Huawei’s revenue grew 19.5% in 2018 – hitting US$100 billion – despite pressure from President Donald Trump on allies to boycott or ban Huawei from participating in the fifth-generation mobile networks, otherwise known as 5G, the latest mobile internet technology engineered to greatly increase the speed and responsiveness of wireless networks.

It was quite an achievement considering Huawei smartphones are “locked out” of the U.S. market. The US$100 billion mark effectively put Huawei in the same league as Microsoft and Google. The Chinese tech giant said it was targeting total revenue of US$125 billion in 2019 – a record high. But that announcement came before Trump goes nuclear on Huawei – banning the company.

Less than 2 months after Huawei announced its achievement of hitting US$100 billion in revenue, and slamming the United States for having “a loser’s attitude” because its tech can’t compete with the Chinese, Trump effectively banned Huawei on May 15 under the boring “national security threat” reason. The “Executive Order” was seen as a bully tactic to undermine the unstoppable Huawei.

After being blacklisted, Huawei admitted it would experience a 40% to 60% drop in international smartphone shipments. However, in the G20 Osaka Summit (28-29 June), the U.S. president stunningly told the press that he had decided to allow U.S. companies to sell to Huawei, despite literally putting the Chinese tech giant on the trade blacklist just a month earlier.

The massive U-turn saw confusion and backlash from not only the business community, but also from lawmakers over national security concerns. But even before Trump flip-flops, proving that Huawei has never been a threat to homeland security in the first place, but merely a fake accusation to temporarily paralyse the Chinese company, Huawei had shipped 100 million smartphones by 30 May.

Huawei’s shipment of 100 million devices by 30 May was an improvement of 49 days, when it clocked the same number on 18 July last year. In order to offset the anticipated decline in international shipments, Huawei planned to grab half of China’s smartphone market this year, in which it had 34% share. And it appears the company is on the track to meet its own promise.

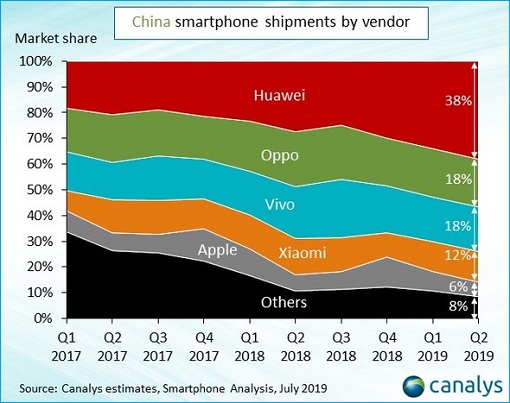

Based on the latest report from Canalys, Huawei’s smartphone shipments in China surged in the second quarter and captured the highest market share of any vendor in the country in 8 years. Its shipments in China soared 31% year-on-year, even as the overall market slowed. Shipments from competitors such as Oppo, Vivo and Xiaomi – even Apple – tumbled.

Oppo’s shipments was down 18% with only 17.9 million units, while Vivo plunged 19% to 17.1 million units. Xiaomi, on the other hand, saw its shipments down a whopping 20% to 11.5 million units. Apple, once the darling of the Chinese consumers, was down 14% to only 5.7 million units. But despite the overall 6% shipment decline, Huawei sold 37.3 million units in China.

With 64% of its smartphone shipments in Q2 made in the home market – the highest since 2013 – Huawei has now captured 38% market share in China, further increases its gap with the second place Oppo (18%). On the third spot is Vivo (17.5%), follows by Xiaomi (11.8%) and Apple (5.8%). Huawei proves that when the situation gets tough, it could shift back to China to meet its numbers.

Hours ago, Huawei reported revenue of 401.3 billion Yuan (US$58.3 billion; £47.9 billion; RM240.5 billion) – a 23.2% year-over-year increase for the first six months of 2019 year despite facing political headwinds. The company’s net profit margin for the first half of 2019 was 8.7%. Its consumer business hit 220.8 billion Yuan where the smartphone shipments reached 118 million units – up 24% year-over-year.

In the same period, Huawei’s carrier business recorded 146.5 billion Yuan. To date, the company says it has secured 50 commercial 5G contracts, including more than 150,000 base stations, with leading global telecommunication carriers. The Chinese tech giant announced that it will continue investing a staggering 120 billion Yuan in R&D alone this year.

Fifth-generation wireless, or 5G, is the latest mobile internet technology engineered to greatly increase the speed and responsiveness of wireless networks. With 5G, data transmitted over wireless broadband connections could travel at rates as high as 20-Gbps by some estimates – making it the buzzword as the backbone of future cities and even driverless cars.

Apparently, the US-China trade war creates new opportunities to Huawei back at home, without which it would never know about its brand appeal to local consumers. Advertisements linking Huawei with being the patriotic choice have been incredibly successful. Interestingly, Chinese consumers are holding on their upgrades, primarily due to the pending 5G network and devices.

With the commercial launch of 5G scheduled to be in the second half of 2019, not to mention improvements in network coverage and quality of service in 2020, the Chinese consumers’ sudden switch to 5G-capable smartphones could also boost Huawei share market accordingly. Already, Huawei has been aggressively cutting prices to increase its customer base.

Other Articles That May Interest You …

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- Trump Made A Mistake Of Extending Huawei Lifeline – China To Boost & Create Its Own Tech Landscape

- Watch Out Trump!! – China May Weaponize “Rare Earth” To Retaliate Against U.S.’ Ban On Huawei

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

- As Huawei Hits $100 Billion Revenue, Chairman Said The U.S. Has “Loser’s Attitude” & “Table Manners” Problem

- “You Cannot Crush Us” – Huawei Founder Warned About Shifting Investment From The U.S. To U.K.

- Huawei Strikes Back – U.S. Fears Of Being Left Behind, Fails To Hack Into Huawei To Spy

- From Trade War To Political Kidnapping – Two Canadians Held “Hostage” As China Retaliates

- China Invasion – Top 10 American Iconic Brands Now Owned By Chinese

|

|

July 30th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply