Between 2000 and 2007, Moody’s doled out AAA ratings to 30 mortgage-backed securities every day. When the 2008 subprime crisis finally hit the United States, 83% of those first class securities became junk – they were downgraded. The funny part was – Lehman Brothers’ own debt still had an investment grade rating when it filed for bankruptcy protection.

But Moody’s Investors Service wasn’t alone in scamming investors. Together with Standard & Poor’s and Fitch Ratings, the big three credit-rating agencies were all guilty for not only failing to warn investors of the dangers of investing in many of the mortgage-backed securities at the epicentre of the financial meltdown, but benefiting by not pointing out deficiencies.

In fact, S&P (Standard & Poor’s) was sued by the U.S. Department of Justice over its despicable role. Those credit-rating agencies were working hand-in-glove with investment banks in the marketing of risky mortgage-backed securities, also known as collateralized debt obligations, which helped bring the U.S. financial system to its knees 10 years ago.

Everything was rigged. Thanks to major lawsuits by the San Diego-based law firm Robbins Geller Rudman & Dowd, documents revealed that the U.S.’ two top ratings companies – Moody’s and S&P – have for many years been shameless tools for the banks, willing to give just about anything a high rating in exchange for cash.

An exposed email written by one Standard & Poor’s executive says – “Lord help our fucking scam … this has to be the stupidest place I have worked at.” Another high-ranking S&P analyst confessed – “As you know, I had difficulties explaining ‘HOW’ we got to those numbers since there is no science behind it. Let’s hope we are all wealthy and retired by the time this house of cards falters.”

Two days ago, the Moody’s lectured Malaysian new government after 93-year-old Prime Minister Mahathir Mohamad announced the abolishment of the highly unpopular 6% Goods and Services Tax (GST), and the reinstatement of the 10% Sales and Services Tax (SST). Moody’s threatened to slap the country’s sovereign credit ratings with “negative” unless the government is able to cushion the revenue loss.

Does Moody’s, and other rating agencies for that matter, care about the fact that the people were suffering and businesses were plunging due to GST, introduced by ex-prime minister Najib Razak? Don’t be silly. They don’t care that the world’s biggest crook was driving the country to bankruptcy. If they didn’t care about their own country in 2008, why should they care about Malaysia in 2018?

As of January 2018, S&P Global Ratings’ credit rating for Malaysia stands at A-’ with a ‘Stable’ outlook, while Moody’s Investors Service Inc and Fitch Ratings Inc have fixed credit rating of ‘A3’ and ‘A-’ respectively, with a ‘Stable’ outlook. Yes, despite knowing that Mr. Najib had plundered and stolen at least US$4.5 billion, they continued decorating his regime with stellar credit ratings.

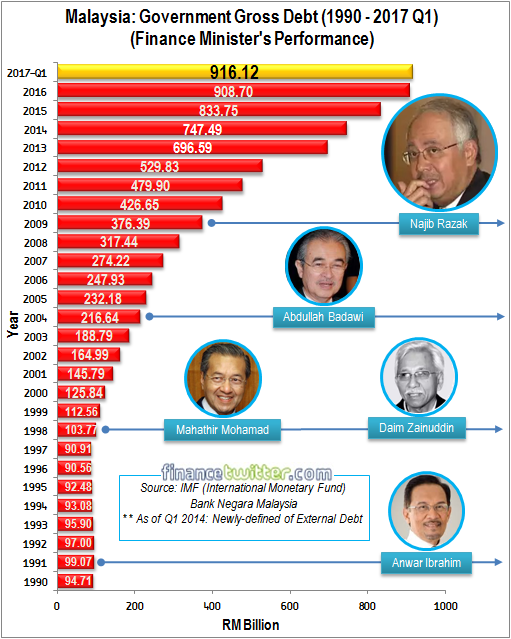

It didn’t matter to the credit rating agencies that the previous Najib government debt which was below the self-imposed ceiling of 55% of gross domestic product (GDP) was actually a half-baked figure with more debts hidden under “red-files”. They were happy with Najib’s GST simply because the tax provided a good source of income to the government, and that was all that matter.

Actually, if the crooked Najib was willing to pay the right price, the “Big Three” Moody’s and S&P and Fitch would be more than happy to rubber-stamp Malaysia credit rating to a triple-A rating. If they had conspired with America’s investment banks leading to the 2008 Great Recession, they can certainly do it again with Malaysia’s corrupt government.

But the three big credit-rating agencies were not the only boys who were shocked by the stunning defeat of coalition Barisan Nasional, which had ruled the country for 61 years since independence. Now, Bloomberg‘s Andy Mukherjee isn’t happy because the new government decides to practice transparency. It appears that Bloomberg’s definition of transparency is rather different from that of Malaysia’s.

Malaysia new Finance Minister Lim Guan Eng has finally unveiled the truth – that the country’s total debt and liabilities as of Dec 31, 2017 was RM1,087.3 billion (80.3% of GDP, Gross Domestic Product). That confirms the RM1 trillion debt announced earlier by Prime Minister Mahathir Mohamad. The revelation is the purest form of transparency the country has ever seen.

Strangely, not many people are impressed with such transparency. While it’s understandable why ex-PM Najib Razak was furious that the new finance minister exposed the RM1 trillion debt accumulated by his regime, it’s quite puzzling why Andy Mukherjee was offended by Finance Minister Lim’s remarks against 1MDB President and CEO Arul “Anaconda” Kanda Kandasamy.

It’s a fact that snake oil salesman Mr. Arul has been deceiving and misleading investors and financial markets by lying through his teeth since 2015 regarding the 1MDB financial health. Interestingly, Andy Mukherjee took offence that Mr. Lim called Mr. Arul a “dishonest and untrustworthy” person. The Bloomberg columnist thinks Mr. Lim should not say that because he is no longer an opposition politician.

Well, what did Mukherjee expect Lim to say after Arul made a complete 180 degrees turn after it was revealed that taxpayers have been “secretly” bailing the 1MDB “Ponzi Scheme” from April 2017 to the tune of RM6.98 billion? As 1MDB President and CEO, Arul, whose Muslim name is Azrul Kanda, had misled and deceived the financial markets into thinking that everything in the 1MDB garden was rosy?

Like the U.S. credit rating agencies, Mukherjee, an award-winning Indian journalist, was also critical of Malaysia new government pulling the plug on GST, supposedly a major revenue driver for the government. He argued that slashing the tax would reduce revenue collection, which generated an eye-popping RM43.8 billion in 2017.

The gullible Bloomberg’s columnist was, of course, couldn’t explain why the country could “prosper without GST” since its independence in 1957, until Najib introduced the tax in 2015. Obviously, this so-called award-winning Indian journalist was clueless of how corrupt Najib regime was. The loss of revenue in scrapping GST could easily be compensated by plugging corruption.

Like the world’s biggest crook Najib Razak, Andy Mukherjee appears to suggest that Lim Guan Eng should not expose any further skeleton hidden in the closet of the shocking state of affairs at the scandal-ridden state fund 1MDB. For the sake of local stock market, the finance minister should shut the heck up, suggested Mukherjee.

Suddenly, transparency has to take a back seat. 1MDB is insolvent and even a director of the state fund admitted it was nothing but a scam from the beginning. And thanks to Najib’s incompetency, the country is saddled with RM1 trillion in debts, partly contributed by the 1MDB scandal. To cover the massive debts, Najib unleashed the GST in 2015 to save his skin, not the country.

So, how much tactful Andy Mukherjee wants Lim Guan Eng to be? Had Mr. Lim refused to disclose the actual level of debt now, just to prevent a temporary stock market setback, the new government of Pakatan Harapan would be blamed, not Najib regime, for the RM1 trillion debts. For the sake of transparency, it was a necessity to tell all and sundry the mess the new government has inherited.

Other Articles That May Interest You …

- Taxpayers’ Money Secretly Used To Bailout 1MDB – Here’s Why Snake Oil Salesman Arul Should Be Jailed

- This Chart Shows How Najib Drove The Country To RM1 Trillion In Debt

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- No Deal For Bad Deal – Here’s Why China Pulls Plug On Bandar Malaysia

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- What Took You So Long, Singapore? Trying To Cover Najib’s 1MDB Scandal?

- Najib’s Twin Scandals – It’s Not Over Yet, It’s Just The Beginning

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

- 1MDB Scandal – From A-to-Z, Both Arul & Zeti Are Great Liars

|

|

May 25th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

FT,

Leslie Lau of MM concurs.

The lofty bloomberg peanut got mouthful of wisdom not to play the white man’s proxy!

see link https://www.malaymail.com/s/1634850/a-less-blunt-tool-for-lim-guan-eng-really-mr-mukherjee

Bloomberg just as other prominent Western media still cannot digest the Trump victory for he is an outsider. Now an outsider government has been installed in Malaysia which is still one of the largest economies in the world. Deep State Losing control ?

Whst else can you expect for the scum journalist Andy Mukherjee ? He has to please his masters.

1998 Financial Crisis, everyone criticized Malaysia for the decision to set the FX at RM3.80 per USD, saying it was wrong, but we got through it better than most. No reason for us Malaysians not to back him now for transparency. Maybe we suffer now, but I believe it is just a minor setback. We’ll be up and running again in the very near future.

For us Malaysians, it is now “In Tun M we trust.”

Excellent piece. Rightly called the rating agencies as nothing more than ‘money making schemes ‘. As for the clown from India, the less said about him the better.

There is no morality in business & finance. Greed is good. Money makes the world go round. It is hopeless to preach to these smart financial experts. They have the numbers & systems behind them.

I agree with much of what is written here by Financial Twitter.

I’ve come across more than a fair share of Malaysians, including business and financial analysts, politicians, business journallists and so forth who appears to regard anything critical about Malaysia, which comes out of the mouths as well as the anuses of these western, especially U.S. based rating agencies as being the gospel truth, similar to the words inscribed into two stone tablets by divine hand and carried down from Mount Sinai by Moses bearing the commandments of the divine for his people.

To such people, the farts of these ratings agencies smell fragrant, like the finest perfume, whilst whatever is said by official Malaysian sources or by independent voices and opinion, are always lies which stink to high heaven, not to be believed.

Just like the U.S. and western mainstream media, these ratings agencies serve their geostrategic, economic and commercial interests, so their messages should be treated with a dose of healthy scepticism, with independent thought and research applied before they are accepted as valid, either partially or totally.

As for why Najib introduced the GST, whilst I do not know of the reason first hand, however I have been told by a third party who heard it from another supposedly authoritative and reliable party, that some bonds and debentures issued by Malaysia were coming due for redemption around the time but Malaysia did not have the money and risked default, so approached supposedly multilateral agencies for loans and was told that they would provide such loans, provided Malaysia introduce measures such as the GST in order to obtain the money to pay back the loans.

Whether that is true or not, I do not know, though hopefully, someone can enlighten me.

This Andy Muk apanama?is nothing but a sell- out mouth piece for the Rothschilds international central Banksters, he’s only as good in his job as they portray him to be, whatever he says is what he has been instructed to say.

FT,

Absolutely spot on!! Clap Clap Clap.

I couldn’t agree with you guys more!! I am really impressed with your observation and opinion.

This is neo-colonialism at it’s subtle best!

And as for that bloomberg peanut, ( brown on the outside and white on the inside), he’s just a paid lap-dog to keep his masters’ voice heard. Just an armchair critic with no experience in realtime governance!!

Keep your good blog going, only 2 i love – outsyedthebox & FT!!!!