Alibaba has set another new sales record for this year’s annual “Singles Day” shopping spree. The Singles Day, first started in China as a 24-hour shopping event that celebrates people who are not in relationships, has been such a massive success that it makes Black Friday and Cyber Monday in the United States look like a child’s play.

In 2013, sales on Alibaba’s sites, Tmall and Taobao, were only US$5.8 billion. By 2019, the Chinese e-commerce giant set a sales record of 268.4 billion Yuan (US$38.4 billion), surpassing 2018’s US$30.5 billion sales. But Alibaba was not the only winner. Competitors like JD.com and Pinduoduo were offering their own discounts on 11.11 (Double 11).

But this year, retailers JD.com and Alibaba have extended the shopping event, running from November 1 and will end at midnight on November 12. Alibaba, adopting U.S. retailers’ strategy, started its early discount days between Nov 1-3 that included American brands like Apple, Nike and Adidas. In only 1 minutes, consumers snapped US$15 million worth of Nike’s products.

Both Alibaba and JD.com revealed that the U.S. was the top foreign seller in China during the Singles’ Day shopping extravaganza. With more than 250,000 brands, 16 million discounted products and 800 million consumers spending like crazy in the world’s largest shopping event, this year also marks the first year Alibaba held its sale over 4 days, rather than its traditional one-day event on Nov 11.

As of 12:30 a.m. Beijing time on 11.11, Alibaba’s sales already reached 372.3 billion Yuan (US$56.42 billion). Astonishingly, the company said at its peak the order rate hit a record 583,000 orders per second. JD.com, which started its promotions on Nov 1, recorded 200 billion Yuan (US$30.18 billion) worth of sales within 9 minutes of midnight on 11.11.

Unlike last year where Alibaba named the U.S. and Japan as its biggest sellers, this year saw the revelation of other top-selling countries like Australia, Germany and South Korea. L’Oreal, Lancome and Sharp were some of the best-selling products. The sale was so crazy that over 470 companies exceeded 100 million Yuan (US$15 billion) in gross merchandise volume (GMV).

Combined, Alibaba’s 498.2 billion Yuan (US$75.27 billion) and JD.com’s 271.5 billion Yuan (US$40.96) of the sale saw this year’s Singles’ Day shopping spree generating a jaw-dropping US$116 billion in sale. The annual shopping festival is closely watched as a barometer for consumption in China and so far, it appears that the Coronavirus pandemic has helped, not spoiled, the shopping event.

Alibaba Group Vice President Liu Bo said – “Because of Covid-19, many Chinese cannot go overseas. This actually stimulates online consumption.” The revenge spending in the world’s second largest economy saw how 3 million workers and 4,000 planes and cargo ships being engaged in logistic and delivery nightmare for the China’s Singles’ Day.

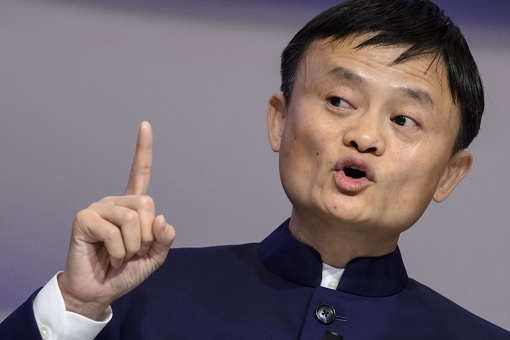

Yet, despite soaring sales, e-commerce giants Alibaba and JD.com have other problems to worry. Alibaba’s stock price in the Hong Kong Stock Exchange dropped 10% on Wednesday (Nov 11), while it’s U.S.-listed shares down more than 8% a day earlier on Tuesday – losing US$60 billion in market capitalization in just one day. But billionaire Jack Ma’s company was not alone.

Similarly, JD.com’s U.S. shares closed over 5% lower on Tuesday, while its Hong Kong stock fell 9.2% on Wednesday. Meanwhile, Tencent, the Chinese giant that monopolises online gaming, online music, and social network dropped 7.9%. Smartphone maker Xiaomi’s stock price tumbled 8.18%. In 2 days alone, US$280 billion in market values was wiped off from the five tech heavyweights.

Yes, the Chinese government has finally come with the big stick as it proposed new antitrust regulations. For the first time, the regulatory body – State Administration for Market Regulation (SAMR) – unveiled on Tuesday the draft rules that define the scope of anti-competitive behaviour that includes pricing, payment methods, use of data to target shoppers.

Coincidentally, the anti-monopoly measures announcement by SAMR came about a week after financial technology giant Ant Group’s highly-anticipated IPO (initial public offering) in Shanghai and Hong Kong was abruptly suspended following a meeting between the company’s billionaire founder Jack Ma and top executives with Chinese financial regulators.

Some think the dramatic suspension of Ant Group, which could add another US$37 billion to Jack Ma’s empire, was due to the billionaire’s “big mouth”. Making critical comments about China’s financial regulator, he said – “Today’s financial system is the legacy of the Industrial Age. We must set up a new one for the next generation and young people. We must reform the current system.”

It may be true that the China’s Communist Party has shown Jack Ma who’s the real boss after he lectured Beijing how to run the country’s financial system. The government could be offended over his arrogance, and wanted to teach the billionaire a lesson that he is not untouchable. The listing of Ant Group, valued at US$316 billion, would make Jack Ma a very powerful man.

Beijing realized that the ambitious Mr Ma, who once told his colleagues that his mobile and online payment platform – Alipay – would someday become China’s biggest bank, has become increasingly dangerous when he crossed the red line. Condemning the government and flexing his muscle in the financial sector after dominating the e-commerce is the secret recipe for disaster.

When Jack Ma criticized China’s regulators on October 24, accusing the mostly state-owned banks of having a “pawnshop mentality” that requires collateral and guarantees to extend credit, he was seen as openly challenging Beijing. It’s feared that Ant Group’s business model would not only disrupt and destroy the financial system, but also the emergence of a man who cannot be controlled.

The Chinese government may sound authoritarian, but it’s also true that Ant Group, the successor of Alipay, controls the data of over 700 million monthly active users along with 80 million merchants. This is something like how Donald Trump fought back when Amazon boss Jeff Bezos bought The Washington Post for US$250 million and used the news media to attack the U.S. president.

In actuality, it’s not yesterday that China realized Jack Ma’s financial-technology empire has become too huge to control. In 2018, the vice governor of China’s central bank warned that some influential payment institutions should not think of themselves as

In 2017, Ant Financial Services Group handled US$8.8 trillion transactions, more than MasterCard’s US$5.2 trillion. By 2019, it managed some US$17 trillion in payments. When the company kicked off a campaign to promote a “cashless society” – even allowing customers to stash Alipay money in an online money-market fund to earn income – the China’s central bank knew Ant Group was a threat.

Alibaba, which owns a roughly 33% stake in Ant Group, is also ruthless in the already fiercely competitive environment in e-commerce. With tons of money, Alibaba often subsidizes its promotional activities. JD.com also used the same tactic. To have an idea how competitive the market is, even player like Pinduoduo splashed 10 billion Yuan last year in the form of coupons to subsidize customers.

To counter the rise of Pinduoduo who offers rock-bottom prices to tier-3 consumers, both Alibaba and JD.com have launched rival apps. While JD.com rolled out a group-buying app “Jingxi” to target consumers in China’s lower-tier cities, Alibaba has its own app called Taobao Tejia (means Taobao Discounts), which offers massive discounts on products almost the entire year.

Tencent’s popular messaging app WeChat, which has over 1.15 billion monthly active users, along with Alibaba and Ant, commanded a combined market capitalization of nearly US$2 trillion before Beijing unveiled regulations to curb the practice of monopoly in the internet industry. Jack Ma’s toxic remarks finally forced China to step up efforts to control some of China’s powerful companies.

Other Articles That May Interest You …

- Move Over Jack Ma – Meet China’s New Richest Man, Who Made His Fortune Selling Bottled Water

- Meet Eric Yuan & His Inspiring Story – The CEO & Founder Of Zoom Who Got $6.6 Billion Richer In Just 24 Hours

- Fake News Blogger Raja Petra “Kowtow” To Billionaire Jack Ma – Removes Article After Lawsuit Threat

- Jack Ma’s Financial Ant Has Become Too Big – Chinese Banks & Government Aren’t Impressed

- Jack Ma Lectures American Businessmen – “Stop Whining & Bitching About China”

- Robert Kuok – How Chinese Become Amazing Economic Ants Despite Poverty & Discrimination

- Beijing Sends Jack Ma To Befriends Donald Trump, Offering 1-Million Jobs

- Alibaba New Discovery – Women With Bigger Boobs Spend More

- Alibaba Jack Ma Raising Money Via IPO, But This Guy’s Raising Money Via Girlfriend Rental

|

|

November 12th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply