After spending his pocket money to the tune of billions of Euros, bad boy Alexis Tsipras is coming home to ask for more. Only this time, his father Francois Hollande is out of job while his mother Angela Merkel could be joining his daddy. Yes, the infamous Greece debt crisis is back, making a full cycle of the problems that had never been solved in the first place.

Once upon a time before the Italian referendum, before the Brexit, before the election of President Donald Trump, there was a monster problem – Greece. Before the great Chancellor of German – Angela Merkel – brings 1.2-million migrants / refugees from the Middle East, the anti-EU sentiment had already begun. People didn’t see it because nobody got killed.

Unlike Merkel’s open border policy which has gotten people assaulted, raped, robbed, beaten and killed, Greece’s debt crisis was the first public crack in the European Union’s shining armour. When the Greek debt crisis broke in 2010, Athens turned to the EU for help. And good old mommy Merkel agreed to bailout spoilt little boy Alexis Tsipras.

Nearly 7 years, 13 austerity packages, and 3 bailouts (running into a total of US$366 billion) later, the Greek economy is still struggling. Its debt is now 177% of GDP. The non-performing loans (NPL) alone total US$119 billion, accounting for 45% of the country’s loans. That speaks volumes about the trouble Greece is facing despite multiple bailouts.

Global financiers at the IMF (International Monetary Fund) are increasingly unwilling to fund endless bailouts for the eurozone’s most troubled country, passing more of the burden onto the EU – at a time when Chancellor Angela Merkel is fighting for her own survival in a tough re-election battle. Hard-working Germans are arguing why lazy Greeks deserve unfair bailout – again.

Here’s the fun part – the Greek debt crisis could explode, again, as soon as July, 2017. That’s when Greece is due to repay some 7-billion Euros to its creditors – money the country cannot pay without a fresh injection of bailout cash. To add salt into Merkel’s injury, that’s “before” the Germany federal election in September, hence, she has to “cover the crisis”.

After the Brexit and the election of President Donald Trump, the European Union is in disarray with Poland leading angry EU members calling for a return to the union’s founding principles – asking for a fundamental overhaul of treaties that would return power back to nation states. In fact, the IMF doesn’t believe Greek debt crisis can be solved the conventional way.

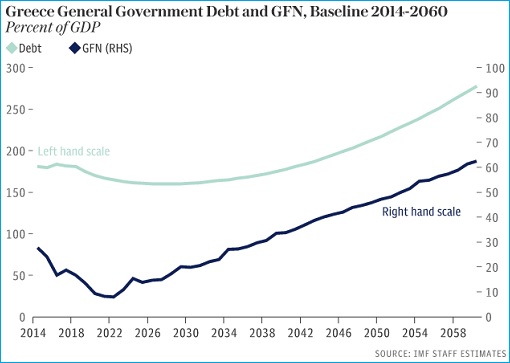

Although Greece’s GDP has started to grow, it is expanding at a snail pace of roughly 0.4%, below IMF’s expectation of at least 1% annually over the long-term. Even if the country successfully implements all of its planned financial and economic reforms, its debt is projected to fall to from 179% of GDP a year ago to 160% of GDP by 2030 “but become explosive thereafter”.

Despite IMF’s estimation that by 2060 Greek debts will amount to a mind-boggling 275% of GDP, Angela Merkel and her band of EU elite believed that the Greek bailout was sustainable. By refusing to acknowledge that Greece is a bottomless pit, the problem has now returned to haunt the wealthiest but arrogant EU countries.

The IMF passes the ball to EU, urging the Europe to provide “significant debt relief” to Greece, meaning writes off huge chunk of money lent by EU to Greece. If the EU somehow decides to bailout its member for the fourth time, the people of United Kingdom should be glad they made the correct decision – Brexit – getting the hell out of the European Union.

Both IMF and EU were equally guilty for pushing a half-baked non-workable solution hoping to solve Greece’s financial meltdown. The deep cuts to public services and pensions had come “at a high cost to society”. With unemployment stubbornly at 23%, there were simply not enough income to pay the country’s debt, let alone grows the economy.

The Greeks are to blame too – they consider taxes as theft and thanks to occupation by Ottomans, the culture of “avoiding taxes is a sign of patriotism” has been remaining until today. In comparison, only 2.3% Germans do not pay their taxes but a staggering 89.5% Greeks do not pay taxes promptly. In short, they can’t pay, won’t pay and don’t care to pay.

Two years ago when the Greeks were asked to vote, 61% overwhelmingly rejected “conditions” of a rescue package. Amusingly, opinion polls showed 74% wanted Greece to remain in the EU. What they wanted were more money to bailout their country – without any obligation to pay back. The Greeks were betting that the EU would not dare kick them out.

Today, with France Francois Hollande not seeking another term and Chancellor of Germany Angela Merkel desperately clinging to power, Greece Prime Minister Alexis Tsipras may not be so lucky this time. However, Greece still managed to freak out Germany when they sent a warning message that the proud Greeks are ready to ditch Euro in favour of US dollar.

The game now is really about how desperate Germany wants Greece to stay in the eurozone. While Germany cannot afford to continue funnelling money into the EU to bail out other countries, at the same time, Berlin cannot allow a eurozone economy to collapse or leave the monetary union. The Greece government has stated that no more reforms will be accepted.

EU and Greece have until June 2017 to decide how the game should be played. That’s when Athens runs out of money to pay its bills. If IMF insists on refusing to pump more money, the EU alone will be forced to bailout the Greek economy – if they still want to rescue and pamper Greece.

Other Articles That May Interest You …

- Merkel’s Gift To Migrants – “We’ll Pay You Money, Lots of Money, If You Leave”

- Unpopular & Unwanted – France’s President Hollande Exits … Shamefully

- EU Elites Panic As Italian PM Renzi’s Failed Referendum Could Lead To “Italexit”

- BREXIT 2.0!! – Here’re 12 Major Reasons Trump Wins Presidency, Against All Odds

- BREXIT!! – Here’re 7 Major Reasons Forcing British To Leave The EU

- Here’re Comics To Help You Understand Greece Childish Crisis

- A Big Fat “NO” – Greeks Celebrate, Not Paying Taxes & Debt A Patriotism

- Greeks Pride – Can’t Pay, Won’t Pay, Don’t Care To Pay

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

February 14th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply