Planning to migrate to Canada? Cool, but before you jump into the next available flight or ship, there’re tons of factors to consider. Besides the weather, accommodation, kids’ education, employment and what not, it pays to give the taxes a little thought. Besides, didn’t Benjamin Franklin said there were only two things certain in life – death and taxes.

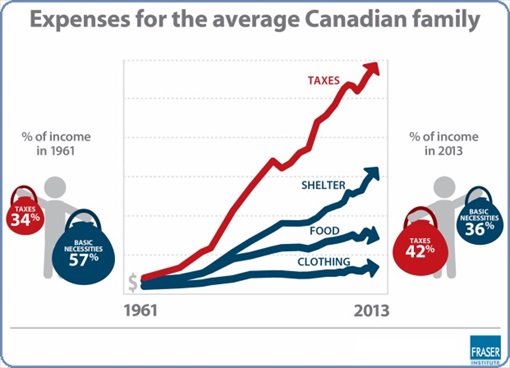

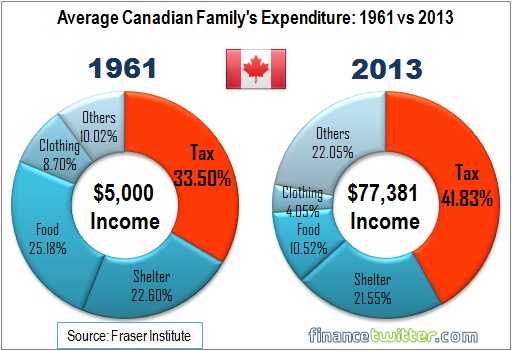

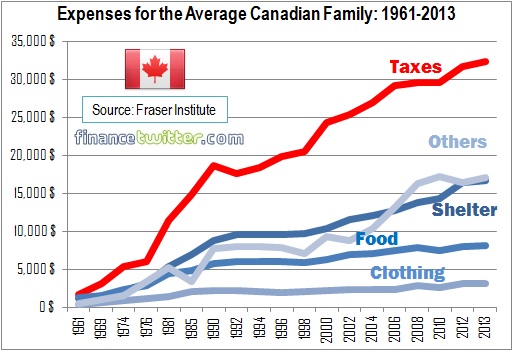

According to a latest study by Fraser Institute, the average Canadian family spends more on taxes than on food, shelter and clothing combined. Interestingly, the Canadian Consumer Tax Index, which tracks the total tax bill of the average Canadian family from 1961 to 2013, finds that the average family earned $77,381 and paid $32,369 in total taxes (or 41.83% of income) last year compared to 36.1% for food, shelter and clothing.

As comparison, the average family earned approximately $5,000 and spent 56.5% on food, shelter and clothing while $1,675 or 33.5% went to taxes – in 1961. The total tax here represents both visible and hidden taxes paid to the federal, provincial and local governments. This includes income taxes, import taxes, property taxes, payroll taxes, health taxes, fuel taxes, vehicle taxes, sales taxes, alcohol and tobacco taxes, and others.

The study also shows that the average family’s total tax bill has increased by 1,832% since 1961, dwarfing increases in shelter costs (1,375%), clothing (620%) and food (546%). On the same note, the average family’s income only increased by 1,447% since 1961. Even after accounting for changes in overall prices (inflation) over the period, the tax bill shot up 147%.

The rate in tax increase has also greatly outpaced the increase in the Consumer Price Index (682%) – which measures the average price that consumers pay for food, shelter, clothing, transportation, health and personal care, education, and other items. In short, Canadians pay 41.83% in taxes in 2013 compared to merely 33.50% in 1961 from their income.

Many Canadians were not aware of this stunning fact until this Canadian public policy think-tank released its study. If you ask Canadians, most of them still think their biggest expenditure goes to housing. In reality, they went to taxes, without the citizens even realize it. However, some people said the study was flawed because the country’s medicare started only in 1961, the same year the study uses as baseline.

Nevertheless, the report can be considered as “good” due to the fact that health-care spending was negligible – less than $100 per person in the early 1960s, 57% of which was covered by government. But by 2010, health-care spending had jumped to $5,614, of which 70% was paid for by Ottawa. Critics also pointed to the reality that with more Canadians get higher education, the increase in educational taxes contribute to the overall higher tax.

There’re good news though – all three components of shelter, food and clothing have become less expensive, relatively speaking. Canadians spent 8.7% on clothing, 25.18% on food and 22.60% on shelter in 1961; while they only spend 4.05%, 10.52% and 21.55% respectively on the same components in 2013. Canadians should also take pride that the country is a good place to do business though.

Last year, Forbes ranked Canada the best country in the world to do business, citing its dropping tax rate, sound banks, investor protection and relative lack of red tape. Canada’s total average tax rate on medium-sized domestic companies is listed as 26.9%, the U.K.’s at 35.5% and the United States at 46.7%. Still, if you think you’re paying too much taxes as a Canadian, you should ask your fellow Manitobans – they pay one of the highest tax in Canada.

Other Articles That May Interest You …

- Here’s A Guide On Cheapest & Best Time For Your Trips To 25 Popular Tourist Destinations

- Cracking 16 Digits Credit Card Numbers – What Do They Mean?

- 10 Lousy Lies Bosses Tell, That You Should Know

- 10 Companies That Control Almost Everything You Buy & Eat

- American Top-20 Best Burger That You Must Try

- How To Save Money This Year – 15 Exciting Tips

- Your Next Holiday Tip: 2013 Top-20 Islands In The World

|

|

August 13th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply