Time will tell if President Donald Trump’s first declaration of trade war is a smart or dumb move. It could be both, after he signed a pair of trade actions imposing steep tariffs on washing machines and solar panels. The move was, of course, to get his message out, that the taxes on imports “demonstrate to the world that the United States won’t be taken advantage of any more.”

Trump wanted to send a message that unlike his predecessors, he finally manages to make fair trade. On top of that, he also wanted to send a message that he’s a fair guy, not a bully. Therefore, the punishment was designed to prevent his administration from being accused of specifically targeting China only. And that’s why Trump imposes tariffs on both solar panels and washing machines.

China probably has anticipated the tariff on its solar panels export to the U.S. But South Korea – a strong ally of the U.S. – was caught in surprise with the slap of tariff on two of its washing machines’ brands – LG and Samsung. Samsung and LG both protested the tariffs on washing machines while China has raised very little noise that it should have.

South Korea said it will complain to the World Trade Organization (WTO) about the U.S.’ tariff punishment, calling the decision is “excessive” and “regrettable”. South Korea’s trade minister Kim Hyun-chong said – “It is clear that the latest safeguard measures would violate the WTO rules. We will actively respond to protectionist measures.”

Effectively, a 20% tariff on the first 1.2 million imported large residential washing machines in the first year and a 50% tariff on additional machines will be imposed. U.S.-based appliance manufacturer Whirlpool, however, lauded the move and has already added 200 new full-time positions. Whirlpool Chairman Jeff Fettig said – “This is a victory for American workers and consumers alike.”

But not all Americans are happy with the tariffs imposed by the Trump administration, which also saw a 30% tariff slapped on Chinese solar panels. Goldman Sachs analysts forecast that the cost per washing machine could rise by anywhere from 8% to 20% in the first year, depending on how much of the tax is passed on to U.S. consumers.

Because the tariff also includes a tax on machine parts, it could drive some costs higher for domestic manufacturers as well, not necessarily LG and Samsung brands alone. The U.S. imports a whopping 3.4 million washing machines every year, with both South Korea manufacturers gobbling the giant share – 33% of the domestic market share.

On the other hand, the 4 years tariffs on solar will see imported solar modules and cells starts at 30% in the first year, declines to 25% in the second, 20% in the third and ends at 15% in the fourth. Chinese manufacturers such as JinkoSolar Holding Co. and JA Solar Holdings Co. are among the big losers. But the Chinese companies aren’t the only losers here.

U.S. rooftop solar installers and renewable energy developers are the losers too. U.S. trade group Solar Energy Industries Association has projected 23,000 job losses this year in a sector that employed 260,000 and warned that the tariffs would delay or eliminate billions of dollars of investments in the sector. According to Bloomberg, the costs of large solar farms may rise by less than 10%.

Trump’s agenda is to force Chinese companies such as solar panel makers Longi Green Energy Technology Co. and JinkoSolar to invest in America and in the process, creates jobs. But analysts are already questioning whether 4 years of tariffs are enough to encourage investments. After all, factories built by solar companies are increasingly automated.

Gordon Johnson, a New York-based analyst at the Vertical Group, said – “Are you going to spend millions of dollars over the next few years for four years of tariffs?” Hugh Bromley, an analyst of Bloomberg, agreed – “A tariff lasting only 4 years and ratcheting down quickly is unlikely to attract any manufacturing investment that was not going to occur anyway.”

More importantly, U.S. manufacturers aren’t the leader in the solar sector to begin with. While Bell Labs in the U.S. invented the modern photovoltaic cell in the 1950s, China’s government support for solar manufacturers in the middle of the last decade with cheap loans from state-controlled banks is now bearing fruits.

![]()

Dominating the world’s solar industry, China has by far the most production capacity for crystalline silicon PV modules. In fact, China has itself become the biggest market for solar panels, dwarfing all other markets combined. As the Chinese are fighting pollution internally, the domestic market demand accounted for 54% of total installations last year.

Leading panel exporters to the U.S. such as Risen Energy Co. and Trina Solar Ltd. are likely to feel the impact of the tariffs on sales they make to the U.S. But even then, these Chinese companies’ sales to the U.S. are quite negligible. Risen exported only US$167.9 million worth of cell and modules to the U.S. in 2017 while Trina sold US$132.3 million.

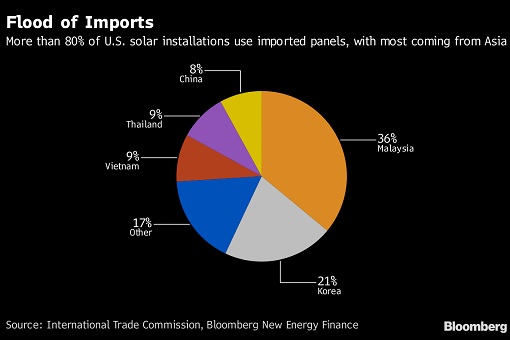

Surprisingly, Malaysia (36%) and South Korea (21%), NOT China (8%), that will be heavily affected in terms of solar panels export to the United States. While the major impact of the duties will be on panel installers, who get most of their supplies from Chinese companies, the biggest loser is none other than the renewable energy industry in the U.S.

Trump’s tariffs on solar panels potentially deals a blow to the US$28 billion industry that relies on parts made abroad for 80% of its supply. Of course, Donald Trump doesn’t care simply because he’s a non-believer in renewable energy industry. This could be just the beginning. The president has until April to decide whether to add new tariffs on imports of aluminium and steel.

Obviously, there’s a price to pay to fulfil Trump’s MAGA (Make America Great Again). Senator John McCain called the tariffs “nothing more than a tax on consumers.” The tariffs on washing machines and solar panels will definitely be passed on to American consumers. Moms and dads shopping on a budget for a new washing machine will pay for this – not big companies.

Other Articles That May Interest You …

- Something Is Very Wrong!! – World’s Richest 1% Grab 82% Of Global’s Wealth

- Apple’s $350 Billion Investment Plan Proves Trump Is A Business Genius

- Trump To Slap China With A “Huge Fine” – Probably Billions Of Dollars – Over IP Theft

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

- U.S. Household Debt Hits Record $12.84 Trillion – China Top Owner Of I.O.U. Papers

- US$1.021 Trillion – Americans’ Credit Card Debt Hits History High

- A US-China Trade War About To Happen – Here’s Why The Yankees Can’t Win

- U.S. Debt – How Much Does Each American Owe?

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

January 24th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply