Up to today, many still think that HSBC is actually a bank which is Chinese-owned, Hong Kong-based, located and headquartered in the small but prosperous financial city. After all, HSBC refers to “HongKong and Shanghai Banking Corporation”. Well, it’s HQ was based in Hong Kong until 1993 before the bank decided to abandon Hong Kong for London. So “no”, HSBC is not a Chinese-owned bank, even though it was founded in Hong Kong.

HSBC was founded by Scotsman “Sir Thomas Sutherland” in the then British colony in 1865, primarily due to the booming business in opium trading. In preparation for the transfer of sovereignty of Hong Kong to China in 1997, a new parent company – HSBC Holdings Pls – was set up in the United Kingdom in 1991. Subsequently, “HSBC” relocated its world headquarters from Hong Kong (Stock: HKG: 0005) to London (Stock: LON: HSBA) in 1993.

But since the “HQ relocation”, many thought and still think it was a wrong decision. And there has been numerous talks about HSBC moving back to its original home. Commercially, it’s a no brainer to move back to Hong Kong because it can immediately save a whopping US$1.1 billion (£716 million; RM4 billion) on annual banking levy, which it paid to the Britain’s Treasury in 2014 alone.

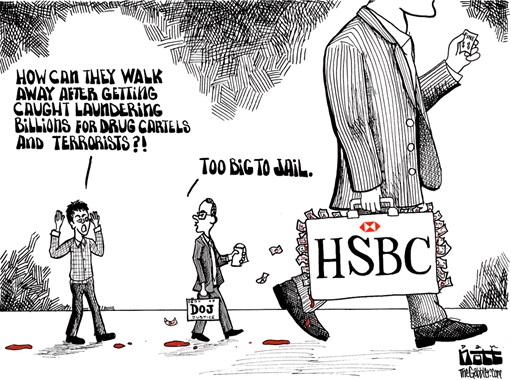

With lower taxes, obviously HSBC shareholders like the idea that Hong Kong has looser capital controls. What this means is HSBC would have more “options” to make money – both legally and illegally. Before you scream till foam at mouth, it’s a public knowledge that HSBC has been engaging illegal financial activities – from manipulating foreign currency markets, helping the richest evade tax to money laundering.

But HSBC can afford to do all the dirty transactions you can ever imagine, simply because they’re too big to fall. With a balance sheet of US$2.6 trillion (£1.7 trillion, RM9.4 trillion), HSBC is nine times the size of Hong Kong’s entire economy. So, if you’ve tons of dirty money to be legitimised, don’t go to Switzerland. Go and talk to HSBC instead. They’re Britain’s biggest bank that loves helping people to cheat.

Now, HSBC has announced it will begin charging other banks for depositing money in currencies of countries that have negative interest rates. Essentially, deposits in Euros, Swiss francs, Danish krone and Swedish krona – all currencies of countries that have negative interest rates – will be affected, effective this week and will introduce negative interest rates starting August 1.

Fortunately, it will not affect the deposits of individual or corporate customers, for now. But it’s a matter of time before the average Joes and Janes are made to pay for keeping money in banks. Erhvervsbank, a small Danish bank, and Skatbank, a regional German lender, have already announced plans to make retail customers pay to hold money in deposit accounts.

Still, the glaring question that begs answer – if a giant such as HSBC has to resort to charging clients on deposits, does that mean the European Union’s economy still sucks and on the verge of collapsing, for real? Or could it be that HSBC was simply greedy for more money for its shareholders? Perhaps HSBC should regain its ancient fabulous “feng-shui” by moving back to Hong Kong.

Other Articles That May Interest You …

- Here’re 14 Crazy Facts How Huge (1MDB) RM42 Billion Debt Is

- Cashless Societies – Do You Really Want To Create Such Monsters?

- 2010 Wall Street Trillion-Dollar Flash Crash – Genius Trader Sarao Made Scapegoat?

- Exposed!! – How HSBC Swiss Bank Helped Hide (Dirty) Money

- Forget About Oil Crisis, Here’s New US$57 Trillion Global Debt Crisis

- Here’s How Your “Wave & Pay” Cards Could Be Swiped Secretly

- Foreign Exchange Scandal – 5 Big Banks Fined A Paltry US$3.3 billion

- Here’re Tax Havens To Hide Your Black Money & Plunder

|

|

May 20th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply