When the crude oil dropped to below US$30 a barrel, some said it’s impossible for it to reach US$20. But when it finally breached the US$20 level, they said it’s absolutely impossible to go US$10. Guess what, the US$10 a barrel of oil has just been breached. On Sunday, the U.S. benchmark – WTI (West Texas Intermediate) – had fallen to the US$15 price range.

In fact, the commodity dropped as much as 21% to US$14.47 per barrel – the lowest in 21 years. The only good news – the international Brent crude oil benchmark was still holding up above US$25 a barrel (trading at US$26.90), but not for long. As of the time of writing, the WTI crude oil continues to be hammered on Monday, trading at a jaw-dropping US$8.90 per barrel – down by 51%.

To make matters worse, the May contract of WTI will expire on Tuesday, hence encouraging more extreme selling. The huge price spreads between WTI and Brent show something very interesting. It shows that the situation in the U.S. is extremely serious. It shows that the demands for oil in America are expected to be very bearish, so much so that oil price could not support US$10 a barrel.

So, what happens? The answer:- lack of storage. Yes, the declining demand for oil has reached a level where even the recent production cut has failed to arrest the supply glut, thanks to Coronavirus. The pandemic has forced countries to shut down, with governments declaring either partial or full “lockdown”, leading to restrictive movement of billions of people.

When people stay home or prohibited from travelling, it creates a sudden drop in demand for oil. The energy markets, already flush with oil, quickly fills up storage space – both onshore and offshore. On Wednesday, the International Energy Agency (IEA) reported a record 19 million barrel increase in crude oil supplies in the U.S. alone, the biggest crude-producing country.

Essentially, the U.S. has produced so much oil that the Trump administration is actually considering paying American oil producers to stop pumping. Adding salt into injury, the IEA said demand in April is estimated to be 29 million barrels per day lower than a year ago, hitting a level last seen in 1995. For the second quarter, oil demand is expected to be 23.1 million barrels per day below year-ago levels.

The Paris-based IEA further said – “Even if travel restrictions are eased in the second half of the year, we expect that global oil demand in 2020 will fall by 9.3 million barrels a day versus 2019, wiping almost a decade of growth.” The IEA’s projection was revealed after OPEC and its non-OPEC allies finalized a historic agreement to cut oil output by as much as 9.7 million barrels per day.

The agreement was made together with the G-20 countries, including the U.S., in a desperate attempt to bring the oil industry back from the brink of a total collapse. The energy markets had initially rallied after President Donald Trump intervened to end the price war between Russia and Saudi Arabia. But it wasn’t enough, even though Trump called it a “great deal for all”.

Heck, Trump had even declared that the deal, which he brokered would “save hundreds of thousands of energy jobs in the United States”, after pledging last month that America would buy “large quantities of crude oil” for storage in the Strategic Petroleum Reserve. But North American producers were already shutting down their rigs because they don’t have space to store their crude.

Obviously the deal was too little too late because the demand was down by about 25 million barrels per day. While Trump was trying to be optimistic, Russian Energy Minister Alexander Novak poured cold water, saying he did not expect oil markets to recover before “end of the year, in the best case scenario”. In short, no output cut could fully offset or rescue the near-term drops facing the market.

Worldwide, Coronavirus cases continues to skyrocket to almost 2.5-million, while the death toll breaches more than 165,000. In the U.S. alone, there were more than 750,000 confirmed cases with more than 40,000 people have died. Any production cut from the OPEC+ is immaterial. What is more important is a lifting of lockdowns in the U.S.

While Brent crude does not have the same storage problems, at least for now, a prolonged lockdown by countries around the world could trigger a similar oversupply crisis. You have so many factors affecting the crude oil price at the same time – oversupply of oil, insufficient storage, plunging economy, Covid-19, lack of vaccine, price war and whatnot.

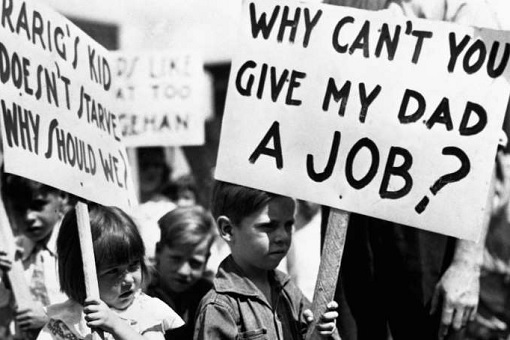

Last week, the IMF (International Monetary Fund) dropped a bombshell – the global economy will suffer the worst financial crisis since the 1929 Great Depression. It said that the global economy is expected to contract by at least 3% in 2020, a huge U-turn from its own forecast in January of a global GDP (gross domestic product) expansion of 3.3% for this year.

Gita Gopinath, the IMF’s chief economist, said – “It is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.” That means the coming recession meltdown will be worse than the 2008-09 Financial Crisis, also known as the Great Recession.

Similarly, the World Trade Organization (WTO) said the global trade will contract by between 13% and 32% this year due to the Covid-19 pandemic. It further said that nearly all regions will suffer “double-digit” declines in trade volumes, with exports from North America and Asia to be hit the most. The lockdown measures implemented by most of the countries have stalled business activities.

Other Articles That May Interest You …

- IMF – The “Great Lockdown” Is Set To Triggers The World’s Worst Recession Since The 1929 Great Depression

- Kaboom! – Oil Plunges Below $28, Oil-Reliant Countries Are Set To Lose Revenue By Up To 85%

- The World Is Working On 20 Coronavirus Vaccines – But It Could Take Up To 18 Months

- Get Ready For A Brutal Recession – Trump’s Speech Fails To Inspire As 150 Million Americans Could Get Infected

- Get Ready For $20 Oil – All Eyes On “Russia vs Saudi” After 30% Oil Crash Sparked By Price War

- Get Ready For $30 – Here’s Why Russia Prefers A Meltdown Of Oil Price Than Another Supply Cut Proposed By Saudi

- Forget OPEC – These 3 Powerful Men Will Determine & Control The World Oil Prices

- Here’s How Oil Could Crash To $10 – In 6 To 8 Years

- 1 Salmon For 1 Barrel Of Oil, Anyone?

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

|

|

April 21st, 2020 by financetwitter

|

|

|

|

|

|

|

It is not like storing palm oil in our guts when we drink that five times a day.

If we continue pumping oil and stealing that from Sarawak, not only we are not going to get bare-minimum price, we are not going to find anywhere to store it.

Two oils and no price.

What a cursed way for the country to go under!