Goldman Sachs CEO David Solomon on Wednesday (Jan 16) apologised to the Malaysian people for former banker Tim Leissner’s role in the sovereign wealth fund 1MDB scandal. However, the chief executive cunningly distanced the bank from the scheme, choosing to throw the former partner under the bus instead, as Malaysia filed criminal charges against it last month.

Solomon admitted – “It’s very clear that the people of Malaysia were defrauded by many individuals, including the highest members of the prior government. Tim Leissner, who was a partner at our firm, by his own admission was one of those people. For Leissner’s role in that fraud, we apologize to the Malaysian people.”

Last month, Malaysia filed criminal charges against three subsidiaries of Goldman Sachs Inc over their handling of bonds totalling US$6.5 billion issued by 1Malaysia Development Bhd (1MDB). The three subsidiaries are Goldman Sachs International (UK), Goldman Sachs (Singapore) Pte and Goldman Sachs (Asia) LLC.

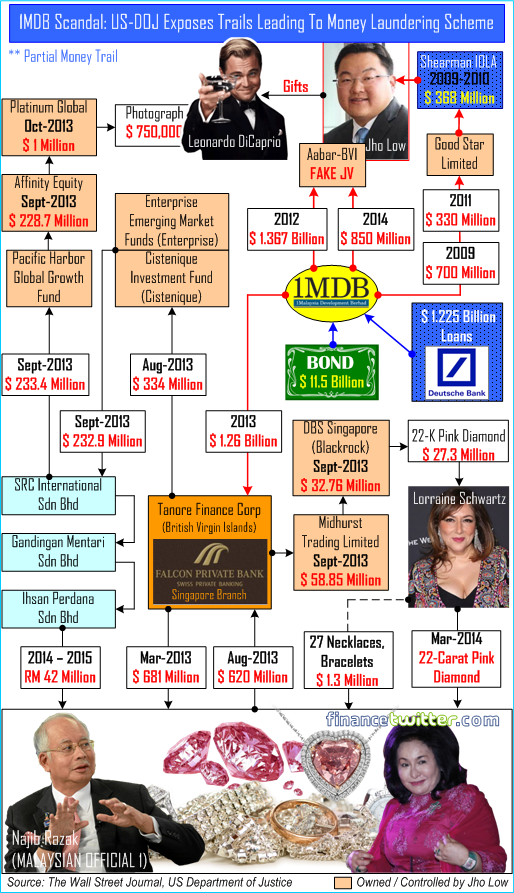

Goldman Sachs, the 149-year-old American investment bank, raised nearly US$6.5 billion in three bond sales between 2012 and 2013 for 1MDB. However, more than US$2.5 billion raised from these bonds was misappropriated by high-level 1MDB officials, their relatives and associates, according to U.S. Department of Justice civil lawsuits filed in a U.S. court in 2016.

In the process, Goldman earned almost US$600 million for the three deals – a jaw-dropping amount of close to 10% commission, far in excess of the normal 1-2 percent fees a bank could expect for helping sell bonds. The fees alone – 5 to 10 times more than usual rate – should have had raised the red flag that something fishy was going on, which today has been proven to be true.

Essentially, the US$600 million in fees earned would make 1MDB the most profitable client in the world for Goldman during those years. Malaysia is seeking US$7.5 billion from the American bank for the “agony” and “trauma” the country experienced as a result of the scandal involving former Prime Minister Najib Razak and Goldman Sachs.

Goldman is not expected to hand over the US$7.5 billion demanded by the new Malaysian government, who had dethroned the disgraced Najib son of the Razak in May elections, without a good fight. Armed with battalions of top lawyers, the bank will instead put the blames on the previous Malaysian government for being the mastermind of the 1MDB fraud.

As part of Goldman’s due diligence efforts, Mr Solomon argued that the bank sought and received written assurances from 1MDB and International Petroleum Investment Co (IPIC) that no third-parties were involved in the first two bond sales. Abu Dhabi’s IPIC had apparently co-guaranteed the 1MDB bonds when they were issued in 2012.

Hence, Goldman, in its defence in the U.S. courts, will repeat its rhetoric that there was “detailed due diligence” done in the bond offerings. It will also point fingers at Mr. Leissner and Malaysian officials who gave assurances that no intermediaries were involved – which ended up being false, as disgraced financier Jho Low has since been identified as a mastermind of the 1MDB fraud.

However, it’s also true that as far back as 2009, three years before the bond sales, the firm’s then-CEO Lloyd Blankfein personally helped forge ties with Malaysia and its new sovereign wealth fund 1MDB at a meeting with the crooked ex-PM Najib Razak together with his partner-in-crime Jho Low (real name: Low Taek Jho) at the Four Seasons hotel in New York.

In fact, more than 30 Goldman Sachs executives – including David Solomon himself and his predecessor Lloyd Blankfein – had actually reviewed the Malaysian debt deals, which would lead to criminal charges against two of its former bankers (Tim Leissner and Roger Ng Choon Hwa).

Make no mistake about it. Goldman Sachs apologises to the Malaysian people because it had no choice after being caught with its pants down. Leissner has pleaded guilty to conspiracy to launder money and violate the Foreign Corrupt Practices Act. More importantly, Goldman faces investigations around the world, including an investigation by the U.S. Department of Justice.

What’s even more problematic for the bank is that Leissner told the court during his guilty plea last year that there was a “culture” at Goldman Sachs of bypassing internal compliance. But the apology tendered by CEO David Solomon, whether was done sincerely or with ulterior motive to arrive at a settlement, isn’t a good news for Mr. Najib.

For as long as one can remember, serial liar Najib, who was the Chairman of 1MDB, has denied any involvement in the scandal, although he was caught with his hand in the cookie jar – a whopping US$681 million in his private bank accounts. Instead, he has claimed that the money was donations from Saudi royal family, a claim that he could not be fully substantiated.

Najib’s wife, Rosmah Mansor, was also exposed to have had purchased a 22-carat pink diamond necklace – worth a stunning US$27.3 million – using money siphoned from 1MDB. According to U.S.-DOJ investigations, Jho Low had arranged for jewellery designer Lorraine Schwartz (also known as “Jewish Queen of Oscar Bling”) for the pink diamond on June 2, 2013.

Amusingly, Najib was forced into making a small U-turn during an hour-grilling with Al-Jazeera’s reporter Mary Ann Jolley last year. Speaking to Al Jazeera’s 101 East in an exclusive interview on Oct 26, 2018, the “pink lips” said he actually did not verify the source of the RM2.6 billion. His latest twist was that he had “assumed” that the donations were connected to Saudi Arabia.

Heck, calling it a “contingency fund” to counter opposition’s alleged plan to form a new government by buying over up to 40 Member of Parliaments, Najib even lied that the King Abdullah had actually wanted to give him US$800 million instead, but the son of Razak only took US$681 million from the king of the Kingdom of the Saudi Arabia.

Now that Goldman Sachs CEO David Solomon has apologized for the role of one of his former bankers in the 1MDB scandal, Najib’s “assumption” that the US$681 billion (RM2.6 billion) was somehow linked to the Saudi royal family does not hold water anymore. Najib should start worrying about the US$4.5 billion plundered from the 1MDB fund by Jho Low and his minions.

Other Articles That May Interest You …

- Sorry Folks, None Of Goldman Sachs Bankers Will Go To Jail – They’re Untouchable White Collar Crooks

- Here’s Why Malaysia Should Sue Goldman Sachs In 1MDB Corruption & Money Laundering Scandal

- Al-Jazeera Interview – How Mary Ann Jolley Skillfully Skins & Grills Najib Till He Runs Away

- Congrats Najib!! – You Lose A Powerful Witness, Saudi Denies Any Knowledge About RM2.6 Billion Donation

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Blood Bonds – Greedy Goldman Sachs Making Money Off The Killing Of Venezuelans

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- By Hiding Again From IACC, 130 Countries Assume Najib Is Guilty

|

|

January 17th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply