Apple has been ordered to pay up to €13 billion (US$14.5 billion; £11 billion; RM58.8 billion) in back taxes, plus interest, to Ireland after the European antitrust regulators ruled that a special scheme hatched between Apple (stock-code: AAPL) and the Irish tax authorities to route profits through Ireland was considered illegal state aid.

The commission said Ireland’s tax arrangements with Apple between 1991 and 2015 had allowed the U.S. company to attribute sales to a “head office” that existed on paper only and could not have generated such profits. Ireland had allowed for a complicated tax arrangement for Apple Sales International to pay effective tax rate of 1% in 2003, which dropped to 0.005% in 2014.

The ruling also said the taxable profits from Apple Sales International and Apple Operations Europe, two Irish incorporated companies of the Apple group, did not matched up. Competition Commission Margrethe Vestager said – “Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years.”

The commission said it was up to Ireland to collect the tax from Apple but the Irish government wants the ruling to be reversed. Ireland Finance Minister Michael Noonan has defended his country’s position – “that the full amount of tax was paid and no state aid was provided. Ireland did not give favourable tax treatment to Apple. Ireland does not do deals with taxpayers.”

Mr. Noonan further added – “The decision leaves me with no choice but to seek cabinet approval to appeal the decision before the European courts. This is necessary to defend the integrity of our tax system; to provide tax certainty to business; and to challenge the encroachment of EU state aid rules into the sovereign member state competence of taxation.”

Eager to maintain the country’s attractiveness to foreign firms, Noonan said it was now “important that we send a strong message that Ireland remains an attractive and stable location of choice for long-term substantive investment. Apple has been in Ireland since the 1980s and employs 5,000 of people in Cork, Ireland.”

In retaliation to accusations that Apple was avoiding taxes, CEO Tim Cook has simply dismissed as “political crap”. While claiming Apple pays every tax dollar owe, Cook said it doesn’t make sense to bring profits back home to the United States because it would cost the technology giant 40% in taxes.

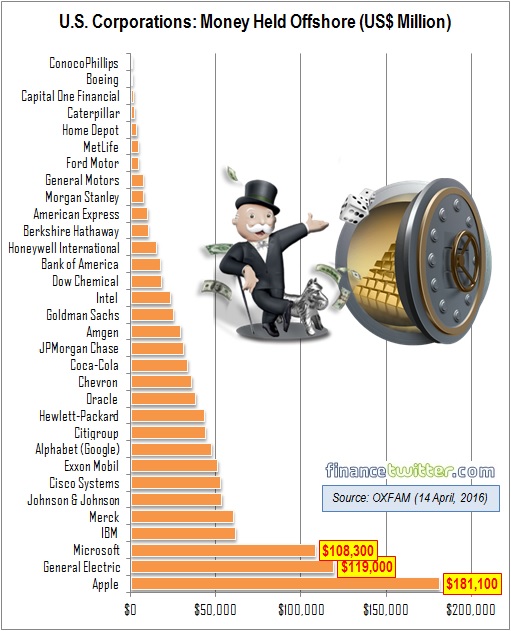

In reality, even if Apple and Ireland were to lose their appeal against the latest EU Commission ruling, the US$14.5 billion unpaid taxes is considered loose change, considering the amount is merely 6.3% of a mind-boggling US$231.5 billion cash pile it holds in foreign subsidiaries. Last year alone, Apple earned US$18 billion, more than enough to pay the back taxes.

While Apple has accused the European Commission of threatening future investment and job creation on the continent, Ireland will be forced to choose between EU and the country’s attractiveness to foreign firms. For over 20 years, Ireland’s low corporate tax rate has been the main reason 1 in every 10 workers in the country is employed by multinational companies.

The ruling could potentially be turned into a political issue as the EU could be perceived as interfering with every EU member state’s right in applying its tax rate. Although the investigation by the European Commission found the arrangements dating back to the 1990s were illegal under state aid rules, it was perfectly legal within the context of Ireland.

Provoking the Government of Ireland, however, is not the only thing the EU is challenging as it also involves the Government of the United States. Last week, the U.S. Treasury Department released a report criticizing any efforts to claw back taxes from American companies. Obviously, both EU and U.S. are fighting over the mouth watering cash piles parked by American companies.

The U.S. claimed that the European Commission did not have the right to undertake the tax clawbacks and that they could harm America’s efforts to collect taxes from domestic companies with vast international operations. Essentially, the U.S. Treasury is accusing the EU of stealing revenue from the U.S. government and its taxpayers.

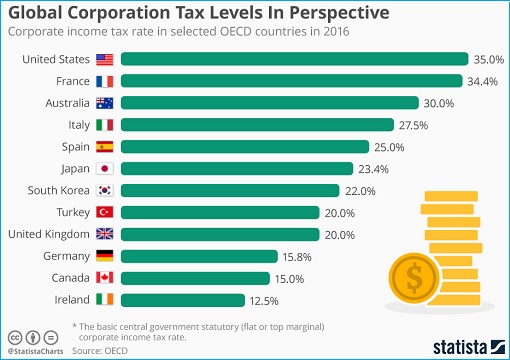

Sure, Ireland’s corporate tax rate at 12.5% is already super low, and to pay 0.005% (in 2014) is unbelievably insane. But hey, it was the Government of Ireland who willingly introduced such loopholes and deals. In fact, now that the European Commission has begun “slaughtering” billions of dollars from Apple coffer, it’s Irish government which is more anxious to stop it.

Overall, Ireland has benefited from US$277 billion (€248 billion; £211 billion; RM1.1 trillion) of US direct foreign investment in the past two decades. Based on figures from American Chamber of Commerce in Ireland, there’re a staggering 700 US companies based in Ireland, providing employment to at least 130,000 people – Intel, Dell, Google, Facebook, Pfizer, Johnson and Johnson and Boston Scientific.

Besides Apple, there’re more American cash cows such as Amazon, McDonald’s, Starbucks and others which the European Commission plans to slaughter. Like it or not, the next President of the United States – either Donald Trump or Hillary Clinton – has to introduce an attractive repatriation tax reform so that mountain of cash parked overseas can benefit U.S. instead of EU.

Other Articles That May Interest You …

- WhatsApp To Sell Your Phone No To Evil Zuckerberg – Here’s How To Stop It

- Soros Will Lose All His Money On “Put Options” If Bull Market Continues

- BREXIT!! – Here’re 7 Major Reasons Forcing British To Leave The EU

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

- Few Americans In Panama Papers – Top 50 U.S. Companies Hide US$1.4 Trillion

- Exposed – The Hidden Lives Of The Rich Kids Of Tehran

- Here’re Tax Havens To Hide Your Black Money & Plunder

|

|

August 30th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply