Who will become Malaysia’s next prime minister after the 15th General Election, which does not need to be held till middle of 2023, but is being vigorously pushed by the top leadership of the United Malays National Organization (UMNO)? The political party has just concluded its general assembly, but the competition for the top post has just begun, and Prime Minister Ismail Sabri is in trouble.

As the Court Cluster, in reference to several UMNO leaders facing graft charges in court, including former Prime Minister Najib Razak and UMNO president Zahid Hamidi, used the UMNO assembly to pressure the head of Minister Cluster (PM Ismail) to dissolve the Parliament for a snap election, the lame duck prime minister appears ready to surrender.

The first sign the premier, who is one of three UMNO vice presidents, has been cowed into submission was the sudden U-turn to allow Employees Provident Fund (EPF) contributors to make yet another special withdrawal. Najib and Zahid had previously demanded that the government approved the withdrawal – a populist idea to hoodwink gullible supporters, especially the Malays.

The speculations that finance minister Zafrul Abdul Aziz has resigned is believed to be linked to the weak prime minister’s decision. He has warned that EPF (KWSP) may have to sell its assets overseas if the government allows contributors another round of withdrawals from the retirement fund, which could cost RM63 billion based on 6.3 million members withdrawing RM10,000 each.

It’s now increasingly possible that Ismail Sabri may have no choice but to obediently call for an early national polls, making him the shortest serving prime minister. Even though Zahid has suggested that Ismail remains as UMNO’s PM candidate after the next election, and UMNO deputy president Mohamad Hasan becomes the next PM after the 16th General Election, most likely he was lying.

Zahid has even ruled out himself, along with his former boss Najib, as the next prime minister. However, Najib has kept quiet and never agreed with Zahid’s statement. In truth, both power-crazy Zahid and Najib wanted very much the position. The UMNO president was putting words into Sabri, Tok Mat and Najib’s mouths in order not to rock the boat before the elections.

If a snap election is held this year, not only UMNO-led Barisan Nasional coalition will easily win, the next prime minister could be either Zahid or Najib. Sure, Najib is a convict who has been sentenced to 12 years in prison. But who is going to argue with the King Sultan Abdullah if the monarch bulldozes Najib appointment as PM, arguing that his appeal is still pending the Federal Court’s verdict?

Not only both Zahid and Najib will be cleansed by the Kangaroo Court if UMNO wins the next election, the new illegitimate regime will certainly introduce new taxes to replenish the national coffers. Even if the next prime minister is Mohamad Hasan or Ismail Sabri, it doesn’t change the fact that the country has more than RM1 trillion of debts, hence new taxes are urgently required.

{ 1 } Multi-Tier EPF Dividends

When the backdoor Prime Minister Muhyiddin Yassin allowed EPF contributors to withdraw a maximum of RM500 monthly from their own retirement fund to buy essential goods in March 2020 due to Covid-19 pandemic, he has recklessly opened the floodgate that can never be closed. About 12 million members rushed to withdraw their own savings for a period of 12 months, depleting EPF of RM40 billion.

The best part was when most of the low-income members were dumb enough to be misled by Muhyiddin that he was a caring leader for allowing the withdrawals. The EPF members had no idea that not only they were emptying their own money, but was helping to boost the economy while the government sat and watched. The addiction to EPF saving continued after the i-Lestari scheme.

After “i-Lestari” Account 2 Withdrawal Scheme, the government unleashed a new scheme called “i-Sinar” Account 1 Withdrawal Scheme in December 2020, even though Finance Minister Zafrul admitted that 42% of EPF members have less than RM5,000 in Account 1. The i-Sinar allowed 8 million EPF members to withdraw up to RM60,000, emptying RM56.3 billion from EPF.

In June 2021, Muhyiddin took the easy way out again after mismanaged the economy and mishandled the Coronavirus. He irresponsibly introduced i-Citra, allowing 12.6 million EPF members to withdraw up to RM5,000 from their retirement fund, emptying another RM30 billion from EPF. The disgraced Najib hijacked the scheme, telling the government to raise the withdrawal limit to RM10,000.

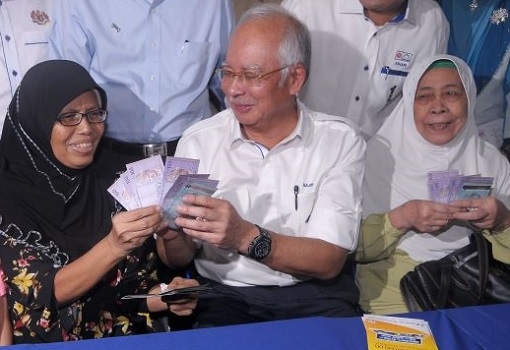

Not satisfied with i-Lestari, i-Sinar and i-Citra schemes which saw more than RM100 billion in withdrawal, Najib had even proposed that flood victims be allowed to withdraw more money from their EPF retirement fund. But how can EPF contributors recover their funds meant for retirement? Mr Najib apparently has a brilliant solution – “rob Peter to pay Paul”.

As an experienced thief who had stolen from KWAP, EPF, Tabung Haji, 1MDB, and whatnot through creative schemes, Mr Najib has proposed a restructuring plan where the lower EPF savings receive a higher dividend while the higher savings only get minimum dividends. Meaning higher income members will subsidize lower income contributors, while a new Najib government gets all the credit.

For example, instead of fairly distributing the same 6% annual dividends across the board, Peter, whose account has RM100,000 could unfairly get 3% dividend (RM3,000 instead of RM6,000). Paul, with RM10,000 in his retirement saving may get 9% (RM900 instead of RM600). Essentially, Peter gets RM3,000 less dividend, which would be used to fund 10 low income members like Paul.

The government can afford to lose 1 vote in exchange for 10 very happy voters. The restructuring of EPF dividend payout does not affect the Employees Provident Fund at all because it still pays the same amount of dividends. This may not sound like a new tax, but to the contributors with higher savings, the loss of dividend payout is similar to being “unfairly taxed”.

{ 2 } Fuel Price Float

Before Najib administration was defeated in the 2018 General Election, the fuel price at petrol stations would be adjusted or “floated” on a monthly basis according to the global crude oil prices. However, the actual formula was never known and was as secretive as the KFC’s secret recipe. What is known is the pricing was calculated using the Automatic Pricing Mechanism (APM).

Malaysia scrapped the subsidies for RON95 petrol and diesel starting December 2014, a move which then-PM Najib Razak said had saved his government billions of Ringgit. For example, when the crude oil price was US$44 a barrel, the price of RON95 was set to RM1.95 a litre. So, theoretically, the petrol price could easily fetch RM4 a litre based on US$90 a barrel.

However, during Pakatan Harapan government, petrol price for RON95 was fixed at a certain ceiling price, without which the people would suffer today as a result of Russia-Ukraine conflict, which saw crude oil hit US$130 a barrel. The return of Najib as prime minister again could see the scrapping of fuel subsidies, leading to skyrocketing petrol price.

As compensation, Najib may channel part of the “fuel tax” to lower income people as cash handout, boosting his own popularity and at the same time tricks the dumb village folks. His blind supporters will not realize that it will trigger inflation. Najib could easily blame the high petrol price on Russia, America, CIA and DAP, and his zombie-walking fans will foolishly swallow the hook, line and sinker.

{ 3 } Windfall Tax

Narcissist Najib loves to act as if he was a Robin Hood – stealing from the rich to feed the poor. He had used this trick quite successfully to promote the highly unpopular GST (goods and services tax). During the Covid-19 pandemic, he has been a strong supporter of slapping a windfall tax on profitable organizations to raise money to replenish the national coffers.

For example, he had proposed for the windfall tax on palm oil to be increased from 3% to 6% to boost the federal government’s coffers, even though palm oil growers from Sabah and Sarawak were terribly upset over the unfair doubling up of the windfall profit levy rate from 1.5% to 3% (unlike other states, Sarawak and Sabah also pay a state CPO sales tax of 5% and 7.5% respectively).

Likewise, the incompetent and corrupt UMNO government of Ismail Sabri has imposed “Prosperity Tax (Cukai Makmur)” of 33% (instead of 24%) on companies’ earnings above RM100 million in the Budget 2022. The disgusting tax regime saw RM34 billion wiped off from the stock market immediately after the Budget 2022 was unveiled.

Now, even though the Prosperity Tax was supposed to be a “one-off” thing, what is there to stop Najib or Zahid government from taking a second bite at the juicy apple? Worse, after tasting the blood, the next UMNO government could expand the tax regime to tax more companies by lowering the target bracket to those with earnings RM20 million, for example.

{ 4 } Capital Gains Tax

After UMNO lost power in 2018, Najib warned the Pakatan Harapan government that foreign and domestic investors will be driven to other markets if Capital Gains Tax (CGT) is introduced on the sale and purchase of shares. He said – “If CGT is introduced in Malaysia, foreign and domestic investors will be driven to other markets which don’t have such tax.”

Three years later (2021), the Pakatan Harapan was toppled and UMNO has returned to power as an unelected government. This time, Najib no longer moaned, whined and bitched about the danger of capital gains tax. He made a U-turn and proposed all sorts of taxes, including condominiums development tax, inheritance tax, stock market trading tax, and even higher personal income tax.

Suddenly, the UMNO government no longer fears about spooking foreign and domestic investors to other markets which don’t have such tax. Instead, the flip-flop government under Ismail Sabri said most developed countries had already implemented the CGT, and that it was time for Malaysia to embrace a progressive tax system that is more efficient.

So, when Najib and his party UMNO were in the opposition, Capital Gains Tax (CGT) was bad and dangerous. But the moment they are in the government, the same tax regime suddenly becomes the best invention since sliced bread. Anyone with investment plans – stock or unit trust – will be affected. Even if you’re just a normal salary earner, you could be forced to pay higher income tax.

{ 5 } Foreign-Sourced Income Tax

Since 1995, the income of any person derived from sources outside Malaysia and received in Malaysia has been tax-exempt. For example, a Malaysian blogger or YouTuber does not need to pay taxes on income from advertisements or sponsored posts on their contents. They earn US dollar on their foreign-sourced income, which they received and spent locally in Ringgit.

The almost-bankrupt UMNO government made the changes in the Budget 2022, requiring Malaysian residents to pay tax on their foreign-sourced income received in Malaysia at a flat rate of 3% on “gross amount” received from January 1 to June 30, 2022. Thereafter, the tax rate will follow income tax rates. However, the Ministry of Finance suddenly suspended the new tax regime – temporarily.

In order not to anger voters as pressure for a national election increases, the government has delayed the foreign-sourced income tax to December 31, 2026. Additionally, the half-baked tax regime would discourage the remittance of funds back into Malaysia because if the income tax stays overseas, it cannot be taxed. This tax should not even be introduced in the first place.

Resident individuals who remit foreign-sourced income, such as commissions, employment income or dividends actually help boost the local economy, not to mention strengthening the local currency, while the incompetent government could not provide quality jobs for them. There’s no guarantee that the useless and clueless government will not make another U-turn after the 15th General Election.

{ 6 } Congestion Tax

When comes to imposing new taxes, the corrupt Barisan Nasional is never out of idea. Calling it a sexy trend in mega cities like Singapore or London, Transport Minister Wee Ka Siong has pre-emptively told that people that congestion charges are around the corner. Also decorated as environmental fee, the minister said vehicles entering Kuala Lumpur will soon be charged.

For the time being, Mr Wee, the president of Malaysian Chinese Association (MCA), a minor component party of Barisan Nasional ruling government, said the congestion tax will be done once the public transportation network (such as the MRT 3 line) in the city is fully completed after 2030. However, it’s a fact that MRT 3 can never link all the routes in the city, made worse by unreliable and inefficient bus services.

Congestion tax has nothing to do with reducing congestion or protecting the environment, but a fast and lazy way to tax the motorists, who must enter the city because of failure to address “last-mile” connectivity issues. It will definitely provide an excuse for transportation companies raise their cost, which will be passed down to the consumers, who in turn will pay pricier goods due to inflation.

Like the RFID toll collection, the congestion tax will be awarded to yet another crony of corrupt politicians. But it’s only fair to scrap or reduce other charges like road tax or car price if the government wants to burden people with new taxes. Again, there’s no guarantee that the government will not bring forward the collection of congestion tax, or even expand it to other cities – if they win big in the next election.

{ 7 } GST (goods and services tax)

The infamous GST, which brought down the Najib administration in 2018, is almost certain to make a comeback once again if Barisan Nasional wins. After all, this is the most profitable and comprehensive tax regime bulldozed by the former prime minister. When finance minister Zafrul said last year that the Muhyiddin regime would not bring back the GST, it was due to poor timing.

Since then, Muhyiddin had been toppled and UMNO is back to the driver seat. GST brought in an average RM42.7 billion annually in 2016 and 2017 – nearly 20% of the country’s annual revenue. In comparison, the current SST (Sales and Services Tax), which was re-introduced by now-collapsed Pakatan Harapan government to replace GST, contributed RM27.9 billion in 2021.

Najib loves GST for obvious reason. The 6% GST generated so much money that even he did not know how to use it. Till today, the Royal Malaysian Customs Department is still holding some of the refunds, even though the consumption tax was cancelled nearly 4 years ago. It was exposed that Najib diverted GST revenue to other funds when it should go to the GST Trust Fund.

With an extra RM20 billion at his disposal, Najib or a new UMNO prime minister could buy more votes to stay in power. And based on the 4-million votes (primarily from ethnic Malay) received even after the 1MDB scandal and GST uproars, there is simply no reason for UMNO not to bring back the cash-cow GST again. Since the people love GST so much, perhaps Najib should raise it to 10%.

Other Articles That May Interest You …

- 3rd Time U.S. Says “No Saudi Donation” – FBI Confirms Najib Stole RM3.2 Billion, Riza RM1 Billion & Jho Low RM6 Billion

- 12 Years’ Jail & RM210 Million Fine For World’s Biggest Crook Najib – A Result Of Insulting The Judge’s Intelligence

- Zahid Finally Threatens PM Muhyiddin – It’s All About Greedy Malay Leaders Fighting Each Other For Power

- The Dirty Secrets A.G. Idrus Harun Didn’t Want People To Know When He Dropped Musa Aman’s 46 Corruption Charges

- Malay Dignity – For Lust Of Power, Muhyiddin Was Ready To Free UMNO Crooks Like Najib Back In February

- Lack Of Trust & Respect For Muhyiddin – But The Backdoor PM Can’t Hide Forever Behind Coronavirus Lockdown

- The Return Of GST – The Country’s Debt Is So Massive That Not Even Mahathir Knows How To Fix It

- From Crook To Thug – Former PM Najib Unleashed Gangsters To Beat Six University Students

- This Chart Shows How Najib Drove The Country To RM1 Trillion In Debt

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

|

|

March 22nd, 2022 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply