Former premier Najib Razak and former Treasury secretary-general Mohd Irwan Serigar Abdullah were jointly charged with six counts of Criminal Breach of Trust (CBT) involving government funds worth RM6.6 billion yesterday. They were alleged to have committed the offences between Dec 2016 and Dec 2017. Interestingly, both individuals, including their lawyers, think the charges were amusing.

Najib, already facing 32 charges previously including CBT, money laundering and abuse of power, claims that the charges don’t make sense. Proclaiming that “his conscience is clear”, he said – “Don’t assume that the money has disappeared. It has not. Whatever we did, we can prove in court that it was done with the interest of the country in mind, God willing.”

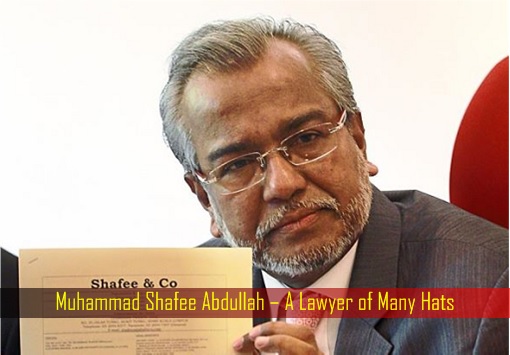

Mr. Najib’s so-called hot-shot lawyer, Muhammad Shafee Abdullah, told all and sundry that his team was absolutely happy because the charges are absurd. Well, if the charges are indeed jaw-dropping and incredibly absurd, then Mr. Shafee should not have any issue defending his client. So, why was there a need for Najib to proclaim his conscience being clear just to make a point?

The first two charges against Najib and Serigar, concerning RM 1.2 billion and RM655 million respectively, involved land acquisitions for two projects. The third charge involved a RM220 million allocation for administration expenses meant for the Kuala Lumpur International Airport (KLIA). The fourth charge involved a RM1.3 billion allocation for subsidy and cash aids (BR1M).

The fifth and sixth charges, involving 1.95 billion Yuan (RM1.261 billion) and RM2 billion respectively, involved Chinese companies. The third to sixth charges were related to a payment to IPIC (Abu Dhabi’s International Petroleum Investment Co). However, “hot shot” lawyer Shafee claims there was no personal benefit involved in this context.

Shafee said the first two charges are “wholly unfounded” and in fact – foolish – as the allegations merely involved a “reprioritisation” of the funds. The decisions undertaken by Najib and Irwan “was for the good of the nation” – claimed Najib’s lawyer. The attorney arrogantly declares – “We’ll have fun and the prosecution will have nightmares.”

Misappropriation – that’s the word to describe what the crooks Najib and Serigar had committed. So, which part of “misappropriation” that hot-shot lawyer Shafee doesn’t understand? Another word for misappropriation is embezzlement. If Najib and his crooked lawyer still don’t like the words, how about stealing, thieving or pilfering?

It was like a finance director of a company who had stolen money decided to borrow money from loan shark using the company as guarantor. He wanted to buy himself a Lamborghini and to satisfy his wife’s desire for Hermes Birkin handbags. Unable to pay back the loans, the crook started to divert funds from the company – from selling furniture to diverting department allocations – in order to pay the loan shark.

Yes, Mr. Shafee and Mr. Najib told only half of the story to gullible and ignorant supporters. Based on their logic, the finance director was merely involved in “reprioritisation” of the funds. The decisions undertaken by the director “was for the good of the company”, without which thugs would be sent by the loan shark. The director’s “clear conscience” had prevented the company from defaulting.

Like the story above, Najib and his lawyer deliberately hide the part about the reason why the ex-prime minister had to divert or reprioritize the national funds in the first place. Of course Najib Razak and Irwan Serigar did not pocket a sen from the RM6.636 billion because that money was already stolen or siphoned “BEFORE” the so-called “reprioritisation” exercise kicks in.

Long story short, Najib and Serigar got themselves into the wrong side of the law when they deliberately and creatively diverted RM1.2 billion (from Chinese companies in ECRL and SSER projects), RM220 million (from KLIA fund), RM1.3 billion (from B1M fund) and RM2 billion (from Bank Negara or Central Bank’s sale of land) to pay one party – IPIC (RM4.78 billion).

IPIC (Abu Dhabi’s International Petroleum Investment Co) was the loan shark (analogically speaking) that Najib had borrowed money from to cover up his 1MDB debts, the sovereign fund from which he and his band of crooks had plundered earlier on. But how did Najib get himself involved with the loan shark?

Mr. Najib’s “Ponzi Scheme“, disguised under 1MDB (1Malaysia Development Berhad), had accumulated debt of more than RM50 billion by 2016 when the scheme was discovered and exposed. Abu Dhabi was approached to bailout 1MDB. In return for unspecified amount of assets from 1MDB, IPIC agreed to lend US$1 billion to 1MDB and assume payments on US$3.5 billion of the Malaysian fund’s debt.

It was believed that one of the assets sought by Abu Dhabi in the debt-for-asset-swap exercise was Bandar Malaysia. To the Arab’s horror, Mr. Najib had “secretly sold off Bandar Malaysia” to somebody else – China. Bandar Malaysia essentially became “Bandar China” via a sale of 16-plots of extremely valuable Sg. Besi land to China Railway Engineering Corporation (CREC).

That’s right, not only Najib was a thief, he was also a conman. Abu Dhabi was furious for being treated like a sucker and demanded its money back. The Kingdom of U.A.E. hadn’t a clue that they would be scammed by fellow Muslim brother Najib Razak. IPIC claimed 1MDB and Malaysia’s Ministry of Finance (of which PM Najib was the minister) failed to perform their contractual obligations under the bailout deal.

1MDB refused to pay and after IPIC took the dispute to arbitration in London, 1MDB said it was “confident in its legal position” and had even submitted a “robust” response through legal counsel. Najib administration had even bravely screamed at IPIC – “See You in Court!!” 1MDB only agreed to pay back the Abu Dhabi’s US$80 billion sovereign-wealth fund after it had lost its case in a London court.

The man who dragged Abu Dhabi into the 1MDB scandal was none other than Khadem Al Qubaisi, former managing director of IPIC. He was working with Jho Low (Low Taek Jho), whom in turn was Najib’s partner-in-crime. 1MDB claimed to have been paid to the IPIC or its subsidiaries a whopping US$3.51 billion, but Abu Dhabi said they had received none.

As a result, 1MDB has to pay IPIC the US$3.51 billion all over again, after claiming they had already paid the money. Najib administration, of course, failed and refused to explain what happened to the US$3.51 billion that had already been paid. As it turned out, 1MDB had paid US$3.51 to Aabar Investments PJS Limited (Aabar BVI) – a fake subsidiary of IPIC (the real subsidiary is Aabar Investments PJS (Aabar)).

One does not need to be a rocket scientist to guess where had the US$3.51 billion gone. The charges against Najib and Serigar were just the beginning. In April 2017, Second Finance Minister Johari Abdul Ghani revealed the existence of a letter confirming that Aabar Investments PJS Ltd (BVI), or Aabar BVI, was a subsidiary of IPIC even though the Abu Dhabi state-owned firm has denied it.

Interestingly, 1MDB former president and chief executive officer Arul Kanda Kandasamy had testified to both the auditor-general and the Public Accounts Committee that the state fund had already paid US$1.367 billion in collateral deposits in 2012, US$993 million in options termination compensation in 2014, and an additional US$1.15 billion in “top-up security deposits”, also in 2014, to the IPIC’s “fake” subsidiary.

Arul “Anaconda” Kanda Kandasamy was the same snake oil salesman who had been running around telling all and sundry that 1MDB was in good health. As far back as 2015, Mr. Arul had lied about the cash in the state investment firm’s BSI Singapore bank account. He updated the 1MDB Board that the balance of US$939,874,085 had been redeemed and had been held as “cash”since 31st December 2014.

In reality, not only was there no “CASH”, but documents supplied by 1MDB relating to its Brazen Sky Limited (BSI) account in Singapore were false bank statements. After exposed by Sarawak Report, Arul Kanda, with his pants down, made a series of retractions before clarified that the assets held by BSI were in the form of “units” instead of “cash”.

After Najib Razak and Mohd Irwan Serigar “Serigala” Abdullah, the next lucky guy to be arrested and charged for the same CBT involving government funds will be none other than Arul “Anaconda” Kanda Kandasamy. If Mr. Serigar was guilty of running red light, Mr. Arul is definitely guilty of speeding, not wearing seat belt, driving a stolen car, using mobile while driving and whatnot.

Other Articles That May Interest You …

- Najib’s Hotshot Lawyer Shafee In Hot Soup – Here’s Why His RM9.5 Million Could Land Him In Jail

- Khazanah Board Mass Resignation – The Secret Operations & Hanky-Panky Deals In The Boardroom

- Taxpayers’ Money Secretly Used To Bailout 1MDB – Here’s Why Snake Oil Salesman Arul Should Be Jailed

- The Dragon Has Landed – China Kick-Off Defence Triangle Via ECRL Malaysia

- No Deal For Bad Deal – Here’s Why China Pulls Plug On Bandar Malaysia

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

- Najib’s Twin Scandals – It’s Not Over Yet, It’s Just The Beginning

- PM Najib’s Exit – Here’re His Cronies & Stocks You Should Avoid

|

|

October 26th, 2018 by financetwitter

|

|

|

|

|

|

|

Actually, he did not commit any of the crimes described. His crime is one of greed. He thought he could come in and get Najib and Co out of trouble for a big sum of money so he can retire in some peaceful country where no one knows him. He knew his reputation would be shit and he would become unemployable after that.

Too bad it did not work out the way he wanted and now he has to face jail for lying to save Najib and Co for crimes he himself did not commit. He took the risk and went in with his eyes open. He has to take the consequences now.