Donald Trump has lost his re-election – for real. And he has no one to blame but himself. His messages to the voters – a great economy and an untrustworthy Biden – didn’t work. He had tried to blame the Covid outbreak squarely on China. But the election results clearly showed that while very few blames him for the pandemic, many were not impressed about how he has handled it.

It’s game over and he knew it. But the man who become the first incumbent president to lose since George H.W. Bush in 1992 has to keep whining, moaning and bitching to save face. Besides failing to recognize the urgent needs to contain the pandemic at its early stage, his divisive approach to governing the country had made moderate voters leave him in droves.

To be fair, Trump did very well in driving up the stock market under the Tax Cuts and Jobs Act. The country was enjoying low unemployment too. There was no major financial crisis, unlike the 2008 Great Recession faced by the Obama administration. In fact, Trump was very lucky because all the stars seemed to be aligned for him – until he played down the virus, and turned it into a disaster.

Some Trump hardcore supporters may still believe his rhetoric that he has won and will continue his second term in the Oval Office. But after the Trump administration finally ended a 16-day of stalemate and denials – reluctantly announced its intention to begin the transition process with President-elect Joe Biden, the writing is on the wall that Trump is ready to pack and leave.

On Tuesday, the White House officially granted the much anticipated approval to give Mr. Biden the president’s daily intelligence briefing – a standard protocol. On the same day, Pennsylvania and Nevada certified their 2020 general election results, formally awarding a combined 26 electoral votes from the two crucial states to Biden – sealing the fate of Trump.

Similarly, after criticisms from even Republicans for delaying tactics, General Services Administration (G.S.A) chief Emily Murphy announced that her agency would formally provide federal resources – including US$6 million in funds – for Mr. Biden to begin a transfer of power. This is an apparent recognition that Joseph R. Biden Jr. is the winner of the presidential election.

Even though the narcissist Trump rhetorically stressed that he hadn’t conceded the election, the fact that he authorized his own administration to cooperate with Biden’s transition team proves that the president has actually admitted defeat. And the U.S. stocks immediately hit the roof on Tuesday to celebrate the official transition to a Biden administration.

For the first time in history, the DJIA (Dow Jones Industrial Average) skyrockets above 30,000 points. The Dow jumped 454.97 points to a record high of 30,046.24 over the news that Trump’s exit would remove the uncertainty about a smooth transition. The bullish stock market means that it’s business as usual – even after the humiliating defeat of Trump.

Trump, who often trumpets and associates stock market bulls with his Midas touch, has repeatedly told his supporters that if Biden won the election, the stock market would crash. Instead, the stocks celebrated Biden’s victory and Trump’s defeat on Tuesday. Still, Trump probably thought he could still claim credit, without realizing he was shooting his own foot.

The president briefly made his appearance in the James Brady Press Briefing Room at the White House on Tuesday (Nov 24) and said – “The stock market, Dow Jones Industrial Average just hit 30,000, which is the highest in history. I just want to congratulate all the people within the administration that worked so hard, and most importantly, I want to congratulate the people of our country.”

Did President Trump realize the Dow Jones had shot above 30,000 despite his defeat in the election? The stock market was celebrating the good news of vaccines being produced by Pfizer-BioNTech, Moderna and AstraZeneca-Oxford, as well as a formal transition to a Biden administration. For Trump to congratulate his administration is like acknowledging the stock markets were celebrating his own exit.

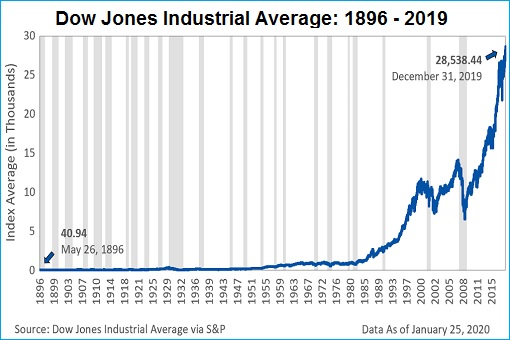

The Dow index, which first began tracking the stock performance of 30 large and powerful companies listed on stock exchanges in the United States in 1896, has gone through a period that saw 22 presidents, 24 recessions, a Great Depression and two global pandemics (the 1918 Spanish flu and 2020 Covid-19). Essentially, it took the DJIA nearly 125 years to hit the 30,000 milestone.

On the first day of the Dow index, it closed at only 40.94 points on May 26, 1896. The index first crossed its triple digits in January 1906, about 10 years later. Back then, the Federal Reserve had yet to exist. During the 1929 Great Depression, the Dow crashed 38 points on Oct 28, which may not sound a lot, but the plunge actually represented 13% of the DJIA index.

The Dow would take decades to hit the 1,000 milestone – in 1972. During the Dot-Com Bull Run in 1999, the index finally hit the 10,000 marks, only to see the bubble burst and plunged 30% by September 2001. The 2008 subprime crisis that triggered the Great Recession saw the Dow astonishingly bottom out at 6,547 points on March 9, 2009 – losing half of its value in less than a year.

It never looked back as the U.S. economy recovered from the Great Recession, hitting 15,000 points on May 7, 2013. It was the best full-year performance of the bull market that year – registering a whopping 26.5% gain. But it was just the beginning. Very few had predicted, let alone believed, that the Dow index would double in less than 10 years later.

Interestingly, the blue chip index would take 120 years to breach the 20,000 mark for the first time on Jan 25, 2017, just days after Donald Trump occupied the Oval Office on Jan 20, 2017. Coincidentally, the same Dow Jones Industrial Average hit the 30,000 mark for the first time on Nov 24, 2020 after it was official that the same U.S. president would leave the office.

Other Articles That May Interest You …

- AstraZeneca-Oxford Vaccine Shows 62% To 90% Effectiveness – Here’s Why This Could Be The Best Bet For Everyone

- If You Can’t Beat Him, Create Trouble For Him – Trump Ramps Up More Anti-China Chaos To Sabotage Biden

- Trump Dumped, Biden Elected – Don’t Write Off The Man Who Won 70 Million Votes, Trump Could Come Back In 2024

- Biden 264 VS Trump 214 – On The Brink Of Losing, President Trump Filed Lawsuits Claiming Fraud & Irregularities

- A Win For Biden Could “Reset” China-U.S. Relations – But China Is Well Prepared For Any Eventuality

- Economic Inequality Could Break Trump As His Election Campaign Spends $800 Million Without Much Effect

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- Despite Trade War And Anti-Chinese Rhetoric, China Wants President Trump To Get Reelected In 2020 – Here’s Why

- Trump Impeachment! – But Here’s Why It’s Incredibly Difficult To Fire The U.S. President

- Go Back To Africa!! – Trump’s Racist Remarks At 4 Congresswomen Set Tongues Wagging

|

|

November 25th, 2020 by financetwitter

|

|

|

|

|

|

|

Doesn’t matter if Trump cannot take credit for much, he will be remembered for his advice to drink bleach for Covid-19.