or Renminbi – to below the psychological level of 7 to a US dollar. Beijing also officially suspended purchases of U.S. agricultural imports, something very critical to Trump’s 2020 presidential re-election.

Since the day Yuan was devalued, it has been 5 consecutive sessions where the People’s Bank of China (PBOC) fixed the midpoint at a level weaker than the “redline” 7-yuan-per-dollar mark. The weakening of Yuan currency was the easiest way to help offset the revenue impact of tariffs imposed by Washington. Stunned, Trump could only name and shame China as a currency manipulator.

Throwing tantrums, Trump also said the United States won’t do business with China’s tech giant Huawei. As if they have anticipated the U.S.’ move, Huawei officially reveals it’s new operating system – Harmony OS. The company claims the operating system can be used in everything from smartphones to smart speakers, wearables, and in-vehicle systems to create a shared ecosystem across devices.

Suddenly, the U.S. stock markets are dancing to the tune of China’s Yuan. According to hedge fund manager and Hayman Capital Management founder Kyle Bass, China’s currency would plunge 30% to 40% without Beijing’s support. That would trigger a global financial meltdown, should Beijing goes nuclear and bring the entire world down with it.

The biggest impact from China’s retaliation isn’t the currency devaluation, but the exit from the U.S. agriculture sector. Instead of buying from U.S. farmers, the Chinese bought around 13 million more tons from Brazil. Suddenly the No. 2 exporter becomes No. 1 exporter, thanks to Trump. Actually, China is paying more for Brazilian soybeans than American soybeans.

But the Chinese willingly pay more just to send a message and to teach Trump a lesson. China has little interest to play games with the U.S. They wanted Huawei to be removed from the Department of Commerce black list and a complete removal of tariffs which Trump had imposed since day 1, before any negotiations could even start.

Desperate, President Trump is reportedly urging Japan to increase its purchase of U.S. agricultural products, threatening to slap 25% tariff on shipments of Japanese cars into America if the Japanese refuse to play ball. To add salt into injury, there is a discrepancy between the figures published by the USDA’s National Agricultural Statistics Service (NASS) and those of the Farm Service Agency (FSA).

As the Agriculture Department found out on Monday (August 12), farmers planted a bigger corn area than analysts estimated and pegged crop yields that also exceeded expectations – leading to a potential loss of almost US$3.5 billion for the American farmers. Lower prices and more than expected supplies would require Trump to announce further aid to farmers.

The funny thing is, while the Chinese have stopped buying the American agricultural products, the U.S. has not stopped importing made-in-China gadgets and widgets. On Tuesday (August 13), Trump suffered another round of humiliation when the president was forced to postpone the 10% tariff on US$300 billion worth of Chinese imports, scheduled to go into effect on September 1.

As the U.S. Trade Representative office said that certain items were being removed from the new tariff list and duties on others would be delayed until mid-December, Donald Trump claimed that he postponed tariffs for the Christmas season “in case it had an impact on shopping” and the delay would “help a lot of people.” The stock market cheered.

However, Trump’s backing off on the tariff he eagerly imposed to punish China shows just how much pain the U.S. could tolerate. In essence, the U.S. president blinked. That sends a message to China that the Americans is not ready for a prolonged trade war. President Xi Jinping will definitely take this as a sign that the U.S. may cave with enough pressure.

More importantly, Trump’s U-turn proves that he was lying through his teeth when he told his supporters that the 25% tariff on US$200 billion of imports from China will force the Chinese to pay “US$100 billion” to the U.S. Treasury. If that is true, the latest 10% tariff on US$300 billion of Chinese goods would bring even more free money, so why did he postpone the tariff?

By exempting items such as cell phones, shoes, clothing, toys, laptops, and video games – all of which are crucial to the U.S. consumer market – from tariffs during the coming holiday shopping season, it means the Americans are paying the tariffs, not the Chinese. Of course, it also shows that every time Trump makes the stock market go down a few hundred points, the president “backs away.”

Other Articles That May Interest You …

- Singapore Cuts Economic Growth To Almost 0% – Here’s Why Everyone Should Be Worried

- China Strikes Back!! – Trade War Becomes Currency War After Suspends U.S. Agricultural Goods & Devalues Currency

- How Wall Street Lost 590 Points After Trump Slapped China With 10% Tariff On $300 Billion Goods

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- Huawei’s Market Share Hits Record 38% In China – All Competitors’ Share Including Apple Plunges

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

August 14th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply