Attending the 33rd ASEAN Summit, Mahathir Mohamad, the world’s oldest prime minister has been having fun condemning everyone he does not like – including Myanmar’s Aung San Suu Kyi and US President Donald Trump. But the biggest culprit the 93-year-old Prime Minister of Malaysia has criticised was the 149-year-old bank Goldman Sachs.

He said bankers at Goldman Sachs, the American investment bank founded in 1869, had “cheated” the country and must be held accountable for their fishy business deals in relation to 1MDB scandal. Mahathir was, of course, leveraging on the U.S.-DOJ investigation results that says over US$4.5 billion was misappropriated from the 1MDB fund.

Earlier this month, we published why Malaysia should sue Goldman Sachs for their involvement in the corruption and money laundering scandal. Subsequently, Malaysian Finance Minister Lim Guan Eng said the country was seeking a full refund of all the fees paid to Goldman Sachs for raising US$6.5 billion in three bonds sales between 2012 and 2013 for 1MDB (1Malaysia Development Berhad).

Goldman earned almost US$600 million from the three deals – a jaw-dropping amount of close to 10%, far in excess of the normal 1-2 percent fees a bank could expect for helping sell bonds. The fees alone – 5 to 10 times more than usual rate – should have raised the red flags within Goldman compliance department that something fishy was going on, which today has proven to be true.

Essentially, the US$588 million in fees earned made 1MDB the most profitable client in the world for Goldman during those years. After Bloomberg reported that the new government of Malaysia was seeking the full refund, Goldman Sachs shares dropped 7.5% on Monday, crashing the U.S. stock market when Dow Jones tumbled by 602.12 points.

Besides calling Goldman a fraudster, PM Mahathir told the media at the Asean Business and Investment Summit that the rule of law must apply to everyone, including American giant Goldman Sachs. He said – “If the law says that somebody has committed a crime, then he should be accordingly be punished through the process of law. It doesn’t matter who, maybe Goldman Sachs, maybe whoever.”

There are basically two parts to Mahathir’s statement. The premier could be parroting Finance Minister Lim’s earlier statement about the country seeking full refund, hence his pressure on the claims. However, he could also be sending a message to pressure the U.S.-Department of Justice to punish Goldman bankers – sending them to prison.

On Nov 1, the U.S. revealed criminal charges against not only former banker Tim Leissner but also another Goldman Sachs banker, Ng Choon Hwa (Roger Ng), together with Malaysian financier fugitive Jho Low (full-name: Low Taek Jho). Roger Ng has been arrested in Malaysia while his former colleague Tim Leissner pleaded guilty to conspiring to launder money and to violating anti-bribery laws.

Tim Leissner agreed to pay US$43.7 million (£33.6 million; RM182 million). Still, it was a good deal considering he has admitted to enriching himself – acknowledging that more than US$200 million in proceeds from 1MDB bonds flowed into accounts controlled by him and a relative in Hong Kong. This sweet deal raises speculation that Leissner may have agreed to turn witness in the explosive scandal.

The former Goldman bankers – Tim Leissner and Roger Ng – had offered bribes to government officials in Malaysia and Abu Dhabi in order to help the bank win the deal. They then stole and laundered money from the 1MDB sovereign-wealth fund using controlled offshore accounts where the stolen money was funnelled to, as the indictment reveals.

But there was another crook – Andrea Vella – who has been Goldman Sachs partner since 2007. Currently placed on leave over his role in the 1MDB scandal, Mr. Vella, who was demoted last month from his management role, matches the description of “Co-Conspirator #4” in the Justice Department’s filings related to charges unsealed. Clearly Andrea Vella wasn’t the last of his kind.

On Nov 7, Goldman Sachs chief executive officer David Solomon told an interview with Bloomberg TV in Singapore that it was “distressing” to find two former Goldman Sachs bankers went around the bank’s policies and broke the law in their dealings with 1MDB, arguably the largest investigation carried out by the Department of Justice under its anti-kleptocracy program.

Mr. Solomon said – “I feel horrible about the fact that people who worked at Goldman Sachs, and it doesn’t matter whether it’s a partner or it’s an entry level employee, would go around our policies and break the law.” Amusingly, he refused to provide assurances that neither he, former CEO Lloyd Blankfein nor any of the senior management team suspected illegality nor compliance breaches in dealings with 1MDB.

It wasn’t hard to understand why Mr. Solomon could not provide such simple assurances. As far back as 2009, three years before the bond sales, the firm’s then-CEO Lloyd Blankfein personally helped forge ties with Malaysia and its new sovereign wealth fund 1MDB at a meeting with the crooked ex-PM Najib Razak together with his partner-in-crime Jho Low at the Four Seasons hotel in New York.

In fact, more than 30 Goldman Sachs executives – including boss David Solomon and his predecessor Lloyd Blankfein – had actually reviewed the Malaysian debt deals that led to criminal charges against two of its former bankers. Heck, even Gary Cohn, the former Goldman president and chief operating officer who joined Trump administration, knew about the dubious deals.

The burning question is this – will any Goldmanites eventually sent to prison? Besides a full refund, perhaps the frustrated Prime Minister Mahathir wants blood – that the U.S. authorities and judiciary system send to jail all the Goldman scumbags involved in the 1MDB scandal. Unfortunately, it would be a wishful thinking as Goldman Sachs is regarded as a holy institution.

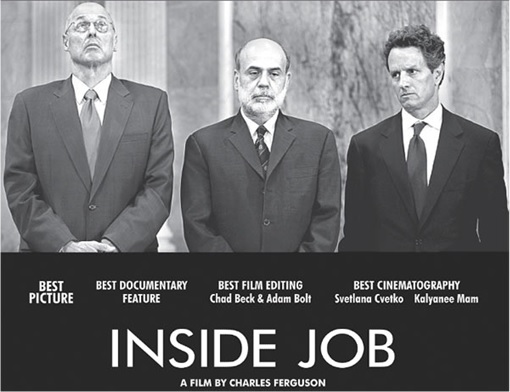

Welcome to American capitalism at its finest. If Mahathir thinks the 1MDB scandal alone could threaten the 149-year-old American investment bank, he should revisit the 2008 subprime crisis again. The financial crisis which hit the United States 10 years ago was caused by corruption in the nation financial system from the beginning.

Barack Obama got into office due to his highly effective “Change” campaign, during which the 2008 great recession hit the country. Obama promised that the era of greed, accounting frauds, irresponsibility and irregularities of Wall Street will be changed – which had turned out to be nothing but empty sloganeering and marketing gimmick.

Adding salt to injury, the same pool of scumbags and crooks whom Obama criticised and blamed for causing the 2008 crisis during his campaign were – surprisingly but not unexpectedly – appointed as top economic advisers in his own administration. Yes, scumbags such as Timothy Geithner, William Dudley, Mark Patterson, Lewis Sachs, Rahm Emanuel, Feldstein, Larry Summers, Ben Bernanke and whatnot.

News media reported that the U.S. treasury department only used US$700 billion in the big bank bailout during the financial crash in September of 2008. In reality, a jaw-dropping US$16.8 trillion (yes, TRILLION) was used for the bailout, a crisis that Goldman Sachs was involved directly when they bundled terrible subprime mortgages and pushed them down the throats of its clients.

Sure, Goldman Sachs was fined a staggering US$550 million in settlement after they were slapped with a lawsuit from the U.S. Securities and Exchange Commission. But the same firm was also given a cool US$10 billion bailout at the same time. Goldman Sachs only cares how much profit they can make at the expense of their clients, even if it means selling them products that are sure to “blow up” eventually.

Even after Obama administration, President Donald Trump continues recruiting former Goldman Sachs employees involved in the 2008 financial crisis – such as current United States Secretary of the Treasury Steven Mnuchin and former chief economic advisor Gary Cohn. Yes, even in the U.S., there appears to be one rule for the rich and powerful and another for the rest of ordinary Joes and Janes.

So, if none of Goldman Sachs bankers were sent to prison despite causing the 2008 financial meltdown, does PM Mahathir, and the world for that matter, think it would be any different with the Goldmanites cheating 1MDB sovereign-wealth fund? Get real, it would be a challenge to get a full refund from Goldman Sachs – even with help from the U.S.-DOJ – let alone demanding American smartest white collar crooks sent to jail.

After the 2008 bailout, Goldman Sachs is essentially an American institution that is too big to fail. But what about the criminal charges filed by the U.S. prosecutors against the two former Goldman Sachs bankers. Well, Tim Leissner would turn witness while in a worst case, Roger Ng would most likely be sacrificed – because he isn’t a U.S. citizen. That explains why Roger is fighting his extradition to the U.S.

Other Goldman Sachs top executives – including David Solomon and Lloyd Blankfein – would walk away scot free. They are the untouchable white collar crooks. There’s only one reason the U.S. prosecutors are breathing down their necks – to put pressure on the firm in order to get the highest possible fines (possibly in the region of billions). Yes, the scandal will be solved through one word – settlement.

Other Articles That May Interest You …

- Here’s Why Malaysia Should Sue Goldman Sachs In 1MDB Corruption & Money Laundering Scandal

- Mahathir Hired The Right Man – After Equanimity, A.G. Thomas To Recover RM24.17 Billion In 1MDB-IPIC Payments

- Al-Jazeera Interview – How Mary Ann Jolley Skillfully Skins & Grills Najib Till He Runs Away

- Congrats Najib!! – You Lose A Powerful Witness, Saudi Denies Any Knowledge About RM2.6 Billion Donation

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Blood Bonds – Greedy Goldman Sachs Making Money Off The Killing Of Venezuelans

- Bribed With Prostitutes, Scammed Of $1.2 Billion – Libya Sues Goldman Sachs

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- By Hiding Again From IACC, 130 Countries Assume Najib Is Guilty

- Najib Secretly Reaching To Goldman Sachs Top Guns Hired By Trump For Help

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

November 14th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply