Everyone was hoping for it to happen, but certain governments were praying it won’t materialise. We’re talking about global crude oil prices. The subject on petrol or gasoline is definitely going to dominate the news until it stabilises. It could make or break a country’s economy, especially when the country depends very much on petroleum income to move its engine. Guess what – it happens!!

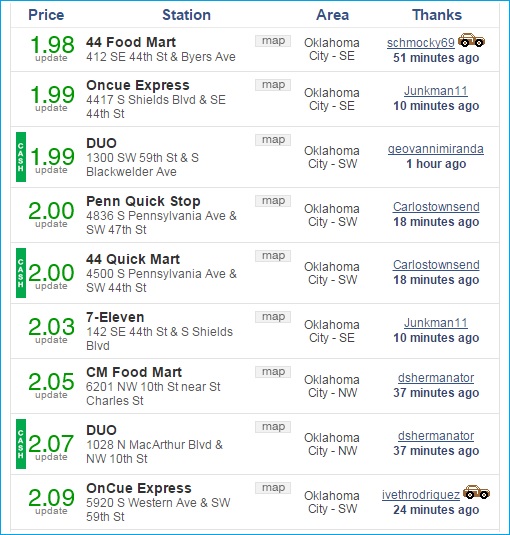

While consumers were wondering if it will ever happen, an Oncue Express station in Oklahoma City, America, was selling the gasoline for US$1.99 a gallon Wednesday (Dec 3), becoming the first one to drop below US$2 in the U.S. since July 30, 2010. That would be roughly about £1.27 or RM6.86 a gallon or 3.785 litre. In terms of litre, that would be around £0.33 or RM1.81 every damn litre (*grin*).

Of course, not every gas station in America is selling at the same price due to different tax rates from different states. Still, about 15% of United States stations are selling fuel below US$2.50 a gallon. That’s about £0.42 or RM2.27 a litre. When the Oncue Express station was selling at US$1.99 a gallon Wednesday, the retail gasoline in U.S. averaged US$2.746 while Oklahoma averaged US$2.532 every gallon.

Today, as this article is being drafted, the retail gasoline average in U.S. dropped further to US$2.728 while Oklahoma averaged US$2.509 every gallon. In other words – BOOM – more gas stations are joining Oncue Express in offering gasoline below US$2 a gallon. Based on our investigation, the latest stations in Oklahoma which jump into the bandwagon are DUO and 44 Food Mart.

Now, the cheapest station is 44 Food Mart, selling at US$1.98 a gallon, one cent lower than both DUO and Oncue Express stations. There’re many stations in the rural Virginia, Missouri, South Carolina, Texas that are selling between US$2.10 to US$2.20 a gallon. But it won’t be long before they join the cheap gas party, probably before the Christmas could even start this month (*grin*).

We’ve published many articles about the danger of relying too much on crude oil as a major income. Countries such as Russia, Venezuela, OPEC and even small exporter like Malaysia are some that are having problems now. Take for example Malaysian government, which derived 29.5% of its revenue from petroleum. Last year alone, Najib Razak administration milked a whopping RM63 billion (US$18.3 billion; £11.7 billion) from Petronas.

One of our articles also mentioned about spending billions of dollars in BR1M, an obvious vote-buying in exchange for cash idea from the genius prime minister Najib Razak. Now that Petronas CEO revealed that payments to the Malaysian government in the form of dividends, tax and royalties could be 37% lower from the previous year to about RM43 billion in 2015 if oil stays around US$75 (RM275) a barrel, what is PM Najib going to do?

Petronas also announced a cut of between 15% and 20% to its annual capital expenditure of RM50 billion. It is expected that 40 listed Oil-and-Gas companies and another 4,000 smaller ones that rely on Petronas for jobs would certainly be in deep trouble. You can bet your last penny that former PM Mahathir’s son – Mokhzani Mahathir – is crying like a baby now that his shareholding value in SapuraKencana drops from RM2.95 billion to RM1.54 billion.

Instead of genuine petrol price drops, local RON-95 and RON-97 were slashed by 4-sen and 9-sen per litre only, to RM2.26 and RM2.46 a litre respectively. It seems Malaysians’ hard earned money is being used to subsidize the corrupt Najib administration instead. It’s a public domain knowledge that for every litre petrol sold, RM0.30 will go into UMNO’s pocket before the abolishment of petrol subsidies.

Hence, when the price should be at RM1.80 a litre now, does that mean PM Najib’s political party UMNO is laughing all the way to the bank, assuming consumers are being milked the fixed RM0.30 plus RM0.46 (being the difference of RM2.26 and RM1.80) for every litre of gasoline? If it’s true, that’s a cool RM0.76 for every litre, mind you. And stop the crap about different fuel qualities, different calculation formulas and whatnot.

The fact that PM Najib’s minion admitted recently that diesel couldn’t be lowered (but being hiked instead) because they have subsidized it previously, speaks volumes about how the reverse is true. From helping people by subsidising petrol, now all Malaysians are being made to subsidise the government instead. Now do you know the real meaning of “managed float system”? It means to ensure UMNO’s corrupt system manage to stay floating (*tongue-in-cheek*).

Other Articles That May Interest You …

- Are You Ready For Crazy Oil Prices At US$30 A Barrel?

- Meet UMNO, The Obnoxious Scrounger Worse Than Communist China

- Scrapping RON95 & Diesel Subsidies – Why It Will Do More Harm Than Good

- After China Steel Cheaper Than Cabbage, Now U.S. Gasoline Cheaper Than Milk

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

|

|

December 5th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply