What do these big names have in common – Dato Dr Warren Eu, Lt. General Athiwat Soonpan, Datuk Raymond Chan Boon Siew, Datuk Daniel Tay, Dato Nazifuddin (second son of Prime Minister Najib Razak)? They’re all involved in uFun Group (directly or indirectly), a supposedly superbly successful company with more than 10 offices worldwide and members from more than 80 countries. Why were they so successful? One word – uToken.

The mention of “members” from different geographical locations would instantly raise eyebrows about a possibility of MLM, which in turns translate to Get-Rich-Scheme, Ponzi Scheme, and whatnot. Hold on, not another Ponzi scheme, after the infamous Genneva Gold (*yawn*) scheme. Apparently, uFun turns out to be as huge as Genneva, if not bigger. Thai police has cracked down on uFun Store late last month, finally.

After a group of 110 victims lodged complaints with Thai police against the company, claiming that it has deceived them out of 35 million baht (US$1 million, £660,000, RM3.7 million), all hell breaks loose. The uFun Store has allegedly swindled 120,000 people involving at least 38 billion baht (US$1.13 billion, £720 million, RM4 billion). In comparison, Genneva Gold Malaysia had 50,000 customers only, before it was raided in 2012.

Although pale in memberships, Genneva Gold’s business turnover was roughly at RM3 billion. Nevertheless, both are still Ponzi scheme. Just like Genneva Gold, uFun investors or members would cry, whine, bitch and accuse authorities of illegal crackdowns and whatnot. But soon, the latecomers who get burnt would lick their wounds, while the early birds would thank their luck they have recovered their investment; and the process repeats itself.

They can disguise as much as they like, as e-commerce, investment, networking marketing and whatnot, but such business model is still “Ponzi Scheme”. At the end of the day, the founders, top executives and early members become multi-millionaires, thanks to money “contributed” by members at the back of the queue. It’s about “rolling money” from one member to another member.

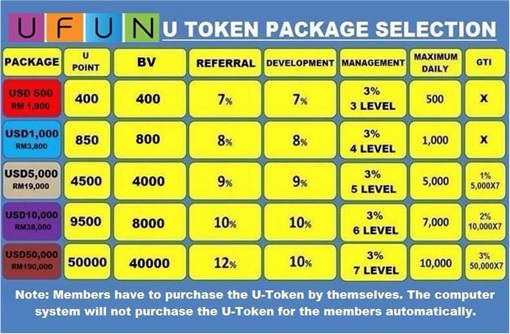

Like it or not, people who have invested in uFun are stupider than those who had joined Genneva Gold. At least Genneva Gold participants get to keep their physical gold (if they were lucky to get it in the first place), whereas uFun members were given digital U-Points, S-Points, P-Points to exchange for virtual uTokens currency. Amusingly, uFun’s currency exchange rate for buy/sell was at RM3.80/RM3.20 (to US$1) in favour of the company.

This is similar to how you would be given “toy tokens” in exchange for your real hard cash when you bring your kids to indoor entertainment centre (*grin*). The only difference is uFun’s uToken appreciates in values, guaranteed, hence superior than stock market. Obviously the “uToken Share Market” was internally manipulated in such a way that the cash-inflow from new members has to be greater than payout during “stock-split”, a period where old members get money, for doing nothing.

Thailand General Athiwat Soonpan, uFun Club International President, had fled the country. Thai police have identified some suspects involved in the illegal scheme. The five Thai suspects are Arthit Pankaew, 37, Apichanat Saenkla, 40, Ratthawit Thitiarunwat, 34, Chaithorn Thonglolert, 41 and Rithidet Warong, 39. The other three Malaysian suspects identified by Thai police are (Daniel) Tay Kim Leng, 41, Lee Kuan Ming, 38 and Won Sing Hlia, 42.

Guess what, Mr Arthit Pankaew, one of shareholders of uFun Thailand is in fact a Chinese. His real name – “Zhang Jian” (real name Song Miqiu). Now, that rings a bell. The so-called billionaire scammer, who made headlines in the Malaysian media not long ago by proclaiming himself as the “future richest man in the world”, had apparently purchased a fake Thai ID in Sa Kaeo province and undergone a plastic surgery to hide his dubious past.

However, what raises eyebrows in Malaysia about the uFun Ponzi scheme is not about Zhang Jian, but rather Mohd Nazifuddin, the second son of PM Najib. After daddy Najib was linked to 1MDB’s RM42 billion debt scandal, the time couldn’t be better when Thai television station NOW-26 released a video report on Monday into alleged links between uFun and Nazifuddin.

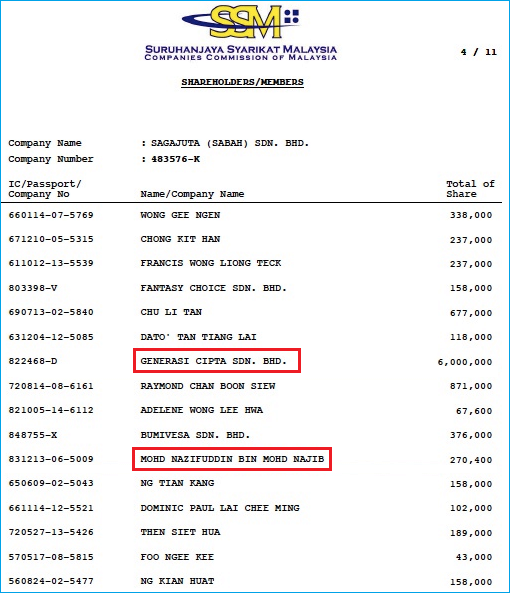

As expected, Nazifuddin denies any involvement with uFun and its schemes, although he admitted he was a director and executive chairman of Sagajuta (Sabah) Sdn Bhd, until May 2012. However, Sarawak Report has revealed that it was less than a month ago (26th April 2015) that uFun signed a memorandum of understanding with Lagenda Erajuta Sdn Bhd, a subsidiary of Sagajuta, for the Gateway Klang development project, worth RM1.2 billion.

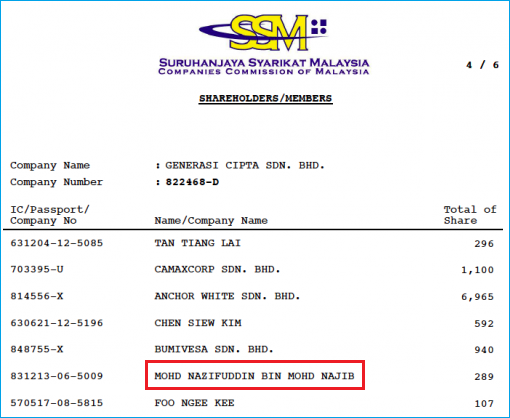

Interestingly, Nazifuddin the son of Najib Razak, is still the biggest shareholder of Sagajuta, through his company Generasi Cipta Sdn Bhd. So, did Nazifuddin play victim, though it was a lousy one, and hope the public would not notice it? Sagajuta managing director, Raymond Chan Boon Siew, is also linked to the scandalous uFun. Surely as a major shareholder, Nazifuddin would have been “informed” about such mega project.

Clearly by working with construction firm Sagajuta, uFun’s 30% stake in Gateway Klang would involved more than RM300 million of Ponzi money. Even if Nazifuddin has indeed resigned from Sagajuta, his 6,270,400 shares through Generasi Cipta and personal stake still makes him the de-facto major decision maker. Who is he trying to bluff that he didn’t know anything with his 62.7% stake in Sagajuta?

On the bright side, perhaps Malaysian authorities should play dumb, since uFun Group has brilliantly sucked and laundered billions of ringgit from Thailand into the local property market, cheekily speaking (*tongue-in-cheek*). There’re also tons of allegation on internet that Selangor royalty was involved indirectly, through chairmanship in uMatrin, a holding company used by Dato Dr Warren Eu to probably launder uFun Club’s funds.

Since Sultan of Selangor and his family members are “untouchable”, the same way Nazifuddin the son of Najib Razak is, maybe Thai authorities should just pluck some small fries from uFun Group and prosecute them. After all, it was the fault of the greedy public who willingly gave away their hard earned money to uFun. Nobody pointed a gun at any of the members into joining the Ponzi Scheme (*grin*).

Other Articles That May Interest You …

- 1MDB Scandal – An Ali-Baba “Scam” Partnership Goes Bust

- Exposed!! – How HSBC Swiss Bank Helped Hide (Dirty) Money

- Only In China – Fake Bank Scams 200 Customers Of 200 Million Yuan

- Sweet Revenge – Scammer Jover Chew Closes Business At Sim Lim Square

- How to Get Back Your Genneva Gold and Money – 10 Things To Do11

- Genneva Gold – Another Collapsing Ponzi Scam?

- Here’re Tax Havens To Hide Your Black Money & Plunder

- Tax Justice Network estimated a mind-boggling of between USD $21 trillion

|

|

May 15th, 2015 by financetwitter

|

|

|

|

|

|

|

You are fantastic. Very thorough indebt investigative report that I have read so far.I enthusiastically read all your postings. With such a large pool of information on unscrupulous people( some well connected ones) and their extensive linkages running businesses(some are Ponzi schemes) at least we get to know their modus operandi and be careful with our investments. I like to tip you on one company called Aquaint Capital Holdings Ltd(ASX:AQU),previously known as Azea Property Investment sdn/pte ltd started by a Spore woman and a Malaysian man. They coached students on property investment then they started selling properties(uk,us,india,malaysian,etc) to them. Then they went for back door listing in the ASX. Students who invested in their projects either as fractional

owners or subscribers to their funds were encouraged to convert to shares. The jv projects were injected into the CO. Apparently most of the projects ran into problems. Share price fell from ipo A$0.60 to a low 0.20 in about 15 mths period. CO Suspended temporarily. Auditor put in a lot of qualifications about the accounts. In the Australian website a certain Dr BENWAY blog wrote stating that it was a PONZI scheme. Investors making queries but not getting answers. Hope you can investigate this matter as it involves hundreds of investors and millions of $$!! Thanking you in anticipation.