On Sunday (July 7) in Europe, 150-year-old German bank – Deutsche Bank – officially launched its restructuring plan to cut a mind-blowing 18,000 jobs by 2022. By Monday morning (July 8), the entire teams in Deutsche Bank’s Asian operations were told to pack and clear their desks, before their security passes are deactivated as their jobs were gone.

Some Deutsche Bank staff in London was told they have until 11am to pack up their stuff, just hours after the retrenchment was announced. Its Australian equities division will be shut down as part of plans to scrap its global equities business. Deutsche had some 4,700 staff in Sydney, Tokyo, Hong Kong and Singapore. That means the bulk of the 18,000 job losses is in Europe.

But the fact that the downsizing plan would cost the bank €7.4 billion (US$8.3 billion; £6.6 billion; RM34.4 billion) speaks volumes about how massive the problem is. Deutsche plans to reduce its workforce to 74,000 employees globally. As part of the restructuring, the German bank will scrap its global equities business and also cut some of its fixed income operations.

The German bank’s decision to scale back investment banking comes just 2 days after investment banking chief Garth Ritchie stepped down after 23 years of service. Under the leadership of Ritchie, the bank was plagued with a series of scandals and investigations. Ritchie was identified by German prosecutors of involvement in alleged tax crimes.

CEO Christian Sewing, who unveiled that one in five jobs at the German bank will be eliminated, said – “I personally greatly regret the impact this will have on some of you. We will only operate where we are competitive. We tried to compete in nearly every corner of the banking market at the same time. We simply spread ourselves too thin.”

Deutsche bank may report a net loss of €2.8 billion (US$3.1 billion) in the second quarter of 2019. The bank was in such a sorry state that it had previously considered merging with rival Commerzbank to push up its position, but the merger talks collapsed in April. But the Deutsche Bank’s restructuring is long overdue as its problem did not start yesterday.

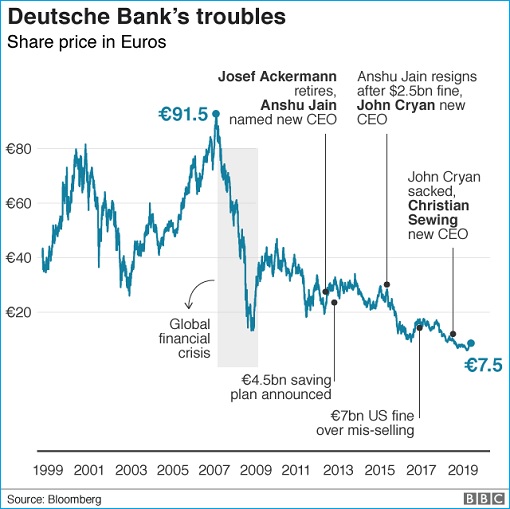

As the biggest bank in Germany, Deutsche at one point dreamed of dominating investment banking, competing with the likes of American heavyweights Goldman Sachs and Morgan Stanley. However, it has been hit by scandals, investigations and massive penalties. While the 2008-09 financial meltdown due to subprime crisis seemed to be a distant memory, the 10-year-old crisis continues to plague the bank.

In April 2015, US and British regulators fined Deutsche Bank US$2.5 billion for allegedly participating in a scheme to rig interest rates. Allegations that the bank and brokerage staff attempted to rig Libor, the rate at which banks say they can borrow from each other, first emerged during the credit crisis in 2008. But it took another 4 years for the story to hit the headlines.

In January 2017, Deutsche bank reached a staggering US$7.2 billion settlement with the U.S. Justice Department for allegedly misleading investors in the sale of toxic mortgage-backed securities leading up to the 2008 financial crisis. In comparison, JP Morgan paid US$9 billion in 2013 while Bank of America paid US$10 billion for their illegal conduct and irresponsible lending practices.

Weeks later in the same year, the German bank was slapped with a US$630 million fine over allegations of Russian money laundering. The U.S. and U.K. regulators found Deutsche guilty for failing to prevent around US$10 billion in suspicious trades being laundered out of Russia in a scheme called “mirror trades” between the bank’s Moscow, London and New York offices from 2011 to 2015.

Headquartered in Frankfurt, Germany, the struggling bank argued that the latest downsizing is to arrest its volatile investment banking division in a restructuring aimed at restoring consistent profitability and better returns to shareholders. The bank went 3 straight years without turning an annual profit before recording positive earnings of €341 million for 2018.

Deutsche’s problem isn’t over even with the gigantic 18,000 job cuts. It’s also caught in a legal tug of war between U.S. President Donald Trump and House Democrats. For years, the German bank has been the main lender for the Trump family, whom other banks have avoided loaning money to because of his repeated bankruptcies and defaults starting in the early 1990s.

The House Intelligence and Financial Services Committees subpoenaed Deutsche in April for records on Trump’s finances. But The Trump family’s lawyers, in a lawsuit filed against Deutsche Bank in late April, challenged the demands for financial documents from the lenders, saying subpoenas from House Democrats were issued to harass President Trump.

To add salt into injury, 7 Democrats on the Senate Banking Committee have also urged the Federal Reserve to probe whistleblower allegations, first reported by the New York Times, that Deutsche Bank buried suspicious activity from accounts associated with Donald Trump and Jared Kushner, the president’s son-in-law and senior White House adviser.

New York Attorney General Leticia James has subpoenaed records from Deutsche Bank related to three large loans the bank extended to Trump’s company in recent years. The bank has assured authorities that it will cooperate with all of the investigations and has begun discussing the best way to turn over the documents covered by the subpoena.

The ambitious Deutsche Bank is also being sucked into one of the largest money-laundering cases in history involving Danske, Denmark’s largest bank. Authorities in the U.S., Denmark, Estonia, France and Britain are investigating US$233 billion in suspicious transactions moving through the bank’s tiny branch in Estonia – nearly 10 times larger than that country’s gross domestic product.

Apparently, Deutsche Bank helped transfer the funds on behalf of Danske, the Denmark’s largest bank. The dubious payments were found to have flowed through its Estonian branch from Russia, former Soviet states and elsewhere between 2007 and 2015. Still, shareholders of the German bank have a bigger problem than scandals and money laundering.

The European economy recovered slower than the United States since the 2008 financial crisis. As a result, Deutsche’s recovery has been particularly slow as it continues to struggle to rebound. Since the 2008 financial crisis, the bank has tried various changes of strategy and management, none of which have been successfully executed.

Other Articles That May Interest You …

- Germany Resists US Pressure – Won’t Ban Huawei From Providing 5G Mobile Technology

- This Profession Will See A Massive Demand – 800,000 Jobs – In Asia Over The Next 20 Years

- Invasion Of China Empire – They’re Now Targeting European, Especially Financial Powerhouse

- After Microsoft, Now Hewlett Packard Plans To Cut 5,000 Jobs – By Christmas – Worldwide

- Microsoft Announces 4,000 Jobs Cut – 75% Employees Abroad To Be Notified

- How To Boost Your Chance By “19 Times” For A Job Interview – Wear Low-Cut

- Here’s Everything About Deutsche Bank Crisis – And Why Merkel Would “Quietly Bailout” Her Bank

- 50,000 Global Jobs Cut So That HSBC Can Reward Shareholders

|

|

July 8th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply