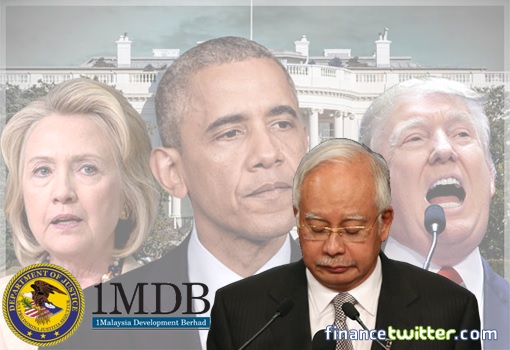

There’s a new Republican president in town, and its bad news to most of the world leaders who have been worshipping liberalization, globalization, multi-culture and whatnot. Just like Germany, France, South Korea, China, Mexico and even the Pope, Malaysia too had bet on the wrong horse – Hillary Clinton – to win the U.S. presidency.

Malaysian Prime Minister Najib Razak was cock sure that Hillary Clinton would win the election. But who can blame him when every single poll conducted by liberal mainstream media gave Clinton a 90% chance of defeating Trump. Chances are Najib and his family members could have bet a couple of millions on Clinton, and lost everything.

Najib was hoping Clinton would take over and continue Obama’s third term so that he could continue to plunder the nation. You see, Najib can easily “kautim (settle)” the U.S.-DOJ lawsuits on his stepson Riza Aziz over corruption and stolen money originated from 1MDB, by supposedly “donating to Clinton Foundation” – the piggybank of corrupt “President Hillary Clinton”.

Unfortunately karma is a bitch. The arrogant Democratic Party didn’t lose only the “Crooked Hillary”, but they also lost both House of Representatives and the Senate to Republicans. What this means is President Donald Trump is set to become a very powerful president, forcing PM Najib to go back to the drawing board on how to suck up to Donald.

Generally, most Republicans have negative views of Muslims and President-elect Donald Trump, who is a reality-TV star more than a politician, didn’t hide his hatred of Muslims whom he blamed for terror attacks around the world, including American soil. Donald was proud to call for a shutdown of Muslims entering the United States.

Of course, other Republican presidential candidates such as Jeb Bush and Ted Cruz came out against Trump’s anti-Muslims proposal. Make no mistake about it – both Bush and Cruz slammed Trump not because they love Muslims more, but because they hadn’t the guts to offend the American-Muslims and liberal voters. Trump is now reaping the rewards for standing firm on his principle.

Coincidently, Mr. Najib was not only corrupted but in favour of Islamic extremism. As authored by John Pang in a memo titled – “The TPP and Malaysia’s Corruption Crisis” – Najib was described as “a poster boy for the 21st century kleptocracy” who has used “a racial supremacist ideology that is collapsing under the weight of corruption” to perpetuate himself in power.

On the subject of radicalization, the memo said under Najib administration, Malaysia is a “net exporter” of militants to Indonesia and Mindanao. The government estimates that there are 50,000 ISIS sympathizers in Malaysia, including members of the military. At least 12% of Malaysian Muslims had favourable attitudes towards ISIS compared to 4% in Indonesia.

To add salt into injury, Mr. Najib wrongly bet on not one, but two horses. After he bet wrongly on Hillary Clinton, he also bet wrongly on China. As he embraces China in exchange for the Chinese money to bailout his 1MDB scandal, he parroted badass Philippines President Rodrigo Duterte – telling the U.S. that former colonial powers should not lecture nations they once exploited on their internal affairs.

When Clinton stunningly losses the election, Najib Razak panicked and quickly switched the photo in his office of him golfing with Obama to Trump’s. As with any other “autographs” signed with nice and polite words, Najib got his boys to sing like a canary and leaked to foreign press the photo signed by Trump with the words “To my favourite Prime Minister.”, as if Trump really loves him.

For now, it’s too early to tell how low Najib would go to curry favour from Trump administration. Considering Donald is an alpha male while Najib belongs to the opposite category (nope, they won’t be gay lovers), the latter will do everything bootlicking Trump including telling the new U.S. president that Xi Jinping isn’t Najib’s true friend because they didn’t golf together.

However, the mistakes of sucking up to a Democrats candidate and ditching the U.S. in favour of China aren’t the biggest problem for Mr. Najib. The biggest issue is Trump’s “Make America Great Again” policy. An expectation and prediction of a Brexit-like pullback on an unlikely Trump victory has turned out to be a Wall Street rally instead.

As a real estate developer, Trump wants to rebuild roads, bridges, highways, tunnels, airports, schools, hospitals, railways and whatnot – an infrastructure investment worth a staggering US$1 trillion over 10 years to be funded largely by private sources. That’s about US$100 billion every year which would boost America’s GDP by 0.5% and reduce unemployment by 0.3%.

US President-elect Donald Trump has said he wants to change or scrap the 1994 NAFTA (North American Free Trade Agreement), along with Obama’s TPP, and right after he won the presidency, Canada and Mexico voluntarily said they’re “willing to talk”. Mexicans would either lose some manufacturing jobs back to the U.S. or risks a 35% tariff on cars imported from Mexico.

Besides re-negotiate NAFTA and kill-off TPP, Trump has also said he would raise tariffs on goods coming from China. He can invoke NAFTA’s Article 2205, without Congress’ approval, to scrap the trade agreement. And if Trump is willing to do that, what make anyone thinks he would think twice about slapping tariffs on Made-in-China products?

Yes, President Trump will bring lots of jobs back to fellow Americans and boost the local economy. That’s why the stock market skyrockets almost immediately after Dow futures temporarily plunged 900 points as news of Trump’s remarkable victory spread like wildfire. A booming “real economy” would push up inflation hence the needs to raise interest rate.

Even before Donald J. Trump wins the presidency, he has been extremely critical of Federal Reserve chairwoman Janet L. Yellen. Mr. Trump is expected to fill a majority of the Fed’s seven-member board with his own nominees over the next 18 months, including replacing Ms. Yellen in February 2018. She was being accused of creating a “false economy” for Obama with near zero interest rate.

With “real economy” driven by a stimulus to the U.S. economy from the Federal government budget, and not “false economy” created by a bullish stock market from the Federal Reserve, it could give inflation a boost, which in turns forces interest rate hikes. A hike in interest rate will also attract hot demand for U.S. dollar from around the world back to America.

The threat of a U.S. rate hike could happen as early as next month (December) when the Federal Reserve meets for the last time of the year. And the impact of the hike was felt almost immediately on Friday when investors dumped government bond market, forcing the Malaysian Ringgit plunged as low as RM4.73 to a dollar for a very brief moment.

Foreign investors, who hold about 40% of outstanding government bonds, pulled RM8.4 billion out of that market in September alone. But the currencies in the Southeast Asia region also suffered the same fate as ringgit on Friday, one may argue. True, but besides losing its value to the US dollar, Malaysian Ringgit also stunningly lost its shine against Singaporean dollar and even to Indonesia Rupiah on Friday.

Clearly, Malaysian Ringgit was treated like “pariah” among the currencies in Southeast Asia. The best part is the tumbling crude oil prices from above US$53 to US$44.50 a barrel within a month because both Saudi Arabia and Russia have cried wolf for umpteenth time about agreeing to stabilize global markets. The latest EIA report proves that the supply has gone up, not down.

Initially, the slowing global economy forces the Malaysia Central Bank (Bank Negara) to consider lowering interest rate. With the sudden prospect of U.S. hiking rate, however, Najib administration is caught with its pants down. If Bank Negara Malaysia Governor Muhammad Ibrahim decides to raise interest rate, the country’s domestic debt of RM609 billion as of Dec 2015 could burst.

But if Bank Negara refuses to, investors would dump not only government bonds but also other financial instruments including local stocks, depressing ringgit even lower against the dollar. Local business owners would have to pay premium for inventory goods while customers might buy less, or temporarily stop buying at all.

Malaysian consumers and transportation sector can expect to pay more for petrol / gasoline if the sagging ringgit continues towards RM4.50, RM4.80 or even RM5.00 to a US dollar. If Trump makes good of his promise to raise tariffs on goods coming from China, Beijing might devalue its Renminbi to make it competitive. This will start currency devaluation war in Asia – including Malaysian Ringgit.

Without improvement in revenue due to low crude oil prices, a weakening Ringgit will not only trigger super-inflation, the RM26.6 billion needed to service the nation’s debt this year will definitely balloon. Unemployment will spike, especially in the private sector due to massive retrenchment. Najib Razak might be forced to increase GST by 2% to 8% to make ends meet sooner than he had expected.

There were also naughty rumours that George Soros together with Mahathir Mohamad and former finance minister Daim Zainuddin have taken the opportunity of the tumbling ringgit on Friday and attacked the currency to make some money. Regardless, Trump presidency means a totally new economic challenge to Najib Razak, and that’s fabulously bad news to him.

Other Articles That May Interest You …

- A Powerful & Vengeful President Trump – ISIS & Radical Muslims Are In Grave Trouble

- Malaysia-China Deals On Navy Ships – What Najib Razak Doesn’t Want You To Know

- Rigged!! – Here’s How Democrats Will Cheat & Steal The Election For Hillary Clinton

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

- WikiLeaks: Soros Slammed Obama Of Trading TPP For A Racist, Extreme & Corrupt Najib

- Here’s How MO1 Can “Donate” To US – “Secretly” – To Cover His 1MDB Scandal

- Here’s Why U.S. Uses “Malaysian Official 1” To Link PM Najib To Stolen Money

- Here’s Why “President Trump” Wants To “Fire” Janet Yellen In 2018

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

- FBI & DOJ Jurisdiction Starts From Jho Low & Riza Aziz’s Money Trail To Najib

- Here’re Why Ringgit Can Go Further – RM4.50 To US$1 – And Beyond

- Ringgit Is Toast – Here’re Proof Malaysia The First Asian To Hit Recession

|

|

November 13th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply