Today (August 17) marks the 100th day of New Malaysia – the administration of 93-year-old Mahathir Mohamad after the collapse of old Barisan Nasional government. Ever since Independence in 1957, then-Malaya and subsequently Malaysia (1963) has only known one federal government – the Alliance – which later restructured to become Barisan Nasional.

Malaysians, after being ruled by the same Barisan government for 61 years, were incredibly angered by corruption, inequality, racism, skyrocketing cost of living and the infamous 1MDB scandal. Hence, on May 9, 2018, they decided to teach the arrogant and out-of-touch Barisan a lesson they would not forget for the rest of their life – send them to the opposition camp.

Since coming to power, the new Pakatan Harapan government has lost no time trying very hard to fulfill its general election manifesto. The manifesto, unveiled on March 8, 2018, basically contains 10 promises to be delivered within its first 100 days in power. That’s an average of 1 promise in every 10 days for the inexperienced Pakatan administration.

Naturally, not all the 10 promises could be fulfilled. Nobody has expected the new government to be able to deliver all its manifesto within the 100 days, and they are pretty cool with that. At least primary issue such as GST (goods and services tax), the “Archilles Heel” which brought down scandal-plagued Najib Razak, has been abolished.

The promise to stabilise price of petrol has also been fulfilled when the RON95 and diesel prices are fixed at RM2.20 and RM2.18 per litre respectively. Six other promised are in progress while 2 promises have not been kept at all – the abolishing of Felda settlers’ debts and RM500 health scheme for B40 (households earning RM3,900 a month or less).

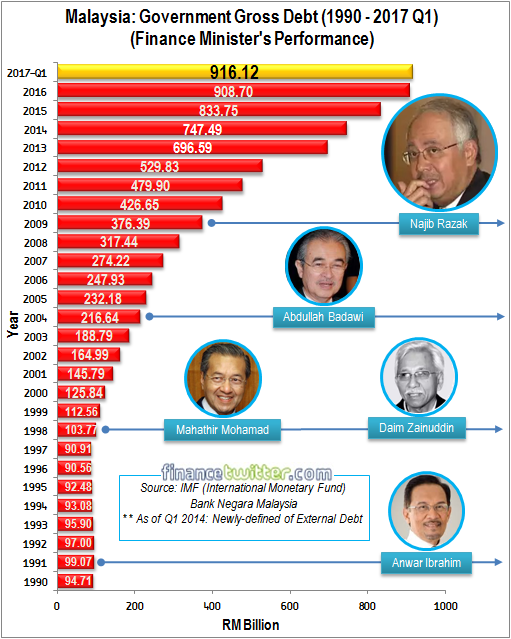

Obviously, the new government would have no problem fulfilling all its 10 promises had the national coffers been in excellent condition. After all, 99% of the problems in the world can be solved with money. Unfortunately, with RM1 trillion in debt thanks to ex-premier Najib, there are only so much that Pakatan government can do.

Still, just because the people understood and forgave the new government on its inability to deliver its 100-day pledges, it doesn’t mean Mahathir administration can forget about them. As the Barisan, now the new opposition, wasted little time ridiculing and criticizing the new government’s failure to keep its promises, many have missed out an important thing – Ringgit.

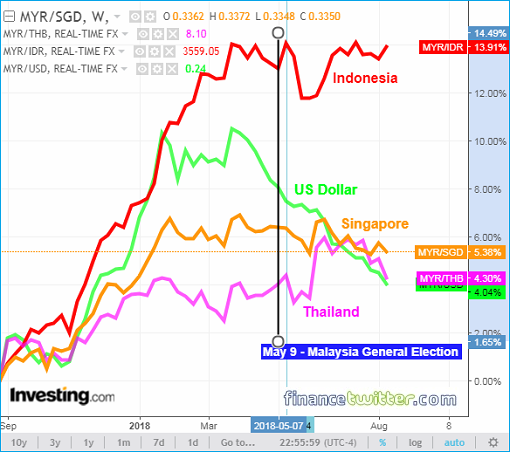

The performance of currency is a vital yardstick in determining the stability of a government, especially so in Malaysia where the new Pakatan government has taken over for the first time in more than half a century. For this reason alone, former PM Najib had spooked the voters that the currency (Ringgit), and stock market for that matter, will crash if Pakatan wins the 14th general election.

Looking at the performance chart of US dollar against major Asian currencies, clearly the Ringgit has been depreciating against the dollar. But so are all the currencies in the region. In fact, the Singapore Dollar, Thai Baht, Indonesia Rupiah and Philippine Peso have all been weakening against the US dollar since early of 2018.

Gaining steam, the dollar has been boosted by the fact U.S. data have been positive, not to mention the multiple interest rate hikes by the Federal Reserve. The current trade war between United States and China could only mean one thing – the Chinese Yuan / Renminbi will continue to depreciate and in the process put pressure on Asian currencies as well.

To be fair, if measured over the 100-days since the Pakatan took over on May 9, the ringgit has depreciated over 3.3% against the US dollar, worse than Indonesian rupiah and Thailand baht’s 3%. But within the same period, the mighty Singapore dollar has weakened by about 2.3%. Not bad for the ringgit since the jaw-dropping revelation that Malaysia has actually RM1 trillion in foreign debts.

More importantly, even when the ringgit is compared against other Asian currencies, the local currency appears to be pretty stable. Malaysians who love to visit sex city Hatyai might be complaining about the conversion rate – 1 Ringgit to 8 Baht. But at the same time, the ringgit is holding quite well against the Singapore dollar, trading below 3 ringgit to a dollar.

Could there be a difference had Barisan under Najib regime won the 14th general election? We will never know. But as the chart says, the ringgit has been under pressure together with other Asian currencies since early of the year. Therefore, chances are the ringgit will suffer the same fate simply because the entire world’s currencies, including the Chinese Yuan, are affected.

What we know, however, is if the country’s RM1 trillion debt is exposed under Najib regime, all hell will break loose. To get a feel of how the ringgit was dumped after the revelation of 1MDB scandal in 2015, one has to revisit the currency performance back in June, 2015. Back then, the US dollar was wrecking havoc in Asia too.

Three years ago, among the 5 major Asian currencies, Malaysian Ringgit was the worst performer, depreciated by as much as 16.47% against the US dollar. That was followed by Indonesia Rupiah (-10.84%), Singapore Dollar (-7.79%), Thai Baht (-3.85%) and Philippines Peso (-3.57%). At the same period, all major Asian currencies actually “appreciated” against the ringgit.

On the same month Mahathir administration exposed that the previous government had accumulated RM1 trillion debts, rating agency Moody’s threatened to slap the country’s sovereign credit ratings with “negative” unless the new government is able to cushion the revenue loss – after the announcement that the 6% GST will be scrapped.

Interestingly, 3 days ago, Fitch Ratings has affirmed Malaysia’s long-term foreign-currency issuer default rating (IDR) at “A-” with a stable outlook supported by solid economic growth. Fitch said the affirmation not only takes into consideration measures such as the rollback of the Goods and Services Tax (GST), but also the stated intention to reduce fiscal deficits and improve governance.

Considering that the GST has been scrapped and the fuel subsidy has been re-introduced, surprisingly the Ringgit isn’t doing too bad. If the new government continues to grow the economic pie and practices prudent spending, the local currency should be doing well.

Other Articles That May Interest You …

- New Government Practices Transparency – And Foreign Analysts & Agencies Aren’t Happy

- This Chart Shows How Najib Drove The Country To RM1 Trillion In Debt

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

- Here’re Why Ringgit Can Go Further – RM4.50 To US$1 – And Beyond

- Ringgit Is Toast – Here’re Proof Malaysia The First Asian To Hit Recession

|

|

August 17th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply