Iron rice bowl is a term Chinese used to refer to an occupation with guaranteed job security, with steady income and perks thrown in. The term is also known as “golden rice bowl”. One of the careers that provide such job security is a job with the government of the day. This was true as long as hundreds of years ago, and is still valid today.

Another career with such stability and benefits is a job with a bank. While this was true decades ago, careers with financial institutions can no longer guarantee security. It doesn’t matter if the bank comes with a name which sounds as if it’s a Chinese-owned bank, such as HSBC, or a bank that you couldn’t pronounce properly, such as Deutsche Bank.

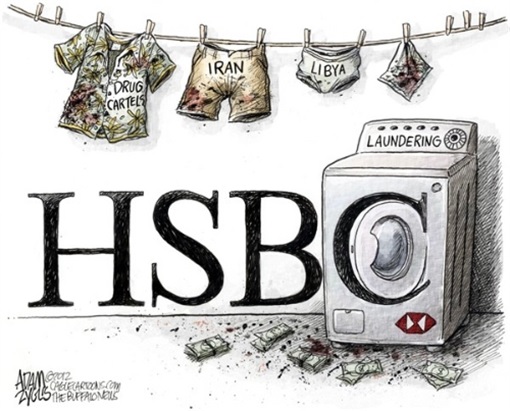

The fact is – there’s no job security with any banking institutions today. Both British-owned HSBC and German-owned Deutsche Bank are well known for their involvement in tax frauds, money laundering, dubious trade transactions, market manipulations and whatnot. Still, both banks cannot provide job security, despite making tons of money from such illegal activities.

Thus far, HSBC spent more than US$11 billion (£7.2 billion; RM41.2 billion) on regulatory and compliance charges in the past 4-years as it faced a number of investigations and agreed to a series of settlements related to accusations of money laundering and the rigging of foreign exchange markets. That speaks volumes about how tainted HSBC businesses were.

While Deutsche Bank AG is weighing options such as job cuts and the sale of assets, with its latest Frankfurt headquarters being raided by prosecutors, HSBC has pledged a new promise of higher dividends for shareholders – by cutting close to 50,000 jobs worldwide. Half of these jobs would be eliminated by selling its businesses in Turkey and Brazil.

In Britain alone, where HSBC is based, an estimated 8,000 jobs will be slashed. That’s about 16% of 48,000 staffs the banking giant employs in the UK. And by axing 50,000 jobs globally, essentially about 20% of its 258,000 worldwide staffs will be made jobless. Additionally, IT and back-office operations will be consolidated, as well as closing branches.

About 12% of its branches worldwide will be closed, with 1,057 branches in U.K. to be affected. Even the United States and Mexico offices are not safe from the major restructuring. This time, HSBC is dead serious about saving as much as US$5 billion (£3.3 billion; RM18.7 billion) annually by 2017.

Interestingly, HSBC (Stock: LON: HSBA) also plans to relocate its UK headquarters from London to Birmingham by 2019, with a possibility of moving back to its original base in Hong Kong (Stock: HKG: 0005) altogether. It may be a national pride to be based in home UK, but a bank levy introduced by Chancellor George Osborne since 2010 also means the bank pays roughly US$1 billion every year.

Although HSBC made a handsome profit of US$13.6 billion last year, the US$1 billion in levy represents 7.3% of its earnings. The problem is, the UK government keeps raising the levy rate – about 9 times already since it was introduced – and has been taking in US$8 billion (£5.3 billion; RM30.4 billion), according to records from the British Bankers’ Association.

HSBC, Europe’s largest bank by assets, has already axed about 40,000 jobs between 2011 and 2014. The latest move will see the bank aggresively pushing online banking and self-service to its customers, which will contribute to 12,000 jobs cut. It also decides that 75% of its software development will be done in China and India, obviously due to lower cost.

By reducing the banking giant’s footprint in developed economies and increase investment in developing countries, it means good news to Asia, especially China. HSBC derives more than 50% of its earnings from Asia. Asean’s asset management and insurance businesses will see a boost from HSBC’s latest stunt.

The giant lender also plans to reduce the so-called risk-weighted assets by 25%, or about US$290 billion (£190 billion; RM1.1 trillion). Clearly, HSBC has been holding some toxic assets, now desperately need to be disposed of. However, based on its stock reaction, investors are not impressed with the latest job cut stunt.

Other Articles That May Interest You …

- FIFA Crackdown – World Cup Of Corruption Operates Like Big Mafia Families

- HSBC To Charge On Deposits – Proof That EU’s Economy Is Collapsing?

- Here’re 14 Crazy Facts How Huge (1MDB) RM42 Billion Debt Is

- UFUN Ponzi Scheme – Did Nazifuddin Son Of PM Najib Razak Lie?

- Exposed!! – How HSBC Swiss Bank Helped Hide (Dirty) Money

- Here’re Tax Havens To Hide Your Black Money & Plunder

|

|

June 10th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply