Depending on the angle at which you view the people that soon-to-be President Donald Trump is hiring, the U.S. could be looking at a pool of crooks working for the 45th U.S. president. We’re talking about Goldman Sachs and of course, we’re linking them to the 1MDB scandal – the biggest “Ponzi Scheme” ever committed by a government and head of state.

Goldman had raised US$6.5 billion for 1MDB (1Malaysia Development Berhad), a fund set up by Malaysian Prime Minister Najib Razak himself in 2009, and earned nearly US$600 million in fees in the process. It was such a lucrative deal that Mr. Najib held talks with Abu Dhabi’s crown prince together with Goldman top executive on a yacht moored at Saint-Tropez.

One of two Trump’s top guns – Steve Bannon – a former Goldman Sachs investment banker has been named Chief Strategist and Senior Counsellor of the White House. Yale graduate Steven Mnuchin, a former Goldman Sachs partner is Trump’s nominee as Secretary of the Treasury. Another former Goldman banker Anthony Scaramucci is now a key transition adviser.

The highest ranking Goldman Sachs executive who is joining Trump administration is none other than its President and COO (Chief Operating Office) Gary Cohn, appointed as Director of the National Economic Council, a position that will make him one of the most influential voices on economic decisions in the White House.

Mr. Trump simply calls Mr. Cohn his “top economic adviser”. The position is so prestigious that it offers the stepping stone to other top government posts including those at Federal Reserve. As the top gun of National Economic Council, which was created by former President Bill Clinton in 1993, Mr. Cohn will be as influential as the Treasury Secretary or other cabinet posts.

Trump’s appointment of an army of ex-Goldman Sachs, however, screams hypocrisy after he promised to “drain the swamp” of favour-seekers during his election campaign. The President-elect had repeatedly singling out Goldman Sachs as an “icon of corrupt elite”. While it’s too early to tell if Trump is actually the swamp himself, the world is waiting for a bombshell.

Will Gary Cohn, Steve Bannon and Steven Mnuchin eventually advice President Barack Obama to urge incoming Attorney General Jeff Sessions to drop the lawsuits by the U.S. Justice Department filed on July 20, 2016 to seize assets that it said were the result of US$3.5 billion that was misappropriated from 1MDB?

Regardless whether Najib Razak could bribe Donald Trump with an offer the POTUS couldn’t resists, the Malaysian prime minister is not leaving any stone unturned to clear his tainted name. The U.S.-DOJ is the primary reason the world believes Mr. Najib is the biggest corrupt scumbag. If the U.S.-DOJ drops the lawsuits, “Mr. Dirty” Najib Razak could suddenly become “Mr. Clean” Mahatma Gandhi.

Gary Cohn was involved in all the wheeling and dealing made during the time when Goldman Sachs charged exorbitant commission in raising money through bond sales for Najib Razak’s 1MDB. It’s hard to believe that Cohn didn’t know the money raised by his company would go to benefit Najib and his family – real estate, clothing, jewellery, art, and financing the production of The Wolf of Wall Street.

Goldman Sachs itself is being investigated in the U.S. in connection with 1MDB, including dealings with Swiss bank BSI, which was shut down by Swiss and Singapore regulators over money-laundering and corruption allegations. U.S. officials are also probing whether Goldman Sachs failed to alert authorities to a suspicious transaction – a US$3 billion Goldman-run bond issue for 1MDB.

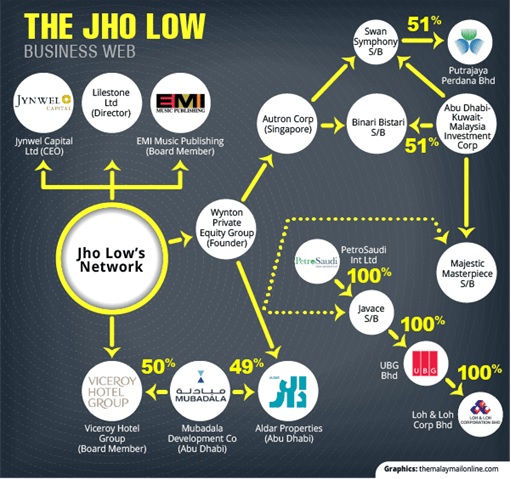

Besides the U.S.-DOJ, the U.S. Federal Reserve, the Securities and Exchange Commission and New York State’s Department of Financial Services also are examining some of Goldman Sachs’ actions. In reality, the bank continued to interact with Jho Low on key 1MDB business decisions, despite claims that Mr. Low (Najib Razak’s confidant) holding no official position there.

In the first tranche, US$1.75 billion was raised after Jho Low introduced Goldman executives and 1MDB officials to Khadem Al Qubaisi, former managing director of IPIC (International Petroleum Investment Company), Abu Dhabi’s US$80 billion sovereign-wealth fund, to guarantee the issue. Goldman charged 1MDB US$192.5 million, or about 11% of the bond issue.

Khadem Al Qubaisi, who was working hand-in-glove with partner-in-crime Jho Low (Low Taek Jho), received at least US$470 million of money siphoned from 1MDB. Jho Low is presently in the process of trying to stop the U.S. from seizing US$650 million in real estate and business investments the U.S. government claims were acquired with funds stolen from his home country – Malaysia.

Inspired by the success of the first bond sale; 1MDB, Goldman and IPIC raised another second tranche of US$1.75 billion to buy more power plants, using the same modus operandi. Goldman’s fee for the second bond deal totalled about US$114 million, according to the U.S. lawsuits. Both deals were approved by five Goldman committees so Mr. Gary Cohn knew everything about it.

Interestingly, when David Ryan, then the bank’s Asia president, questioned why Goldman didn’t lower the fees (sort of discount) on the second bond issue, since it had been able to unload the first batch of bonds so easily, Goldman officials including President Gary Cohn overruled Mr. David’s objections, according to the Wall Street Journal.

As a punishment, Goldman deliberately appointed a pro-1MDB executive to a post above Mr. Ryan in Asia, forcing him to eventually resign from the bank. In early 2013, Mr. Leissner (Goldman’s chairman for Southeast Asia) and Michael Evans, who was a Goldman vice chairman, met with Mr. Najib at the World Economic Forum in Davos, Switzerland.

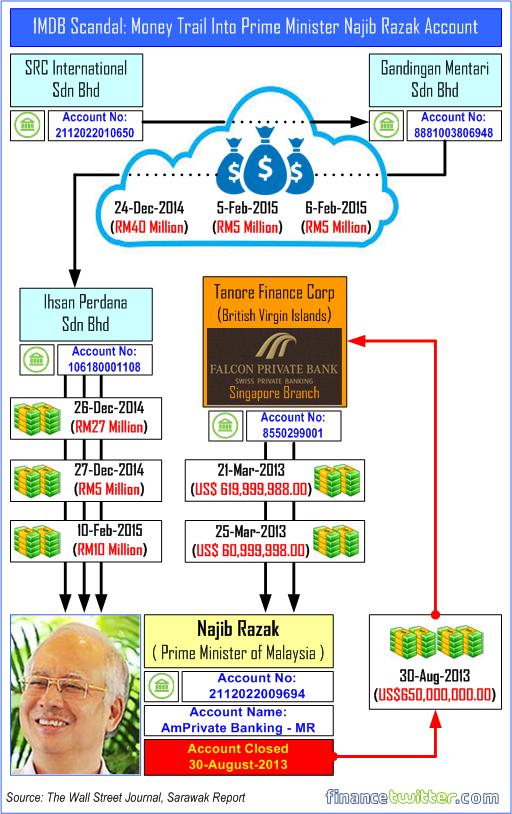

During the meeting, Mr. Najib said 1MDB planned a joint venture with Abu Dhabi to build a financial center in Kuala Lumpur and wanted to sell US$3 billion more of bonds. After Goldman transferred the proceeds to an account controlled by 1MDB, half the funds disappeared offshore, only to surface later in the account of Malaysia’s PM Najib Razak.

Some of the money ultimately landed with Devonshire Funds, which sent US$210 million to a British Virgin Islands shell company called Tanore (now defunct). Tanore later transferred US$681 million into Najib’s personal bank account. Goldman has consistently said it did nothing wrong and had no way of knowing there might be fraud surrounding 1MDB.

The bank has said its main role was raising money but amazingly it was under Gary Cohn’s watch that Goldman didn’t find it suspicious when asked by 1MDB to transfer the US$3 billion in bond proceeds to a miniscule Swiss private bank BSI, instead of a large global bank. Heck, even BSI compliance officials had questioned why the 1MDB bond proceeds were being sent to their bank, given its small size.

Obviously, Goldman Sachs knew very well there were hanky-panky transactions but had chosen to play dumb. After Goldman wired the US$3 billion to 1MDB’s account at BSI, more than a third of it immediately was sent into a web of offshore funds, before ending up in an entity controlled by a Jho Low associate – according to U.S. Justice Department.

Singapore later charged three BSI executives with crimes linked to their dealings with 1MDB. Two (Yak Yew Chee and Yvonne Seah Yew Foong) pleaded guilty to forgery and failing to report suspicious transactions. The third, Yeo Jiawei, was convicted on Wednesday of attempting to pervert the course of justice and is fighting charges that include money laundering.

Yak Yew Chee is serving an 18-week jail term while Yvonne Seah was sentenced to two weeks’ jail and a fine of $10,000. Calling the 1MDB-linked investigation the most complex, sophisticated and largest money laundering case they have handled, the Singapore prosecutors charged that Yeo had amassed S$23.9 million (US$16.55 million) by taking secret profits from 1MDB-linked transactions.

Why did Tim Leissner, who is married to former model Kimora Lee Simmons, resigned from his lucrative job? Mr. Leissner earned more than US$10 million a year at the height of the dealings with 1MDB. As Pablo Salame, co-head of Goldman’s securities division, said – “Those people (Leissner) didn’t work alone. Goldman Sachs (Gary Cohn) did these deals.”

As a corrupt institution that is too big to fall, Goldman Sachs’ top guns have become more powerful (and probably more corrupt) after their appointments to Trump administration. If Najib wishes for a new breath of life, these are the people who can help him (again) in exchange for commissions higher than 11% that the bank had charged 1MDB, which the Malaysian prime minister would gladly pay.

Other Articles That May Interest You …

- Saving Pirate Najib – China To Solve Stolen Money Dispute Between 2 Muslim Nations

- Trump Brings “The Apprentice” To His White House Administration

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

- WikiLeaks: Soros Slammed Obama Of Trading TPP For A Racist, Extreme & Corrupt Najib

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- Leo DiCaprio Could Be In Trouble – For Accepting Gifts Paid With Stolen Money

- Congrats Najib, Your Boy Has Just Proven Your Family Has Everything To Hide

- Here’s Why U.S. Uses “Malaysian Official 1” To Link PM Najib To Stolen Money

- How Najib Razak’s Scandalous 1MDB Brings Down A 143-Year-Old Swiss Bank

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- Here’re 14 Crazy Facts How Huge (1MDB) RM42 Billion Debt Is

- 1MDB Scandal – An Ali-Baba “Scam” Partnership Goes Bust

|

|

December 23rd, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply