There’re basically two major concerns that economists, investors, analysts and other financial experts have been worrying. First – the Chinese economy. Second – Donald Trump as the next President of the United States. While Trump is a newly discovered financial problem, the Chinese economic problem has been a headache for years.

The topic about China’s economy slowdown was already on discussion table years before it actually happens. In the centre of China’s economic meltdown is the country’s debt accumulation. The average total debt of emerging market economies is 175% of GDP. Anything above this figure means trouble and obviously China’s debt has breached the comfort zone.

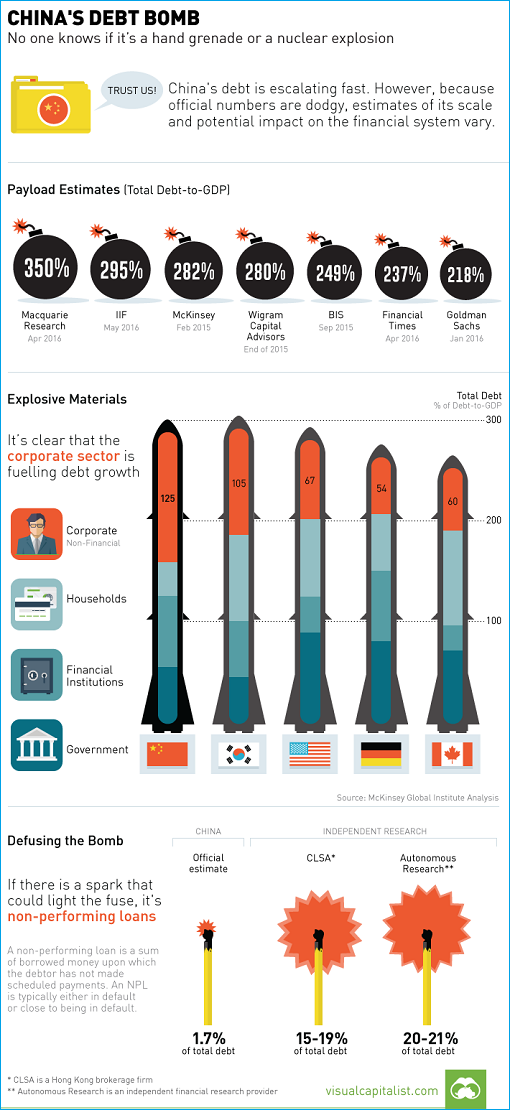

However, nobody on planet Earth – except Chinese top officials – knows the actual debt accumulation of the country. The Chinese government has been super secretive about releasing the debt figures. After all, they are a communist country so the government isn’t answerable to anyone about transparency.

Therefore, even the best brain in the world could only “guess” whether China’s debt is as minor as a hand grenade or as serious as a nuclear bomb. Without official figures from the Chinese government, researchers and consultants have offered a wide range of the country’s total debt-to-GDP.

Goldman Sachs, for example, came out with an estimate in January 2016 of 216% total debt-to-GDP for 2015. Financial Times believes the debt figure was higher at 237% to the GDP. Meanwhile, McKinsey estimated that total Chinese debt was 282% of GDP, based on figures up to Q2-2014. Macquarie analyst Viktor Shvets said that China’s debt was US$35 trillion, or “nearly 350%” of GDP.

Below is an infographic describing China’s debt bomb. Total debt is made up of various components, including government, corporate, banking, and household debts. According to Mckinsey, the country’s corporate sector already has a higher debt-to-GDP than the United States, Canada, South Korea, or Germany, even while still being considered an “emerging market”.

Hedge fund manager Kyle Bass (founder of Dallas-based Hayman Capital) has warned in a letter to investors – a Chinese credit crisis would be 5-times that of the United States’ subprime mortgage crisis. What this means is, when the Chinese debt crisis burst, the losses would be 400% higher than the one struck American banks in 2008.

Bass wrote – “China’s banking system has grown to $34.5 trillion in assets over the past 10 years, from a base of $3 trillion.” He further added – “Even at the biggest banks, loans are not made to borrowers based on their ability to repay. Instead, the decisions are political decisions made by the state.” Of course, the toxic that can ignite the fuse of China’s debt bomb is none other than its NPLs (non-performing loans).

In a nutshell, if China’s banking system loses 10% of assets, essentially Chinese banks will lose approximately US$3.5 trillion of equity. In comparison, U.S. banks lost about US$650 billion of their equity throughout the 2008 global financial crisis. Still, China can rescue its banks but that would require printing in excess of US$10 trillion worth of Yuan to recapitalize its banking system.

Other Articles That May Interest You …

- Move Over U.S. & New York, Now China & Beijing Have More Billionaires

- Why China Can “Take” Any Island In South China Sea … And Get Away

- China Declares 6.9% Growth But Analysts Predict A Financial “Ice Age”

- China (Secretly) “Devalues” Yuan – Global Recession Is Calling

- China Anti-Corruption’s Latest Bans – Golfing & Extramarital Affairs

- China Wins Indonesia High-Speed Train Contract, And Japan Isn’t Happy

- These 8 Charts Show How China’s Economy Meltdown Spreads To The World

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

|

|

May 17th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply