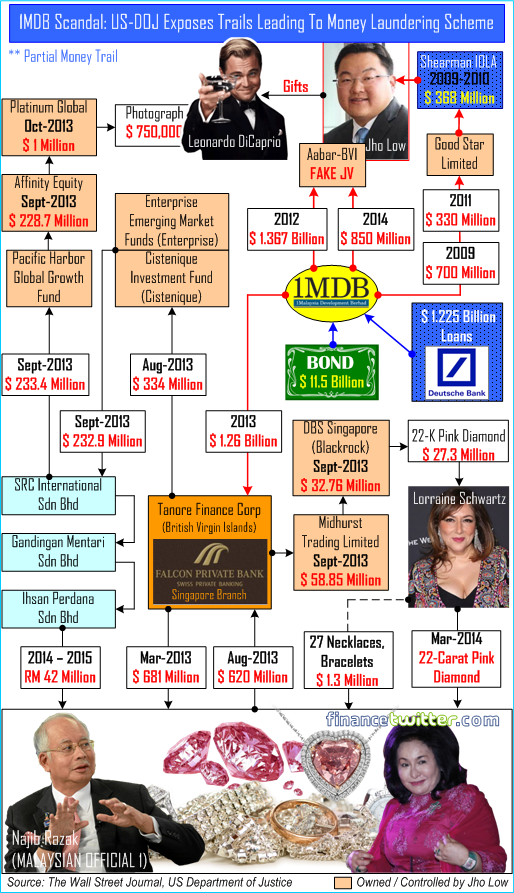

Goldman Sachs, the 149-year-old American investment bank, raised nearly US$6.5 billion in three bond sales between 2012 and 2013 for 1MDB (1Malaysia Development Berhad). More than US$2.5 billion raised from these bonds was misappropriated by high-level 1MDB officials, their relatives and associates, according to U.S. Department of Justice civil lawsuits filed in a U.S. court in 2016.

In the process, Goldman earned almost US$600 million for the three deals – a jaw-dropping amount of close to 10%, far in excess of the normal 1-2 percent fees a bank could expect for helping sell bonds. The fees alone – 5 to 10 times more than usual rate – should raise the red flag that something fishy was going on, which today has proven to be true.

Essentially, the US$600 million in fees earned would make 1MDB the most profitable client in the world for Goldman during those years. Didn’t mommy say there ain’t no such thing as a free lunch? Now, the chickens have come home to roost. The scandal has punched a bigger hole on Goldman’s reputation and credibility, after the bank screwed up everything in the 2008 sub-prime financial crisis.

When the 1MDB scandal first exploded, only one name – Tim Leissner – was put forward as the bad apple. He was basically thrown under the bus. Still, the Goldman former partner and Southeast Asia chairman wasn’t charged at all. He merely resigned in Feb 2016 after he was found to have violated the firm’s internal rules. The downfall of Malaysia PM Najib Razak changes everything.

The defeat of Mr. Najib, the crooked behind 1MDB scandal, in the historical May 9 general election saw Leissner hurriedly seeking talks with U.S. prosecutors to potentially plead guilty to criminal charges, especially to a violation of the U.S. Foreign Corrupt Practices Act, which prohibits the use of bribes to foreign officials to get or keep business.

On Thursday (Nov 1), U.S. revealed criminal charges against not only Tim Leissner but also another Goldman Sachs banker, Ng Choon Hwa (Roger Ng), together with Malaysian financier fugitive Jho Low (full-name: Low Taek Jho). Roger Ng has been arrested in Malaysia while his former colleague Tim Leissner pleaded guilty to conspiring to launder money and to violating anti-bribery laws.

Tim Leissner agreed to pay US$43.7 million (£33.6 million; RM182 million). Still, it was a good deal considering he has admitted to enriching himself – acknowledging that more than US$200 million in proceeds from 1MDB bonds flowed into accounts controlled by him and a relative in Hong Kong. This sweet deal raises speculation that Leissner may have agreed to turn witness in the explosive scandal.

The former Goldman bankers – Tim Leissner and Roger Ng – had offered bribes to government officials in Malaysia and Abu Dhabi in order to help the bank win the deal. They then stole and laundered money from the 1MDB sovereign-wealth fund using controlled offshore accounts where the stolen money was funnelled to, as the indictment reveals.

But there appears to be another culprit, a second Goldman partner whose identity was withheld by prosecutors. The co-conspirator allegedly knew not only about the bribes paid but also helped Mr. Leissner get around Goldman’s internal compliance officials. That crook is believed to be Andrea Vella who has been Goldman Sachs partner since 2007.

According to Vella’s LinkedIn profile, the Italian citizen was JP Morgan Managing Director for close to 10 years from 1998 to 2007 before joining Goldman. Vella, who was demoted last month from his management role as co-head of Goldman’s investment banking division in Asia, was placed on leave Thursday over his role in the 1MDB scandal.

Mr. Vella matches the description of “Co-Conspirator #4” in the Justice Department’s filings related to charges unsealed on Thursday. But is that all? Is Andrea Vella the last of his kind in Goldman Sachs who had stolen and laundered money in the 1MDB scandal? The indictments, the first criminal charges in the U.S. in the 1MDB scandal, are far from over.

People in the industry said to avoid criminal liability, Goldman has blamed rogue employees. If that sounds freaking familiar, that was what the Saudi government and even President Trump said about the brutal murder of journalist Jamal Khashoggi’s as both parties tried to shield and protect Crown Prince Mohammed bin Salman from being indicted.

The Leissner guilty plea is the biggest humiliation for Goldman since 1989, when executive Robert Freeman was led off the trading floor in handcuffs. He was the head of arbitrage at Goldman Sachs convicted of a crime related to insider trading scandal in November 1986. However, New York Times blogger William D. Cohan wrote that Freeman was actually an innocent victim of a prosecutorial “witch hunt.”

Prior to the latest criminal charges, it was all about Tim Leissner and very little about Roger Ng and none about Andrea Vella. Sure, unlike Robert Freeman, Tim Leissner is guilty as hell. But for such a high profile business deal, it’s hard to believe only 3 senior individuals were involved in the biggest heist in the world’s history – to the tune of US$4.5 billion theft from 1MDB funds.

The three bond sales for 1MDB – code-named Projects Magnolia, Maximus and Catalyze – had resulted in more than US$2.7 billion of the US$6.5 billion raised diverted into accounts controlled by Jho Low, Tim Leissner and other crooks, according to U.S. prosecutors. Money stolen was used to pay bribes to government officials, including the purchase of jewellery for Najib’s wife Rosmah Mansor.

Besides Leissner who had pocketed US$200 million, even a relative of Roger Ng received US$24 million from a shell company funded with stolen 1MDB money. In 2014, it was revealed that Jho Low and Tim Leissner used chat messenger to discuss about the need to “suck up to” a government official and send “cakes” to a person prosecutors believe is Rosmah Mansor to get another 1MDB deal.

Lloyd Craig Blankfein, Goldman’s chairman since 2006 and chief executive from 2006 until last month (September 2018), once said the bank’s biggest opportunity was to be “Goldman Sachs in more places.” And when the firm struck gold in Malaysia’s 1MDB deal, Mr. Blankfein had nothing but song of praises for Tim Leissner and Andrea Vella.

Although Leissner and Vella were among Goldman’s 435 partners, a rank bestowed on about 1% of employees, it doesn’t mean Blankfein hadn’t a clue what was going on behind his back. Even Gary Cohn, the former Goldman president who quit to join Trump administration in March this year would probably know about the dubious deals.

Mahathir government should sue not only for the recovery of the US$600 million fees charged, but also for being cheated by the supposedly American trustworthy investment bank. It’s not an exaggeration to say Goldman Sachs is being managed by crooks and liars. Sadly, nobody went to jail despite the firm’s involvement in tanking the U.S. economy in 2007-2008.

The U.S.-DOJ only slapped them with a US$2.385 billion penalty after reaching a settlement with Goldman-Sachs on its role in the 2008 subprime mortgage crisis. Fellow Golmanites such as Gary Cohn, Anthony Scaramucci, Dina Powell and Steve Bannon were promoted to the White House. Even Steven Mnuchin becomes United States Secretary of the Treasury.

Other Articles That May Interest You …

- Mahathir Hired The Right Man – After Equanimity, A.G. Thomas To Recover RM24.17 Billion In 1MDB-IPIC Payments

- Al-Jazeera Interview – How Mary Ann Jolley Skillfully Skins & Grills Najib Till He Runs Away

- Congrats Najib!! – You Lose A Powerful Witness, Saudi Denies Any Knowledge About RM2.6 Billion Donation

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Blood Bonds – Greedy Goldman Sachs Making Money Off The Killing Of Venezuelans

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- Bribed With Prostitutes, Scammed Of $1.2 Billion – Libya Sues Goldman Sachs

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- By Hiding Again From IACC, 130 Countries Assume Najib Is Guilty

|

|

November 2nd, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply