Australia has reported a slightly better economic growth than expected. Against Reuters’ prediction of an economic growth of 0.5% in the June quarter, the Aussie recorded 0.7%. It’s lower than 1.9% increase in the first 3 months of the year. However, Australian Bureau of Statistics (ABS) admitted the latest figures do not provide the full picture of the economy of Australia.

And it’s not hard to understand why it’s too early to celebrate. The country is still struggling from Covid and China factors. Dr Sarah Hunter, BIS Oxford Economics chief economist, said the data was inherently backward-looking – “Economic activity has clearly been severely disrupted, and it is likely that the national economy will contract by around 3% in the September quarter as a result.”

She was, of course, referring to the ongoing lockdowns. Sydney is now in its 11th week of lockdown, not to mention Melbourne and national capital Canberra are also under stay-at-home orders as authorities struggle to contain an outbreak of the Delta variant. Even if the current vaccination rollout continued at its current pace, the eastern states will begin to re-open only in the December quarter.

The state of Victoria, where Melbourne, the country’s second-largest city is located, has hinted that restrictions will be extended. Meanwhile, New South Wales plans to stay shut through all of September – and likely into October. This means the September quarter will definitely look bad. Even though the annual economic growth is 9.6%, the number is misleading.

That’s because Australia actually suffered a record 7% contraction last year in its first round of pandemic lockdowns. Therefore, the net growth is only 2.6%. In fact, if September quarter is negative, chances are it would be the same for the rest of the year. But the biggest problem is the fact that it was strong export prices for mining commodities that drove the June quarter rise.

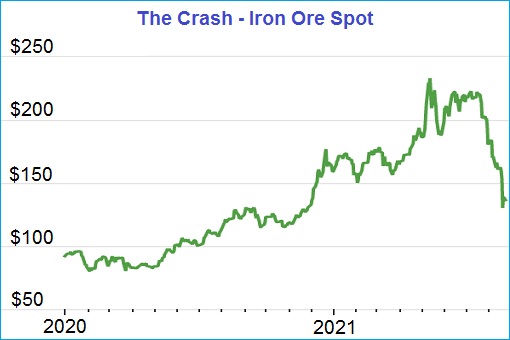

The Australian Bureau of Statistics (ABS) said the export of mining commodities was so critical that it contributed to a 3.2% increase in nominal GDP. However, iron ore, the hottest commodity that has been firing the country’s economy is flaming out. The price of iron ore has fallen about 40% since mid-July on concerns about demand from China.

When the Chinese government started its crusade to punish the Australian government for parroting the U.S. in its call for an inquiry to determine the origins of Covid-19, some said the trade war against Aussie was a wrong strategy and won’t work. They argued that China’s reliance on Australian iron ore was a “strategic weakness” as it did not have any viable alternatives.

Analysts and economists laughed because while Beijing’s trade sanctions on Australian products including beef, wine, barley and lobsters have hurt exporters, surging iron ore prices has more than made up the difference. They said the Chinese government was extremely dumb for giving away billions of free cash to Australia just on export of iron ore alone.

Indeed, in the first five months of the year, China snapped up 444.9 million tonnes of iron ore. The total value of Australian exports to China rose in the first quarter of 2021, largely due to high iron ore price. Despite all the tough talks, Prime Minister Scott Morrison was unwilling to take the one drastic action – boycott iron ore exports to China – because Australia prefers cash than retaliation.

But China was quietly stockpiling the critical resource, as well as diversifying to the Brazilian’s iron ore. Iron ore has remained the most significant Australian export untouched by trade sanctions as the Chinese economy gobbles up the commodity. Iron ore is critical to make steel, a key component of China’s construction stimulus-driven economic recovery.

Then the crash came – fast and furious. From a record high of US$237.57 (A$325) a tonne, iron ore’s price fell to below $US130 (A$176) – a whopping 45% plunge. The speed and quantum of the price drop have taken many analysts and economists by surprise. Conveniently, they blamed on the Chinese slowing economy as the reason for the shocking price correction.

With China accounting for up to 75% of the world’s iron ore imports, Australia’s most valuable export commodity has been hit hard. Australia’s iron ore export constituted 66% of China’s total import. Last financial year, Australia made a record breaking A$149 billion from iron ore exports alone thanks to skyrocketing prices, up from A$63 billion in 2018-2019.

For every US$10 a tonne decrease in the iron ore price relative to the budget forecast this financial year, Australia’s nominal GDP and federal government tax incomes is expected to fall A$6.5 billion and A$1.3 billion respectively. It means the price drop of US$100 a tonne would translate to A$65 billion fall in the Aussie’s nominal GDP and A$13 billion loss in taxes.

In truth, the surge in the price of the commodity was largely due to speculation. To kill the Australian “cash cow”, not only Beijing has stepped up efforts in recent months to limit steel production and exports, which led to lower iron ore prices and reduced demand in the second quarter, but also has been preparing to exterminate “speculation”.

As early as May, China already warned about excessive speculation and hoarding. The next month (June), all hell broke loose when Beijing finally made good on its promise to fight speculation by releasing industrial metals from its national reserves to curb commodity prices. The National Food and Strategic Reserves Administration said it would release batches of metals.

While no one knows how much China has in its reserves of industrial metals, analysts think the country could have stockpiled 2-million tonnes of copper, 700,000 tonnes of zinc and 1.5-million tonnes of aluminium. It was the first publicly announced release of copper from China’s state stockpiles since 2005, and the first time reserves of aluminium and zinc were being sold since 2010.

And it’s unknown how much iron ore in its reserve. Still, some analysts and speculators were betting that it could be just a psychology war to bring down the commodity price, without any real intention to release significant amounts of metal into the market. But the announcement that Beijing will start to “periodically” release reserves of metals were enough to kill commodities, including the high iron-ore price.

It was by design rather than coincidence that iron ore saw its price bust right after China declared a war against insane prices of commodities, but not before it stockpiling Australian iron ore to the brim. It was a big deal because iron ore is the world’s second-most-traded commodity after crude oil. To make it more dramatic, China said it is on a mission to cut carbon emissions.

China’s steel sector accounts for about 15% of the country’s carbon footprint, hence the policy to keep the country’s steel production in 2021 at 2020 levels in order to reduce emissions has added more pressure to the price of iron ore. The expectation that China’s steel output will shrink is fueling the fall of iron ore prices. But was Beijing bluffing?

In July, China’s crude steel output contracted 8.4% a year, indicating that output cuts are not just empty talking, but is happening. Coincidentally, July was also the month that China’s iron ore imports declined for the fourth consecutive month. China’s property and infrastructure sectors – account for 20-25% and 25-30% of China’s steel demand respectively – have also seen weakness.

It was silly of Australia to think China’s steel demand will keep rising forever, let alone thinking the Chinese government will allow itself to be held hostage over the supply of Aussie iron ore. With the Winter Olympics scheduled to kick off in February 2022 in China, there are fears this could also cause substantial drops in demand for iron ore.

Other Articles That May Interest You …

- Not Giving Up! – Australia Wine Still Trying To Access China, Through “Backdoor Entry” And Local Partnership

- Commodities Crash – How China Releases Metal Reserves To Tackle High Prices And Shortage

- Australia’s Wine Export To China Crash 96% – Only $9 Million Sold As Tariffs Wipe Out Aussie’s Biggest Export Market

- Australia’s $1 Billion Wine Industry In Trouble – China Officially Slaps 218.4% Import Duties For 5 Years Effective Sunday

- Australia’s Treasury Wine Forced To Sell Brands & Assets – Profit Suffers 43% Drop After China’s Tariffs Punishment

- China Will Import Coal From Any Country, Except Australia – PM Morrison Upset Over Impact On The A$14 Billion Industry

- Australia’s Economy Being Hit Again – China Bans Wheat, Lobster, Barley, Sugar, Wine, Timber, Coal, Copper

- China Punish Australia Again – Recession-Hit Aussie Saw Its A$2 Billion Cotton Industry Targeted

- Australia Upset! – China Now Uses “Asian Discrimination” To Target Aussie’s A$38 Billion Education Industry

- Coronavirus Inquiry Backfired On Aussie – China Slaps Tariffs, Warns It Has The Power To Hurt Australia Economy

- Lawsuits For Trillions Of Dollars Against China Over Spread Of Coronavirus – Here’s Why It’s A Waste Of Time

|

|

September 1st, 2021 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply