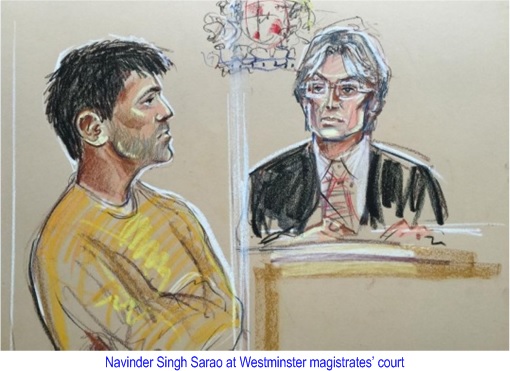

Navinder Singh Sarao was a 36-year-old British futures trader, just like any other traders trying to make money. But the Brunel University graduate is now spending his weekend in British jail after failing to up his £5 million (US$7.6 million, RM27.1 million) bail bond. He was arrested this week at the modest suburban semi in Hounslow, London, where he lives with his parents.

His crime? Accused of helping (or causing) to spark the notorious American “flash crash” of May, 2010, during which the Dow Jones plunged more than a thousand points for no apparent reason. It wiped out £500 million (US$760 million, RM2.7 billion) in a 20-minutes-panic selling on May 6, 2010. By the time the market closed, Mr Sarao had made a cool US$879,018 (£578,796, RM3.14 million) for the day.

Strangely, it took 5-years for the US Department of Justice and Commodity Futures Trading Commission to charge Mr Sarao this week, for allegedly contributing to the panic that day and embarking on a pattern of behaviour that is said to have netted him nearly US$40 million (£26 million, RM143 million) in four years. Not bad for a trader who described himself as “an old school point and click trader”, using his computer mouse to place each trade.

He is also fighting efforts by US authorities to extradite him to Illinois to be tried for one count of wire fraud, ten counts of commodities fraud, ten counts of commodities manipulation and one count of spoofing. That’s right, spoofing, is the name of the game for Mr Sarao. Spoofing is the tactic of placing large orders and quickly cancelling them, which sometimes is used to move prices in the market and generate short-term trading profits.

However, unlike previous rogue traders who caused billions of dollars in losses, such as Nick Leeson who ultimately caused the collapsed of Barings Bank, Mr Sarao didn’t have the balance sheet of a big financial institution behind him. Mr Sarao was a lone day trader who often conducted business out of his parents’ modest suburban home, in his pyjamas.

But here’s the problem – nobody on Wall Street believes Navinder Singh Sarao single-handedly contributed to the “flash crash”, let alone caused close to a trillion dollar losses in a matter of minutes. That’s because almost all (huge) fund managers use “spoofing” tactic every single day. Strangely, he’s the only person accused in connection with the flash crash, prompting speculation that Mr Sarao has been made a scapegoat.

Mr Sarao admitted he was a day trader who changes his mind very, very quickly but that was his unique trading style. His former colleagues said he would never come out drinking, never socialise and drove around in a beat-up Vauxhall Corsa. Despite his alleged wealth, he would travel to work late so he could buy off-peak tickets, only have lunch if he could find discounted sandwiches and shunned drinking in pubs for pints of milk at his desk.

Amazingly, not only he was good in making money but not spending it, he was also so secretive about his wealth that his mother worked two jobs to make ends meet unaware that her son was actually sitting on a US$40 million (£26 million, RM143 million) fortune. He worked at Futex prior to the 2010 crash, where he got his first trading job. When he left Futex in 2008, he took £2.5 million (US$3.8 million, RM13.6 million) with him.

He formed his own company – Nav Sarao Futures Limited – which had a turnover of £19.6 million from May 2011 to October 2013, but made a loss of £31.7 million. Sarao set up a second company, International Guarantee Corporation, in Anguilla, another Caribbean tax haven. Prosecutors said this company, together with Nav Sarao Milking Markets Limited, an offshore on the Caribbean Island of Nevis, was setup as part of a tax avoidance strategy.

As much as the US authorities want to put the blame solely on Mr Sarao, the fact remains that an official report was established that on the day of “flash crash”, a US$4.1 billion (£2.7 billion, RM14.6 billion) transaction of stock index futures alone was done by a single institutional investor, Waddell & Reed, which began at 2:32pm EST. So, why only blames Navinder Singh Sarao, whose trades were much smaller than that?

Other Articles That May Interest You …

- 1MDB Scandal – An Ali-Baba “Scam” Partnership Goes Bust

- Forget About Oil Crisis, Here’s New US$57 Trillion Global Debt Crisis

- Exposed!! – How HSBC Swiss Bank Helped Hide (Dirty) Money

- Only In China – Fake Bank Scams 200 Customers Of 200 Million Yuan

- Foreign Exchange Scandal – 5 Big Banks Fined A Paltry US$3.3 billion

- There’s A New Bank On The Block, And The U.S. Isn’t Happy About It

|

|

April 26th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply